Market Updates

A tug of war emerges as markets grapple with conflicting data. Inflation slows, but the Fed pushes back on rate cut hopes. Risk assets rally, but cracks appear as crypto unwinds leverage. Volatility looms as the outlook muddies. Where will the markets go from here?

TLDR

- Inflation data sparks a rally, but gains look exhausted.

- Fed maintains higher rates needed, worries of a bumpy path.

- Jobless claims tick higher, recession watch intensifying.

- Crypto pulls back as leverage unwinds, volatility ahead.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Macro data sends the market up

This week's key data was the inflation data on Tuesday, which came in softer than the consensus and far softer than the prior months’ numbers.

Risk assets soared higher on the narrative of falling inflation but are somewhat front-running future updates. The inflation battle is won, and the Fed’s rate hike cycle is over. The S&P and the Nasdaq moved meaningfully higher, although the move now looks slightly exhausted.

SPX 1D

NDX 1D

Recently, we have also had Fed-speak and jobless claims data.

Fed-speak

The Fed-speak has essentially acknowledged the progress made on bringing inflation down, but many Fed speakers have also suggested that the path down to the mandated 2% target will be “bumpy and not easy”.

Therefore, Fed speakers have maintained the higher for longer narrative and attempted to slightly walk back the market, which has now priced for rate cuts earlier in 2024 than what had originally been priced last week.

Jobless Claims data

Yesterday, we saw the release of new Jobless Claims data. The Initial Jobless Claims came in at 231k, and Continuing Jobless Claims came in at 1865k. Both were higher than the last reading and came in higher than the consensus.

The markets did not react as it wasn’t a major increase.

However, the markets will now begin to watch this data set more closely. A sharp increase will likely mean a meaningful move higher in unemployment, indicating that a recession may be upon us.

But crypto pulls back

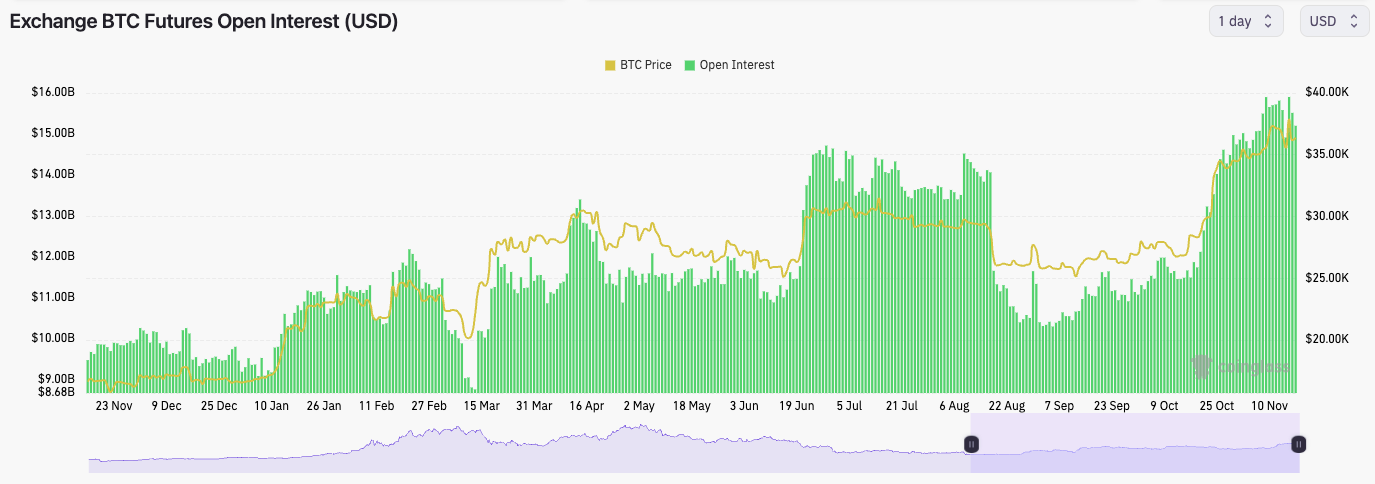

Over the past few weeks, we have seen a large increase in the amount of open Interest in the crypto market. This, up until recently, has been mostly long-biassed with participants trying to chase the markets higher.

But, in the last 48-72 hours, we’ve seen longs become the crowded trade, and as prices have pulled back slightly, late longs have been flushed out while shorts have piled in.

This has meant that the level of open interest hasn’t decreased, so it remains high. Also, the funding rates have come into a more even balance.

But, this suggests that if there is a significant move in the price of Bitcoin, it’ll likely catalyse a more volatile move, and we’ll see the move likely become more exaggerated in that direction.

Cryptonary’s take

Overall, we expect to see some excess leverage in the market to be flushed out in the coming weeks. Many trading indicators on the larger timeframes suggest that many coins are over-exhausted to the upside.

Many coins likely need to pull back or at least go through a period of consolidation, where these metrics/indicators that are heavily overbought can reset. This will be needed for markets to move higher in a sustainable way.

If there is a breakdown in prices, we would be DCA buyers of Bitcoin sub $34,000, with the DCA buys becoming more aggressive sub $33,000.

We see several participants calling for a retest of $30,000. However, when there is a bias amongst traders for a certain level to be reached, it often isn’t always the case.

As always, thanks for reading.

Cryptonary, OUT!