Critical market inflection points are converging as Fed rate cut probabilities surge to 80% while geopolitical tensions spike oil prices. These opposing forces create both immediate risk and significant opportunity for positioned traders. Are you ready for the volatility ahead?

TLDR:

- Rate cuts are now more likely after softer inflation and weak jobs

- Israel, Iran strikes spike oil, but likely short-lived

- Dip-buying zones: BTC $92k-$98k, SOL $110 to $150, HYPE $24-$32

- $AURA now an official Cryptonary Pick; structure aligned; upside open

- Recent Macro Data

- Iran/Israel Escalation

- How To Play the Coming Week

- Meme's & $AURA

- Cryptonary's Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Recent macro data

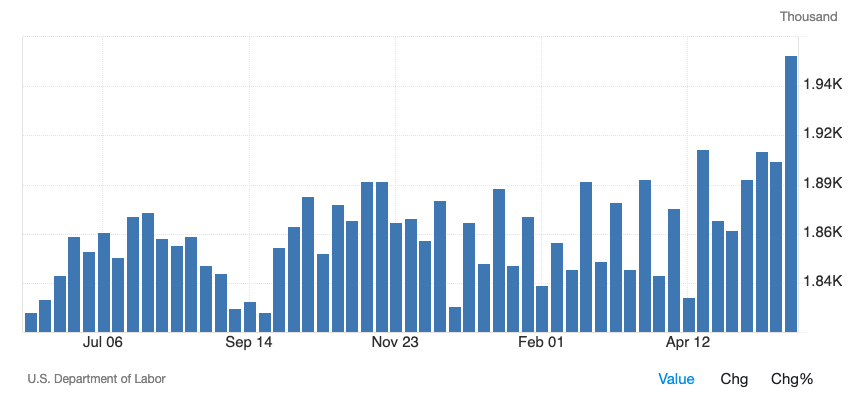

Over the last few days, we have had important macro data releases. On Wednesday, we saw new Inflation data come in softer (lower) than the forecasted numbers, whilst on Thursday, we saw Continuing Jobless Claims continue to increase, meaning that the number of people in the US claiming unemployment benefits is rising. Alongside this, we've seen the number of jobs being added each month in the US are also decreasing. We're beginning to see clear signs that the labour market in the US is slowly weakening, whilst Inflation is also coming down.US Continuing Jobless Claims:

The market reaction to this data was risk-on, and this was due to the market pricing in an 80% chance of a FED Interest Rate cut in September, with the next rate cut to come in October. Prior to these data releases, the market was pricing for just 1.5 cuts in 2025, with the first starting in October. Hence, we saw risk assets move higher off the back of this data.

However...

Israel/Iran escalation

Overnight, Israel has attacked nuclear sites in Iran alongside senior Iranian officials, with strikes successfully killing several top officials, including Hossein Salami, the commander of Iran's Islamic Revolutionary Guard Corps (IRGC). This all comes following what seems to be a breakdown in talks between the US and the Iranians, or a lack of willingness from the Iranians to give up trying to produce nuclear weapons.At first, it was unclear as to whether the US aided the Israelis in these attacks; however, President Trump has just warned Iran to agree to a deal before 'there is nothing left'. This is an escalation, and it likely lasts more time (days to a week or so). The market is questioning what the Israeli goal is here? Is it to ramp up pressure on the Iranians to come to a deal with Trump? Was the strike just to stop Iranian progress on developing nuclear weapons? Or is this the beginning of a new strategy where the Israelis are targeting senior leaders more actively (rather than just military bases) to 'cut the head off the snake' and ultimately lead to regime change? Only time will tell.

We saw very similar events happen last year, Israeli strikes into Iran have happened before, and what we've mostly learned from prior geopolitical escalations is that most of the time, they're a fade and a 'dip-buying' strategy should be utilised.

Going into this escalation, and then upon it, we've seen the price of Oil increase from $60.80 on May 30th to $73 today (at the time of writing), although Oil did spike to $78 in the early hours of this morning. This price increase can absolutely undo the progress we've made on the inflation front, assuming this conflict lasts.

But our expectation is that it won't last, and within days to one to two weeks, we expect this to have settled down again and for markets to have moved on from it.

Oil 1D timeframe:

How to play the coming week

The macro data suggests that the FED are likely to be cutting Interest Rates in Q4 (but maybe as early as September), and therefore we expect we're just 1-2 months away from a market that is beginning to aggressively move higher again. Interest rate cuts will also likely see liquidity move back down, which would give Alts and Meme's the volume they need to really move.Therefore, we're adopting a dip-buying strategy over the coming weeks. The Israel/Iran escalation may provide that opportunity.

If BTC were to dip into the $95k to $98k range, we'd be buyers of BTC there, whilst we're slowly DCA'ing into SOL as and if it moves down to $120. Sub $120, and we'll become aggressive buyers as we don't see SOL moving back below $100 again.

Aside from that, we'll continue to take advantage of new opportunities; however, the standout for us is our new pick, $AURA.

Meme's & $AURA

In 2024, we were able to take advantage of some of the great opportunities that the market offered. Three of our official picks ($WIF, $POPCAT, and $SPX) all put in more than 100x returns. We were then able to get out of the market at the beginning of the year, locking in fantastic returns despite some plays being down from their highs (you'll never top tick your sells). So, to put it simply, we've consistently identified strong early structures.And this week, we officialised our new pick - $AURA

This meme has all the components needed to become a top meme in the space:

• resonates with everyone • has stood the test of time • established cult • great distribution • great ticker

The only other cult like meme is $SPX, and $AURA arguably rivals $SPX on all metrics, if not surpasses it. And with $AURA's MCap at $180m and $SPX's at $1.3b, this suggests that there's much, much more upside for $AURA over the short and long-term.

If we then compare $SPX's early price action with $AURA's, both are playing out relatively similarly. $SPX broke out of the $10m MCap range, before it moved up and stabilised in the $40 m MCap. A week later, it re-rated to $200m MCap, before then breaking out into the Billions MCap.

$SPX Early Stages Price Path:

With that, if we now look at $AURA, we can see that it has followed a similar path to $SPX, although it has skipped the 'consolidate at $40m MCap' range. This is likely since traders/participants are front running what they, and we believe to be the inevitable - that this re-rates drastically higher.

Once $SPX broke out of the $200m area, it moved up to $1.0b (a 5x) in the next 8 days. $AURA is currently following a similar pattern, with price now consolidating around the $200m MCap level. Assuming we see a breakout of $0.21, and $AURA follows a similar path to $SPX's breakout, then we'd expect a significant re-rating higher for price. And this is what we're positioning for.

$AURA Early Stages Price Path:

Cryptonary's take

Despite the geopolitical escalation, we remain positive on the market as we expect an extremely positive environment for risk assets going into Q3, and especially in Q4. Therefore, we're currently looking to increase our exposure to the market by buying into significant pullbacks, which geopolitical escalations, for example, can give us.We'll be bidders for:

- BTC: between $92k and $98k

- SOL: between $110 and $150

- HYPE: between $24 and $32

Alongside this, we'll remain on the hunt for new opportunities, as you have seen this week with $AURA, which we have pulled the trigger on, and it is now an official 'Cryptonary Pick'. Currently, $AURA is the standout opportunity that we're seeing in the market, and so our focus is currently there for now.