Pssst! The bull is back! | February 16th

The market is back in bull mode… or is it? Weekly market structures are changing, bullish engulfing candles are forming all over the place and the overall sentiment is bullish. However, there are still a few obstacles that the market needs to overcome before we confirm that more upside will follow. Luckily, we’re here to show you exactly what needs to happen for the rally to continue.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The Total Market Cap broke above $1.03T once again, and a weekly closure above this level is likely.

- Bitcoin is at resistance. We need it to break above for the rally to continue.

- Bullish engulfing candles are forming on all assets. This indicates we might see higher prices in the coming weeks.

- We go over our targets after this week’s performance, so make sure to keep reading!

Total Market Cap

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap index took $950B as support, and is now back above the $1.03T resistance level. A weekly closure above this level would put $1.35T on the cards, that’s ~+26% from the current price.

The Total Market Cap index took $950B as support, and is now back above the $1.03T resistance level. A weekly closure above this level would put $1.35T on the cards, that’s ~+26% from the current price.

However, there is one obstacle, and that’s Bitcoin approaching resistance. Unless Bitcoin breaks above its $25,150 resistance level, a rejection is likely. This would invalidate the move to $1.35T on the Total Market Cap index. It’s best to wait for the resistance to be broken before we decide to jump back into the market.

Altcoins Market Cap

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The Altcoins Market Cap took $550B perfectly as support and is now heading toward its next resistance between $650B - $700B. For this to happen, Bitcoin needs to break above its $25,150 resistance level as well.

The Altcoins Market Cap took $550B perfectly as support and is now heading toward its next resistance between $650B - $700B. For this to happen, Bitcoin needs to break above its $25,150 resistance level as well.

A move to $650B would provide many great opportunities in the altcoins market, and you need to be prepared for them. Good thing our pro members are covered. 😎

BTC | Bitcoin

We have another potential bullish engulfing here, but this one is forming into resistance. As you might know, a bullish/bearish engulfing candle forming into resistance/support is indecisive. In this case, the buying pressure could be invalidated by the selling pressure found at this level, which increases the odds of rejection.

Because of its latest performance, BTC’s weekly market structure has changed from bearish to bullish. We now have a weekly bullish market structure which suggests there’s more upside to follow.

However, the $25,150 resistance level needs to be broken to confirm further upside. A weekly closure above this level is necessary for the entire market to perform well. Otherwise, we could see BTC ranging between levels ($21,450 and $25,150) until either one is broken, and that could take some time. In case BTC reclaims $25,150, then we should expect the $28,750 - $32,000 resistance area to be tested in the coming weeks after the reclaim.

We have another potential bullish engulfing here, but this one is forming into resistance. As you might know, a bullish/bearish engulfing candle forming into resistance/support is indecisive. In this case, the buying pressure could be invalidated by the selling pressure found at this level, which increases the odds of rejection.

Because of its latest performance, BTC’s weekly market structure has changed from bearish to bullish. We now have a weekly bullish market structure which suggests there’s more upside to follow.

However, the $25,150 resistance level needs to be broken to confirm further upside. A weekly closure above this level is necessary for the entire market to perform well. Otherwise, we could see BTC ranging between levels ($21,450 and $25,150) until either one is broken, and that could take some time. In case BTC reclaims $25,150, then we should expect the $28,750 - $32,000 resistance area to be tested in the coming weeks after the reclaim.

