Market Direction

Rejection at resistance puts Ethereum at risk below $2k

The air grows thinner for Ethereum bulls.

After reaching the peak of $2,120, Ethereum was harshly rejected and sent tumbling below the $2,000 mark. This rejection has shattered the uptrend and snuffed out the hopes of a continued rally, in the short term.

Ethereum is now on shaky ground, struggling to maintain footing above critical support at $1,933. Are the bears back in charge of ETH?

TLDR

- ETH rejected at $2,120 resistance, now struggling to hold support at $1,933.

- The uptrend is broken, and the bull flag was invalidated, so the bearish momentum is now in play.

- Leverage is lower, but the long/short ratio shows traders piled into shorts.

- Increased volatility is likely, but the critical support at $1,933 is holding for now.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.ETH 1D

Technical analysis

ETH followed in BTC’s footsteps yesterday, retracing all of Wednesday’s positive news.- ETH is now out of its uptrend line, and the bull flag we had as a potential setup is now invalidated as a pattern setup.

- The local resistance for ETH remains $2,050, with the more major one at $2,120. If ETH could clear above $2,120, this would open the door for a move to $2,340.

- On-chain data reveals that traders are aggressively shorting ETH following the price rejection.

- ETH is currently at the support between $1,933 to $1,950. If this support zone is lost, this would likely see ETH move down to $1,850

Market mechanics

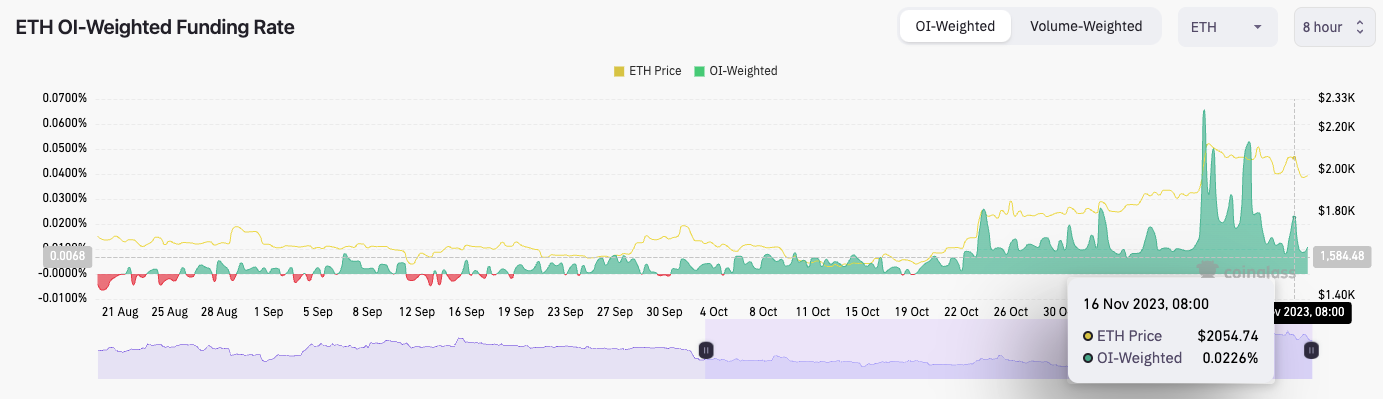

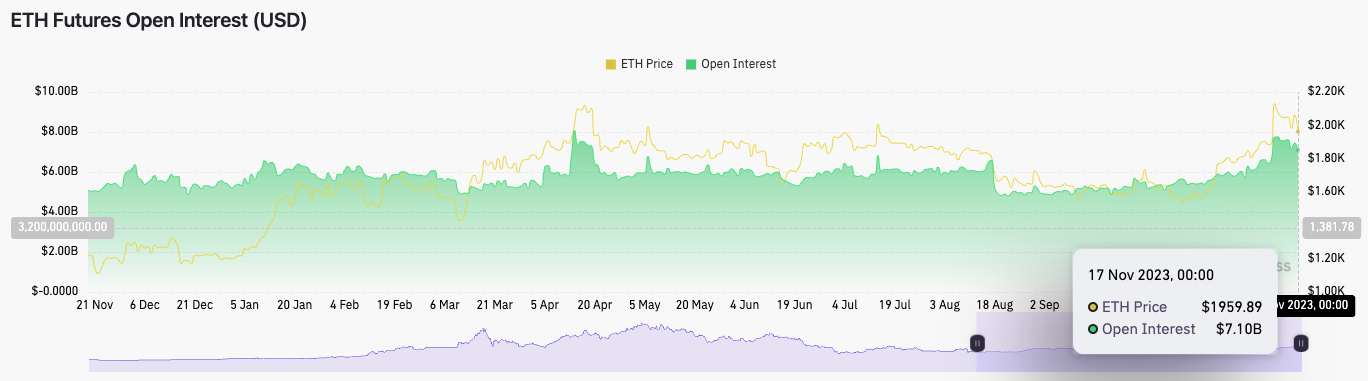

On the mechanics side, ETH is less overheated than several days ago, but we may still be vulnerable to volatility.- ETH’s open interest remains high, but it has come down from $7.75B a few days ago to $7.10B today. This is back to slightly healthier levels.

- The OI-Weighted Funding Rate has decreased from 0.225% yesterday to 0.0094% today. This means longs and shorts are in a much closer balance, whereas yesterday, there was a clear bias to be long. Longs were paying the 0.0225% premium to shorts to be long.

- The long/short Ratio is at 0.9175 over the past 24 hours. This means the number of participants shorting yesterday was far greater than the number of participants longing.

Cryptonary’s take

It’s likely prices remain volatile, particularly with the late Shorts piling in yesterday - a slight move higher in price may drive a small Short-squeeze. It’s critical for ETH that it holds above the $1,933 horizontal support. If not, price could fall to $1,850.In the short-term, price direction is difficult to call, but we may get a short-squeeze to $2,000 before a further move lower.

We will be DCA buyers sub $1,933 and aggressive DCA buyers at $1,850/sub $1,850.