Red-hot RUNE faces critical resistance after 250% surge

After an epic 250% surge, RUNE is flashing clear signs of overextension at major resistance. With overcrowded longs and deeply overbought technicals, analysts caution a pullback is likely imminent. However, momentum has kept RUNE resilient so far, so a breakdown is not guaranteed.

TLDR

- Rune is hitting major resistance at $6.53 after a parabolic 250% climb.

- Bearish divergence and extremely overbought conditions on the daily timeframe.

- Technicals suggest a high likelihood of correction, but momentum could continue to push higher.

- We urge caution and recommend trimming positions if you hold RUNE as a trader.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

RUNE is now butting into a main horizontal resistance at $6.53 after a 253% move up over the past 3 weeks.RUNE 3D

Looking at RUNE on the daily timeframe, we can see that it’s putting in a bearish divergence, deep into overbought territory.

Alongside this, the 3D and the weekly timeframes are also massively overbought. From a trading indicators perspective, RUNE is phenomenally overbought here, and on this alone, we suggest caution. We certainly wouldn’t look to add to our position. If anything, we’d look to trim some of our size.

RUNE 1D

Market mechanics

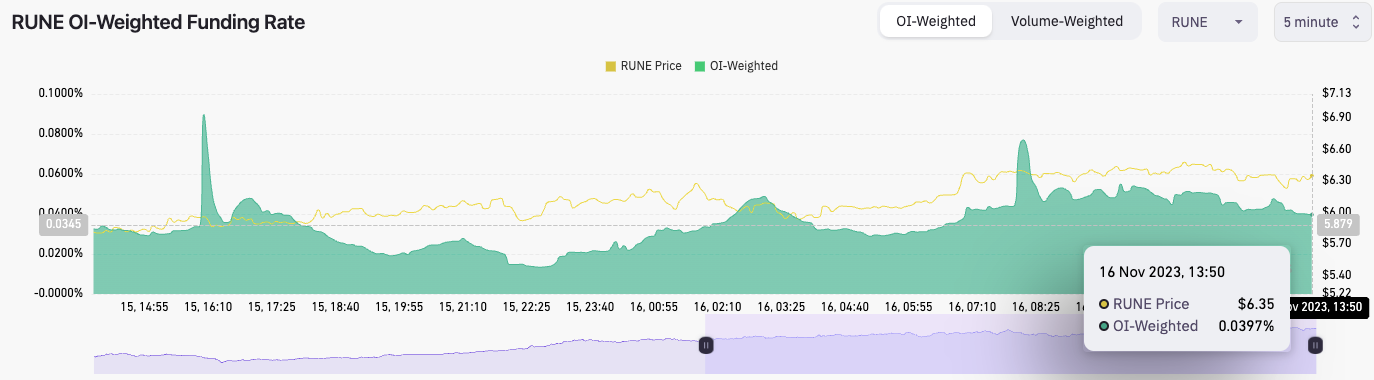

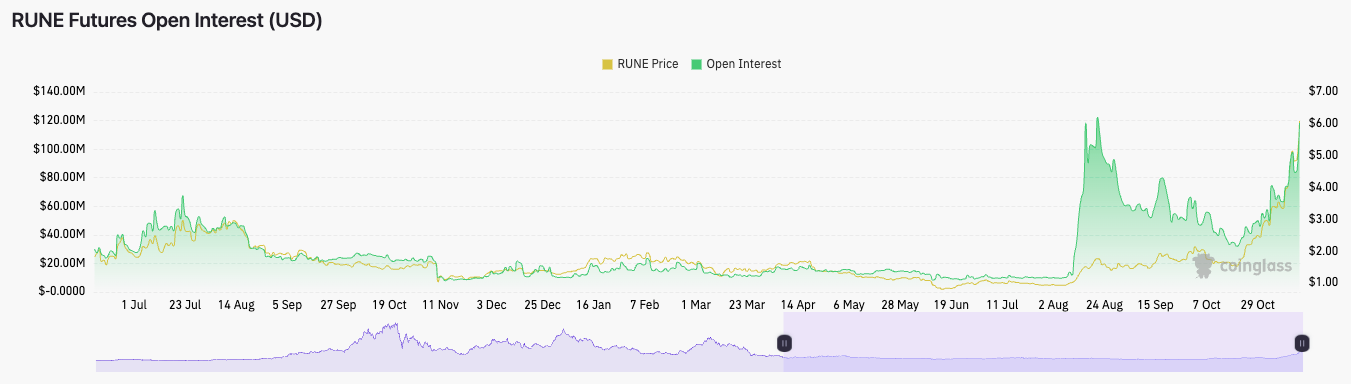

The funding rate for RUNE is also very high, indicating a significant bias to be long. Longs are the overcrowded trade here.

The open interest has soared, with the long/short ratio at 1.07. This is more participants piling into longs over the past 24 hours, which is currently retail-heavy. Longs are vulnerable to being squeezed here.

Cryptonary’s take

As mentioned above, we would be cautious of RUNE here and even potentially look to trim some of our size. We certainly wouldn’t look to add to our position. RUNE is holding up well against a BTC pullback, so it may continue higher. The mechanics and technicals suggest the opposite, but sometimes momentum can be enough.We see the likelihood of RUNE pulling back here as relatively high.