Technical Analysis

Pendle technical analysis: Will $5.74 resistance be reached soon?

Pendle’s recent price action highlights a solid support base at $4.64, fueling bullish momentum with a potential target of $5.74. The strong demand zone reaction suggests continued gains if the current market sentiment is sustained. Explore Pendle’s technical setup for potential near-term opportunities.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview

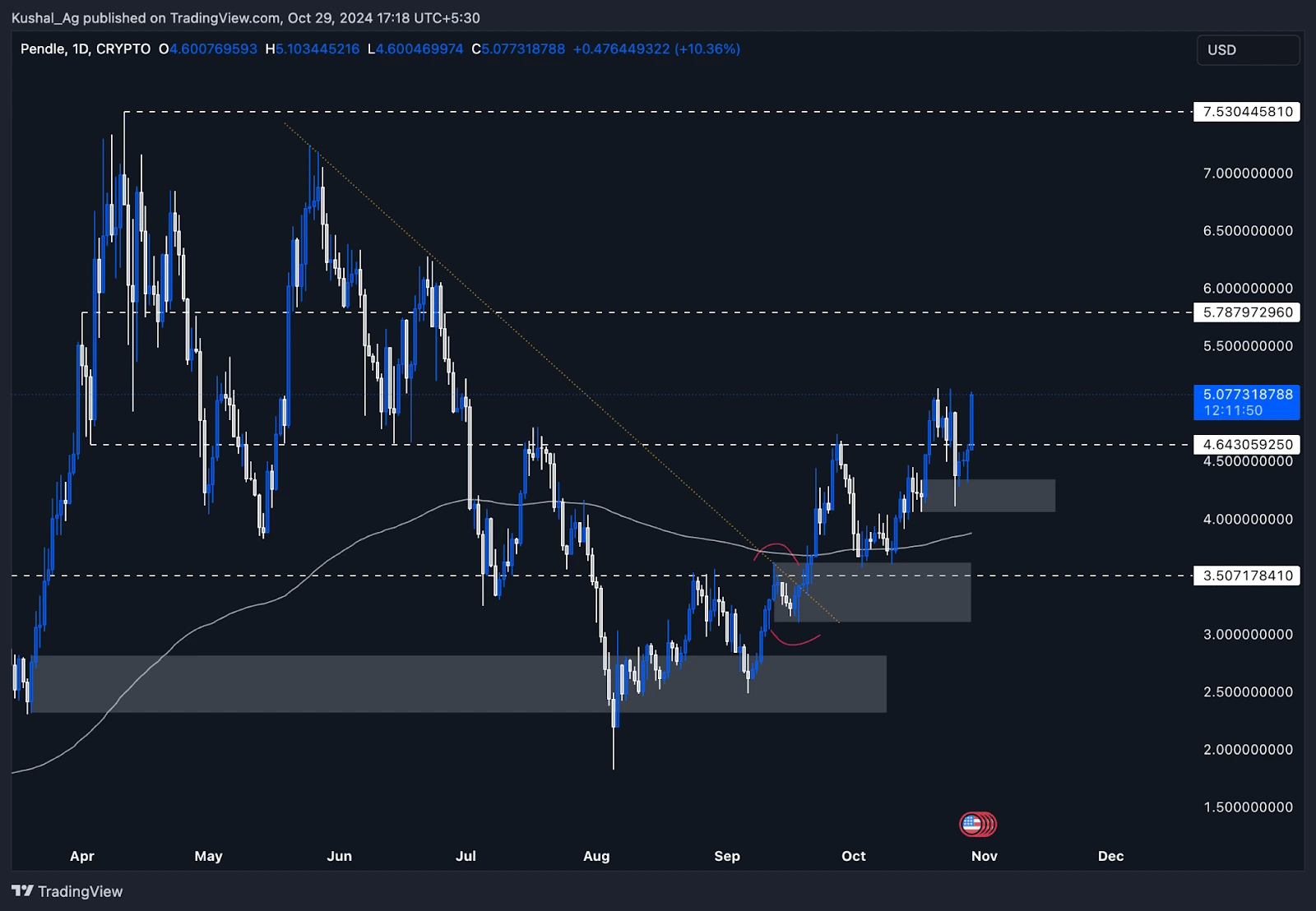

Pendle ($PENDLE) has demonstrated strong price action and adherence to key support levels, reinforcing its bullish structure on the daily time frame. Previously, we analysed Pendle when it was trading around $4.74, just above the $4.64 support zone. We anticipated a scenario in which Pendle could dip into the grey box daily demand zone marked between $4.00 - $4.32, providing a potential accumulation zone before moving upward.Current market outlook (Daily time frame)

Pendle has followed this exact path, dipping into the $4.00 - $4.32 demand zone and making a robust reaction, moving up by nearly 24% since the low. This response underlines the demand and accumulation strength within this zone, with $4.64 now expected to serve as a solid support base moving forward, especially after such a strong rebound.Pendle is now trading back above this support level, consolidating its gains and positioning itself for a potential further move. With the market momentum and demand zone validation, $5.74 is the next resistance level on the upside, which may be reached in the short to medium term if the bullish momentum sustains.

Key insights:

- Demand zone reaction: The grey box demand zone between $4.00 - $4.32 provided strong support, leading to a significant 24% bullish swing.

- Support level: $4.64 now serves as critical support and is unlikely to be breached, given the strong demand zone reaction.

- Resistance: The immediate target is $5.74, the next major resistance, which could be achievable if Pendle maintains its current momentum.