Price prediction today: Bitcoin, Ethereum, and Solana

This week's Market Direction report is not just another analysis- it's your front-row ticket to one of the most electrifying weeks in recent crypto history. We're talking about a perfect storm of crypto market dynamics, economic data, and macro events as a launching pad to send your bag to the moon.

Imagine Bitcoin teetering on the edge of new all-time highs, Ethereum at a crucial inflection point, and Solana possibly ready to explode. Now, add in a Federal Reserve meeting that could signal rate cuts, critical labor market data, and high-stakes corporate earnings reports.

The result? A powder keg of opportunity and volatility that has traders everywhere on the edge of their seats.

Are you ready to dive into a week that could potentially redefine the crypto market trajectory for months to come?

Let's dive in!

Key questions

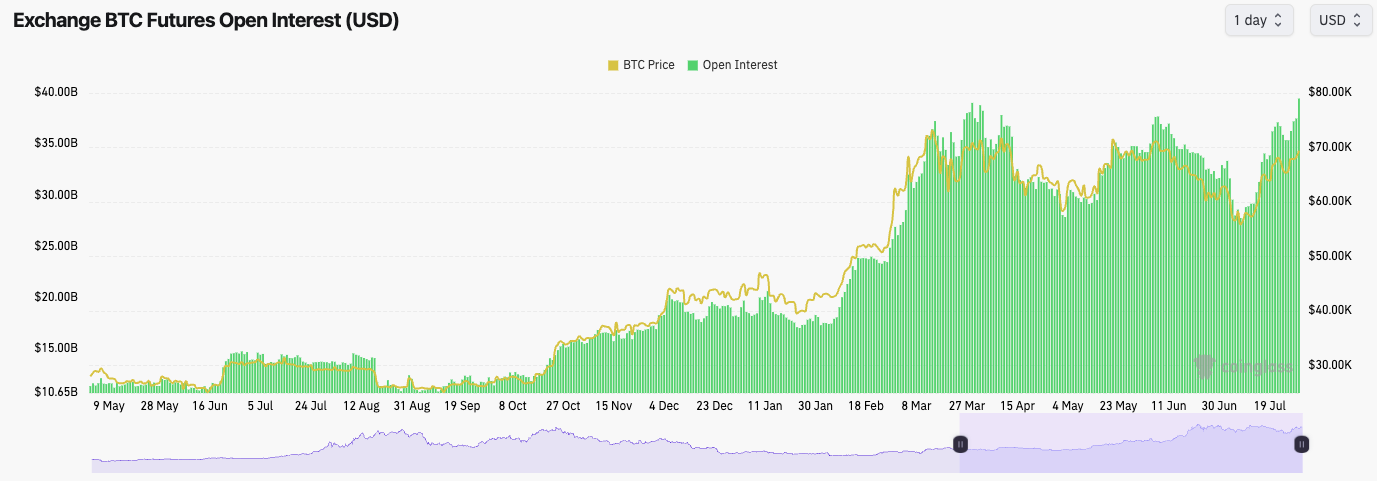

- BTC's Open Interest is at an all-time high, but the Funding Rate isn't spiking. What does this unusual setup mean for Bitcoin's next move?