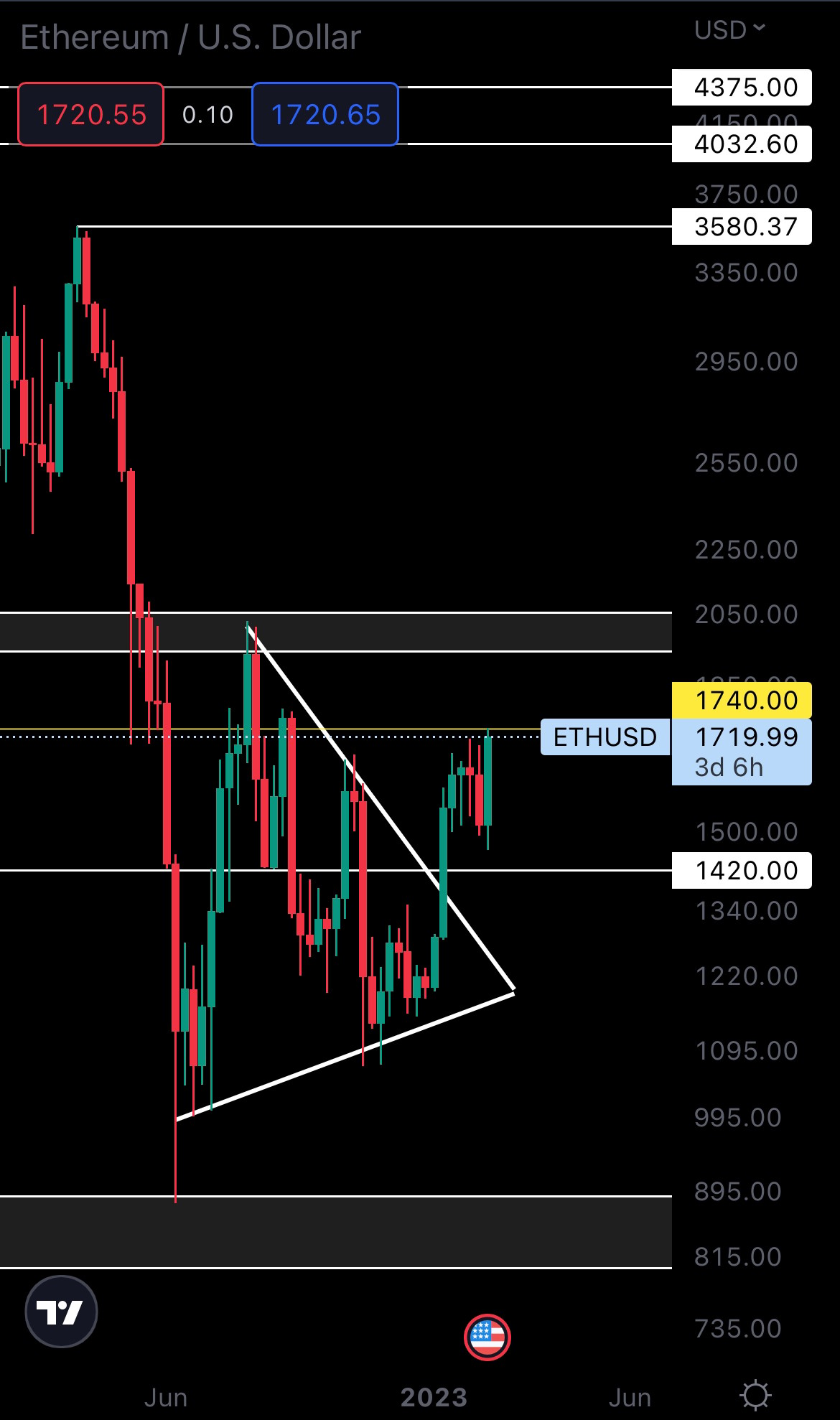

ETH | Ethereum

Yes, another bullish engulfing, and yes, this one’s also forming into resistance.

Yes, another bullish engulfing, and yes, this one’s also forming into resistance.

For Ether to confirm further upside, a weekly reclaim of $1740 is necessary. Ether breaking above this level would also confirm a change in market structures, given that a higher high would form. If $1740 is reclaimed, we should expect $2000 to be reached in the coming weeks.

Overall, things are looking bullish and we believe Ether and the altcoin market will perform extremely well in the coming weeks. There’s just one obstacle on the Bitcoin chart which needs to be taken care of - the $25,150 resistance level.

SOL | Solana

If the market continues to go up, this week’s candle will mark a higher low. This would result in SOL reaching $30 in the coming weeks, a target we have been expecting for over a month now.

If the market continues to go up, this week’s candle will mark a higher low. This would result in SOL reaching $30 in the coming weeks, a target we have been expecting for over a month now.

For SOL’s weekly market structure to change, we need to see it rise above $26.80.

