Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview

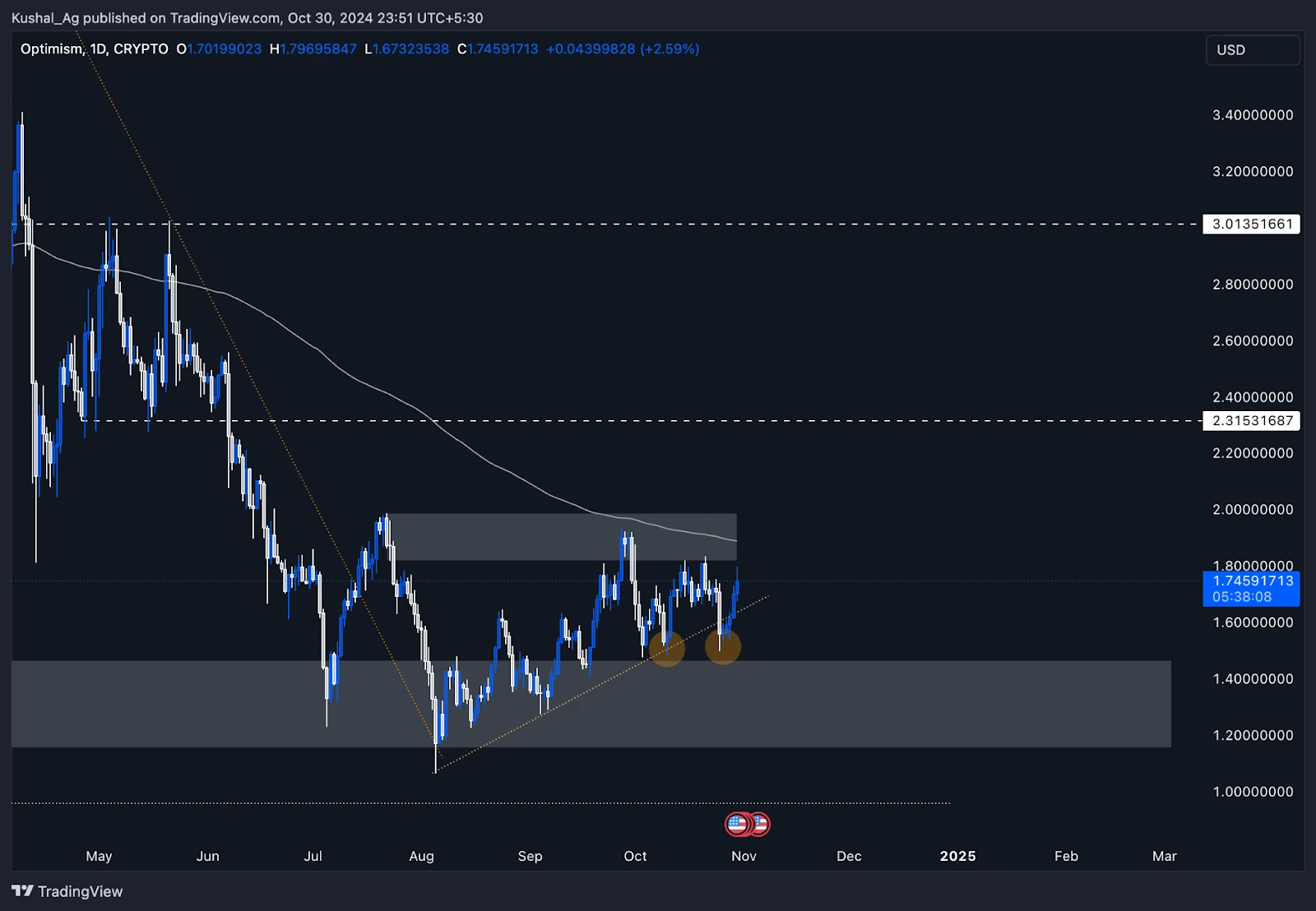

Optimism has been consolidating in a sideways range for over 100 days, between the supply zone at the top around $2 and $1.1 at the bottom, which marks a critical support level. Currently trading at $1.75, OP is testing key resistance levels, including the 200 EMA at $1.89 on the daily time frame and the supply zone between $1.81 and $2.Daily time frame analysis

- Range-bound movement: OP has maintained a tight range, with the price oscillating between $2 and $1.1. This consolidation phase shows that OP is building strength, but a breakout is essential for any significant price move.

- Liquidity grab and quick reversal: Recently, OP dipped below the $1.6 level to $1.49, breaking the yellow trend line and forming a double bottom. This move, marked by two orange circles, served as a liquidity grab, trapping short positions and quickly reversing back into the trend.

- Critical resistance: The 200 EMA at $1.89 and the supply zone at $1.81 to $2 form a crucial resistance overhead. Breaking through and establishing support above this region is vital for any continuation in the uptrend.

- Support levels: On the downside, OP's weekly demand zone between $1.46 and $1.15 provides a solid base, especially with the recent double bottom at $1.5 acting as immediate support.

Potential scenarios

- Bullish scenario: A breakout above the $2 supply zone and 200 EMA would signal a shift in momentum, potentially initiating a new bullish trend. Confirmation of this breakout with support at these levels could provide an entry for upward targets.

- Bearish scenario: Failure to breach the supply zone could see OP retesting the $1.5 level. The further downside might lead to OP testing the lower edge of the weekly demand zone.