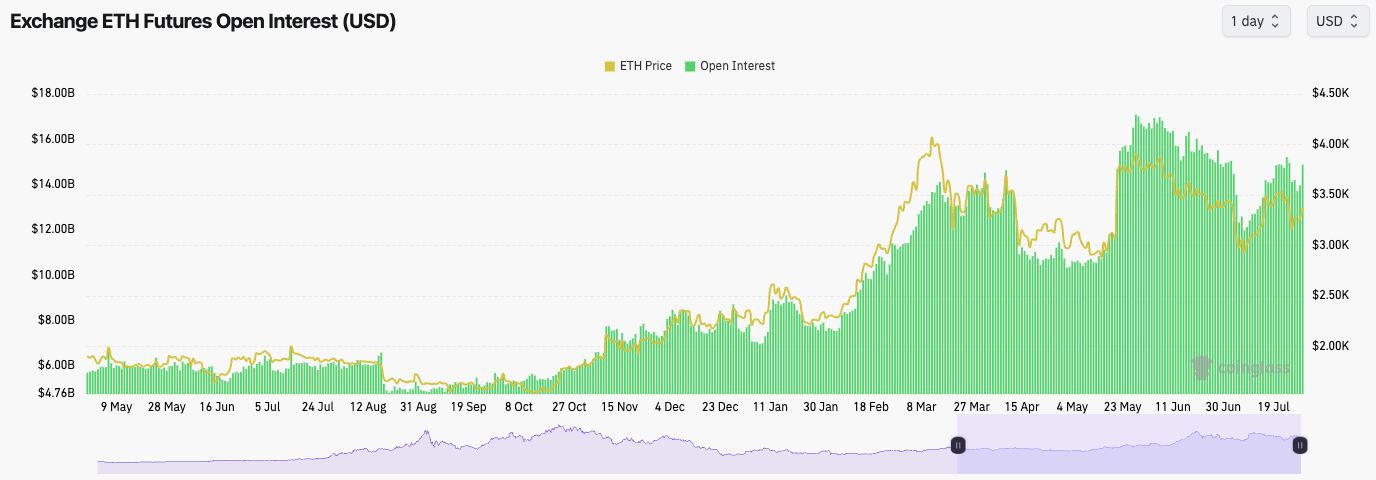

- Ethereum seems to be lagging behind other majors. Is this weakness temporary, or is there a catalyst on the horizon that could change everything?

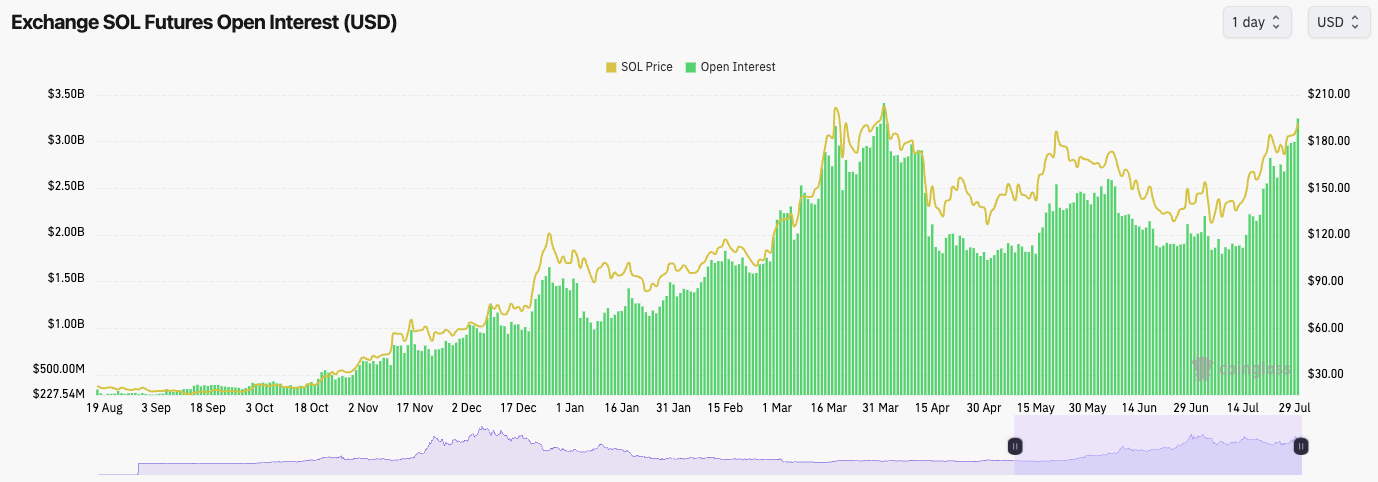

- Solana's breaking records and turning heads. But with the RSI approaching overbought territory, is SOL setting up for a pullback or another leg up?

