RUNE, INJ, OP and TON battle key resistance levels

Since then, TON has broken out of its short-term range top at $5.80, a critical level that previously acted as resistance. Price action is now consolidating around $6.70, which has emerged as a key resistance zone. The market appears to be settling here, with the potential for a gradual grind higher if buyers maintain momentum.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TON:

Market context

TON has made some nice movements since our last analysis. The key floor we identified at $4.75 proved to be an excellent call, acting as the context low. This level was a straightforward support and resistance play, combined with understanding the market context, offering TON investors a prime entry point.Zooming out on the daily chart reinforces the significance of these levels and highlights TON’s tendency to trade in tight ranges following expansions. Its strong association with Telegram, coupled with its retail-friendly narrative, positions it for significant traction as the market cycle progresses.

Playbook

Key levels:- Support: $4.75 (context low).

- Short-term Support: $5.80 (previous range top, potential retest zone).

- Resistance: $6.70 (current consolidation level).

Cryptonary's take

TON continues to establish itself as a standout asset. Breaking past $5.80 and consolidating at $6.70 reflects its strong market structure. The next move is dependent on how the price interacts with $6.70—either a grind higher or a retest of $5.80 for support. Regardless, TON’s connection to Telegram and its retail-focused narrative ensures it remains a strong contender in this cycle.If momentum sustains, we’re looking at $7 and beyond, with the potential to challenge all-time highs. This isn't an asset we hold or a pro picks asset. But we have highlighted TON, a report we wrote with a nice deep dive highlighting its potential.

RUNE:

Market context

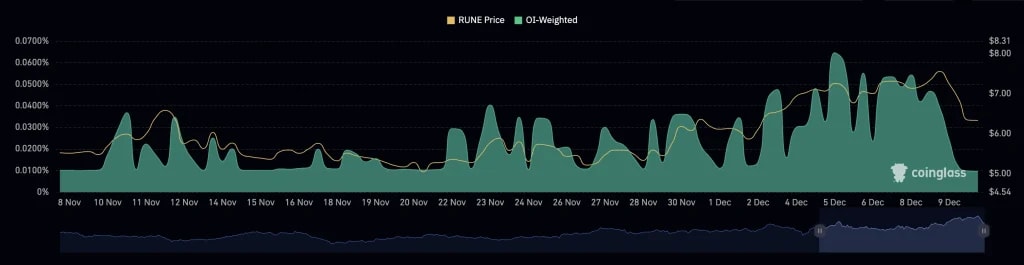

RUNE had been consolidating below the $7.5 resistance, a key level that has proven difficult for bulls to reclaim. This level aligns with increased speculative activity over the past week, as highlighted by funding rates and open interest trends.The market recently experienced a flush out, resetting leverage and providing better clarity on local bottoms. This reset is crucial for reestablishing a more sustainable price structure, with $4.50 acting as the likely local bottom.

Price action

- Resistance: $7.25–$7.50 remains the key level to reclaim for bullish continuation. The price was rejected during the recent liquidity flush, confirming this as a significant resistance zone.

- Support zone: $4.50–$5.00 is the identified buy box. This zone aligns with historical demand and provides an optimal area for spot accumulation.

- Trend context: The rejection at $7.5 and subsequent pullback have cleared over-leveraged long positions, resetting the market for a potential new leg higher.

Market mechanics

Funding rates: Between December 5th and 8th, RUNE saw unusually high funding rates, with readings of 0.046% to 0.06%. This indicated aggressive long positions and heightened speculative interest.

Open interest: While not at extreme levels, open interest increased significantly during this period, further signalling speculative positioning. The combination of high funding rates and rising open interest led to the expected liquidity flush, which has now played out.

Playbook

Spot accumulation- Target the $4.50–$5.00 buy box for accumulation.

- This zone offers a favourable risk-to-reward ratio for long-term positioning.

Breakout play

- Focus on a clean breakout above $7.50, supported by strong volume and momentum.

- Confirmation of this breakout opens upside targets at $8.50–$9.00.