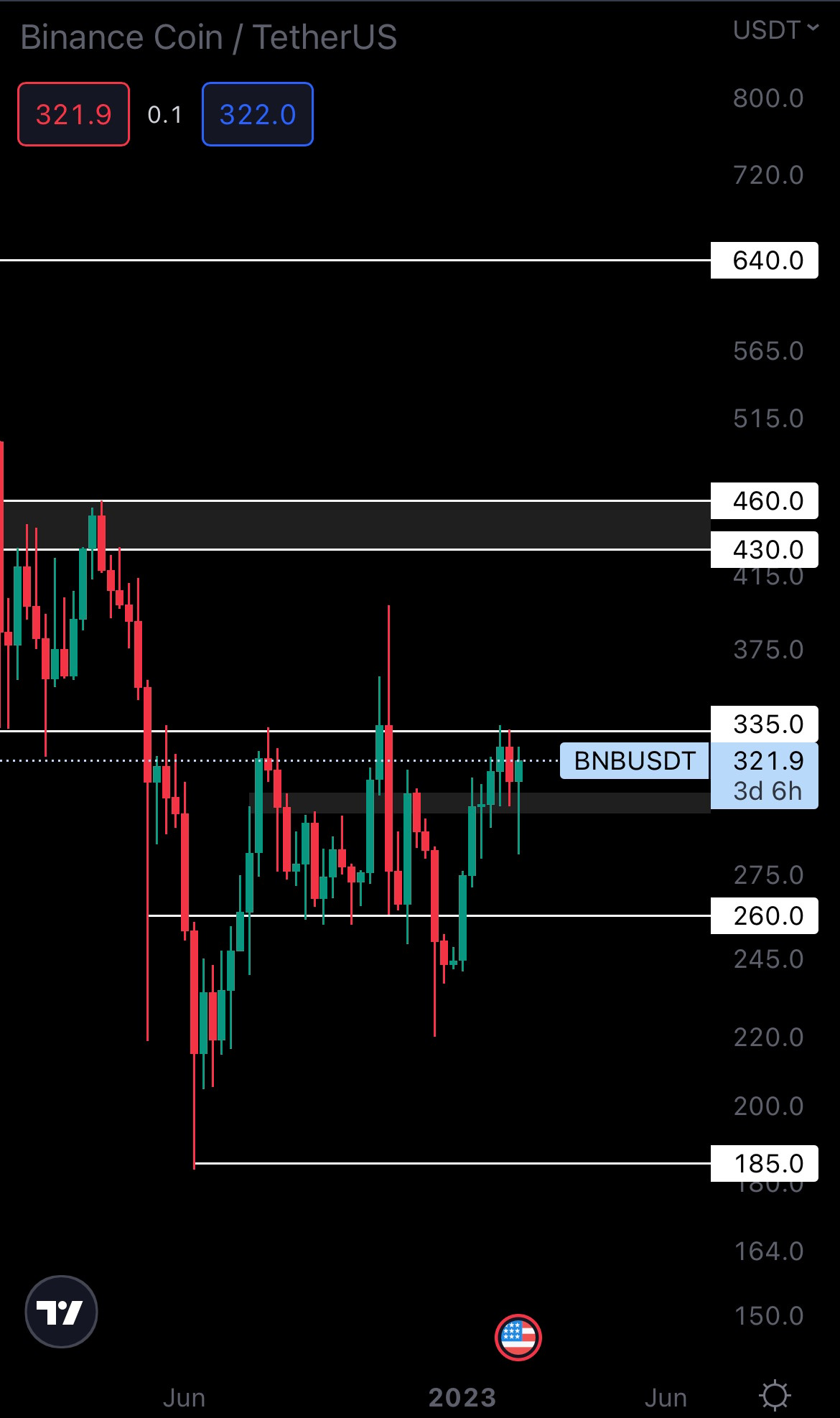

BNB | Binance

Bitcoin saved the day.

There was a lot of selling pressure for BNB this week, which can be seen in the wick. However, due to Bitcoin’s recent performance, BNB invalidated all the selling pressure and is now back above support. A weekly closure above the gray box would invalidate BNB’s move to $260.

A break of $25,150 on Bitcoin would most likely result in BNB breaking resistance at $335. This would open the road for $430. So, there’s a juicy opportunity here if things go well.

Bitcoin saved the day.

There was a lot of selling pressure for BNB this week, which can be seen in the wick. However, due to Bitcoin’s recent performance, BNB invalidated all the selling pressure and is now back above support. A weekly closure above the gray box would invalidate BNB’s move to $260.

A break of $25,150 on Bitcoin would most likely result in BNB breaking resistance at $335. This would open the road for $430. So, there’s a juicy opportunity here if things go well.

UNI | Uniswap

Although UNI is trading in a bearish market structure on the daily timeframe, its weekly timeframe could hint at a change in market structure. For that to happen, UNI would need to rise above $7.53 (its previous high).

A good-performing BTC (and a break of resistance) would put $7.80 back on track. However, for the time being, there are better opportunities out there.

Although UNI is trading in a bearish market structure on the daily timeframe, its weekly timeframe could hint at a change in market structure. For that to happen, UNI would need to rise above $7.53 (its previous high).

A good-performing BTC (and a break of resistance) would put $7.80 back on track. However, for the time being, there are better opportunities out there.

Cryptonary's take

The market is looking ready for more upside, but Bitcoin under resistance does present risk. We recommend waiting for $25,150 to be reclaimed, as only this will confirm higher prices.

Action Steps

- A weekly closure above $25,150 for BTC is necessary. Once/if that happens, multiple opportunities will present themselves. Make sure to take advantage of them.

- Waiting is recommended for the time being. We need actual confirmation that upside can follow, so make sure to stay up to date with our analysis for any development.