- The Fed meeting is upon us. How might Jerome Powell's words impact crypto prices, and what signals should traders be watching for?

- Labor market data and corporate earnings are dropping this week. Could these macro factors be the key to unlocking crypto's next big move?

- Our analysts are eyeing specific price levels across BTC, ETH, and SOL. What are these crucial thresholds, and how might they shape trading strategies for the weeks ahead?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

BTC

Bitcoin is knocking on the door of history with a tantalizing dance around all-time highs. But here's the kicker - we're seeing record-breaking open interest without the usual funding rate spike. What does this unusual setup mean for BTC's trajectory?Market mechanics

Open Interest has spiked up to a new all-time high, just shy of $40.0b. This indicates that traders have piled on a lot of leverage in the last few weeks.The Funding Rate is relatively steady at the even rate of 0.01%. This suggests that the majority of traders are Long, but there is also some Short interest from traders.

Typically, when we've seen Open Interest spike higher, we also see the Funding Rate spike higher (a Long bias), but now we don't have that. This is a slightly healthier setup.

BTC Open Interest:

Technical analysis

- Bitcoin continues in its local uptrend, having bounced off of the local support of $63,400 several times now.

- Bitcoin has then progressed higher, and we expect some short-term stalling out of the move at the major resistance of $68,900. However, price seems to have cleared above this level. Today's candle closure will be important.

- If Bitcoin can move higher, the main level for price to clear above is $71,700.

- To the downside, we'd expect $63,400 to hold as support, although we wouldn't be surprised to see this level not revisited.

- On the Daily timeframe, price is moving into overbought territory, so it is possible we will see a slowdown soon.

Cryptonary's take

This week, we have big macro data: labour market data, the Fed Meeting, and corporate Earnings. This can create volatility in markets, and with Bitcoin's Open Interest (amount of leverage) as high as it is, we could see volatility further exaggerated. This may open the door to downside flushes in price.However, we believe that once you sieve through the noise (of this week), we expect prices to continue grinding higher.

We wouldn't be surprised to see new Bitcoin price all-time highs in August, and we believe this might be catalysed by a dovish J Powell (Fed Chairman), that forward guides the market on Wednesday that the Fed is looking to begin cutting Interest Rates in September.

ETH

Ethereum enthusiasts, brace yourselves for a pivotal moment. While ETH might seem to be playing second fiddle to Bitcoin's recent surge, our analysis reveals a compelling narrative of tension and opportunity. With key resistance levels in sight and the Grayscale supply overhang nearing its end, is ETH coiling up for a spectacular breakout?Market mechanics

ETH's Open Interest also increased in the last day from $13.9b to $14.9b; however, it remains well below the late May highs of $17.1b. This suggests that leverage traders are mostly looking elsewhere for trades rather than ETH.ETH's funding rate is also flat at 0.01%, indicating that the bias amongst traders is mostly long, but there is some short interest.

Expect volatility this week, with both sides likely to have turns at being flushed out/whipsawed.

ETH Open Interest:

Technical analysis

- ETH rejected at the horizontal resistance of $3,485 and the main downtrend line.

- However, price found support at $3,100, swiftly climbing back up and reclaiming the local horizontal support of $3,280.

- Price is now once again retesting the main downtrend line, but it remains below the main horizontal resistance of $3,485.

- ETH is at a key inflection point. A Bitcoin breakout this week could finally help ETH get the major breakout it's been looking for.

- The RSI is in the middle territory, so this doesn't provide any headwinds for price in the short term.

Cryptonary's take

In terms of risk/reward for a trade, ETH perhaps looks better than Bitcoin here simply because its price hasn't increased like that of BTC. However, we do note ETH's general weakness, as it seems to be outperformed by the other majors. However, we expect that once the Grayscale supply overhang ends, ETH will grind higher.We wouldn't look to scale into any big Long trades here, but we're happy to sit on our ETH Spot positions, and we expect to substantially increase in value over the coming months. We're just staying patient on ETH here.