Cryptonary’s take

RUNE’s recent flush-out was a much-needed reset for the market. It cleared excess leverage, allowing the price structure to breathe and providing clarity on the $4.50 local bottom. The rejection at $7.5 is a natural part of this process, and we anticipate further consolidation & some sort of correction before a potential breakout.For now, the focus remains on accumulation within the $4.50–$5.00 range, with an eye on a breakout above $7.5 as the next major move. RUNE’s fundamentals and market structure continue to align with a bullish mid-to-long-term outlook.

Injective (INJ):

Overview

The recent market-wide retracement has impacted $INJ, with the asset pulling back sharply after failing to hold key resistance levels. The injective rejected at the $34 resistance and subsequently broke below the $31.1 level, continuing its descent into a significant support region. Despite the broader market's pullback, Injective is currently trading within a strong daily demand zone, signalling a potential opportunity for stabilization and recovery.Daily timeframe analysis

On the daily timeframe, Injective rejected from the $34 resistance — a significant zone that marked its local high. Following this rejection, the price broke below the $31.1 support, failing to establish a base and retracing further. This correction has brought $INJ into the daily demand zone (marked by a blue box), a key area that previously facilitated bullish reversals.The 200 EMA (Daily), currently at $23.7, aligns with this demand zone, creating a strong confluence of support. The price briefly touched a low of $24.56 before rebounding, indicating initial buyer interest in this region.

- On the upside, the first hurdle for $INJ will be reclaiming the $31.1 level, followed by the $34 resistance, which acted as a significant rejection zone earlier.

- On the downside, if the current demand zone fails to hold, the price could test lower levels, but for now, the combination of the demand zone and the 200 EMA makes this a solid support area.

Cryptonary's take

Injective's recent pullback has brought it into a textbook technical setup, where support at the daily demand zone and the 200 EMA provide a potential platform for a reversal. While the broader market's movements will heavily influence $INJ's next steps, this region offers a favourable risk-reward for accumulation or trade setups.If $INJ can reclaim $31.1, it opens the path for a retest of the $34 resistance, and breaking that could lead to another leg higher. For now, monitoring the price's behaviour within this demand zone is crucial. With Injective's solid fundamentals and strong historical performance, the asset remains one to watch closely in the coming weeks.

Optimism ($OP):

Overview

Optimism ($OP), one of Ethereum’s leading Layer 2 solutions, has faced significant retracement amidst the recent broader market correction. After a sharp rise to a local high of $2.77 just two days ago, OP has pulled back, breaking below the $2.315 support level and is now trading at approximately $2.09. The current market environment highlights the vulnerability of assets like OP, which had gained momentum but succumbed to the wider market’s bearish pressure.The daily timeframe presents a mixed picture, with key support and resistance levels coming into play. The next few sessions will be critical for OP to either stabilize or face deeper retracement.

Daily timeframe analysis

During the daily timeframe, OP entered a critical zone after failing to hold the $2.315 support. The asset is now approaching a gray demand zone that spans between $1.98 and $1.818. This zone, which previously acted as a supply zone, has now shifted to a potential demand area and could provide much-needed support. Adding to this, the 200 EMA on the daily timeframe, currently positioned at $1.938, reinforces this zone as a robust structural floor.The $2.315 level, which acted as a key support earlier, is now a resistance. OP would need to reclaim this level to challenge its local high of $2.77 and aim for the $3 region in the medium term. Breaking above $2.77 could open the path for further upside, with minimal resistance until the $3 mark.

However, if OP fails to hold the $1.98-$1.818 demand zone, it could face a deeper correction. The broader market sentiment will play a pivotal role in determining whether OP can stabilize and resume its upward momentum.

Cryptonary's take

Optimism has shown resilience in the past during retracements, and the current demand zone, coupled with the 200 EMA, provides a solid foundation for recovery. However, the asset needs to reclaim $2.315 to regain bullish momentum.For now, this retracement is a healthy pullback into key support zones, and OP’s reaction in the $1.98-$1.818 range will determine whether it consolidates for another rally or breaks lower for a deeper retracement. Patience and watching these levels closely are key for traders and investors alike.