If we were looking for a degen play, a potential Long from $3,280 (assuming we get a retest) could be the play. But we'd keep the Stop Loss wide and give the trade room to allow for volatility.

SOL

If you thought Solana's recent performance was impressive, you ain't seen nothing yet!Our SOL analysis paints a picture of a potential rocket preparing for liftoff. With a bullish breakout already in play and open interest skyrocketing, are we on the cusp of witnessing SOL's march to new all-time highs?

Market mechanics

We've seen a huge rise in Open Interest over the last 24hrs/week, with OI now not too far off the highs we saw in early April.Funding is flat (0.01%), so there has been a lot of buildup of Shorts here, too. Like BTC, there's potential we see Shorts get squeezed here if price can keep grinding higher.

SOL Open Interest:

Technical analysis

- SOL managed to break above its main downtrend line, formed a bull flag that retested the downtrend line as support, and price was able to break out to the upside. We perfectly predicted this in the last Market Direction for SOL.

- Price now seems to be heading higher, with the main horizontal resistance of $205 in sight.

- A breakout of $205 would likely send SOL pretty swiftly to prior all-time highs of $255. However, it's possible we will see a consolidation above $205 upon the breakout.

- To the downside, there are two levels of horizontal support now, $173 and then $162. We expect $162 to be held.

- We note that the RSI is approaching overbought territory, and currently, SOL is putting in a bearish divergence (higher high in price, lower high on the oscillator). This is a bearish pattern. Despite this, we think the price can continue to grind higher.

Cryptonary's take

SOL is still the play of the cycle, in our opinion, and it looks super positive overall. We do expect SOL to move higher, but $205 may prove strong resistance in the short term. This might lead to a slight pullback from $205 before breaking out higher in the coming weeks/months.We remain very bullish on SOL and fully hold our Spot bags. We're not looking to sell anytime soon, and we expect prices to be substantially higher in the coming months and quarters.

Bitcoin all-time high incoming?

In today's market direction, we covered the Majors (BTC, ETH, and SOL). Later in the week, we will cover memes and other altcoins.But for now, let's look at some of the context for this week, as we have a huge week on the macro front. One of the biggest weeks we've had in a long time.

There are three main things we're paying attention to macro-wise this week:

- Central Bank Interest Rate Decisions

- US Labour Market Data

- Corporate Earnings

1. Central Bank Interest Rate Decisions:

- The major decision this week is the Fed. But we also have the Bank of Japan.

- We're expecting the Fed to maintain the current Interest Rate.

- But we're expecting Powell to forward guide the market for the first Interest Rate cut to come in September.

- We believe the market will react bullishly to Powell and the Fed.

- We have JOLT's Job Openings tomorrow, and the forecast is that there will be 8.03m Job Openings.

- -The goldilocks number for JOLTs is for a slight weakening in this metric, as this would suggest a moderation but not an outright weakening. This aids the 'soft landing' narrative.

- On Friday, we will have Non-Farm Payrolls and the Unemployment Rate.

- The Unemployment Rate is expected to remain at 4.1%. An increase would trigger the Sahm rule, which the markets may react slightly negatively to.

- If Unemployment comes in at 4.1%, markets will likely continue grinding higher.

- For Non-Farm Payrolls, markets may react negatively to a very weak (low number) print. Markets will likely react positively to anything that comes in line.

- This week, we have corporates reporting earnings.

- The market will watch these closely for any signs of more material weakening, as some corporates have reported a weaker consumer so far.

- The key earnings will be from the few Big Tech companies that report this week. Markets will place greater emphasis on these companies' forward outlook, i.e., is it looking weaker for growth, or is growth holding up?

Let's see what we get, but I'll reiterate once more... A massive week.