SCF bounces back, LINK eyes $22 breakout

Chainlink zeroes in on the $18 zone, while SCF experiences an 88% retracement, testing key historical support. Meme tokens like POPCAT and WIF are also at pivotal pullbacks, offering intriguing opportunities for patient investors. Let's dive into the details!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Chainlink (LINK):

Market context

The previous buy box for Chainlink didn't hold, and we've now shifted our focus to a new accumulation zone around $18. This level holds strong historical importance for LINK and aligns with the price action from December 3rd when we saw a sharp move up from this region.LINK has shown a small bounce over the past few days, but this isn't considered the beginning of the next major move just yet. Instead, we're expecting the possibility of a deeper pullback across LINK and other altcoins before the market resumes its upward momentum.

The $18 region remains key, and this retrace continues to fit within the broader narrative of a healthy market reset after LINK's impressive rally.

Price action

Buy box: The new accumulation zone is set around $18. This area aligns with historical support and previous demand.Support levels

- $18: The primary level of interest where buyers are likely to step in.

Resistance levels

- $22: The current resistance that LINK would need to break for bullish continuation.

Playbook

Spot accumulation

- Focus on building positions within the $18 region, keeping an eye on broader market conditions to confirm support holds.

Upside levels

- $22: The first level to reclaim for momentum to shift back upwards.

- $26: A more extended target on a sustained breakout.

Crytonary's take

The shift in the buy box to $18 is a natural adjustment, considering the failure of the previous zone. This level not only reflects strong historical significance but also aligns with December's key price action.While LINK has seen a small bounce recently, we remain cautious about calling this the start of the next move higher. Instead, we're prepared for a bit more downside across the altcoin market before LINK resumes its bullish trend. As always, focus on the levels and be patient- this retrace is setting up for solid long-term positioning.

SCF:

Market context

SCF has broken down below our previous key demand level, retracing into a much deeper price point. With an 88% drawdown from its highs, this stretch goes beyond what we would consider "healthy." However, it's not the end of the road.Assets like SCF have shown they can recover from these kinds of pullbacks before. For context, SCF's first major retrace was 84%, yet it bounced back significantly, which speaks to the unique behaviour of these speculative tokens.

We're now back at a "scene of the crime" level- a zone where strong moves originated in the past- and we are beginning to see some early signs of demand. While this does present an opportunity for those with conviction, it's worth noting that we have other assets with stronger setups and higher conviction, like POPCAT and WIF, both of which are also sitting at key pullback levels.

Price action

Demand zone:

- SCF has retraced deeply into a prior "scene of the crime" level, suggesting the potential for demand to re-emerge here.

Pullback context

- The 88% drawdown is steep but aligns with SCF's history of exaggerated pullbacks.

Playbook

Spot accumulation

- Accumulate with caution at this level, focusing on small builds for those with conviction in the asset.

Alternative opportunities

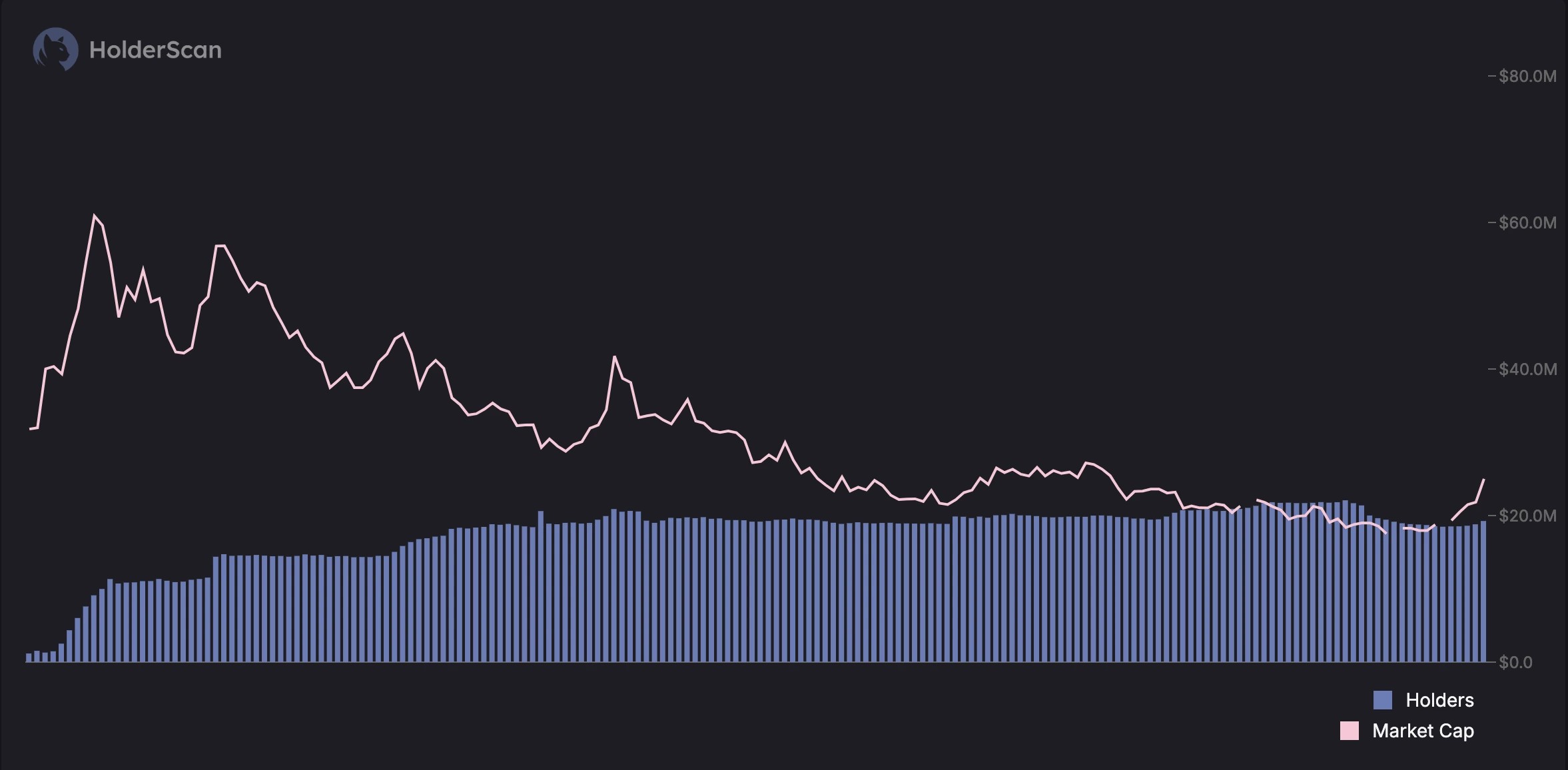

- Consider higher-conviction plays like POPCST and WIF, which are also at key pullback zones and may offer stronger setups. Holder Breakdown

In an ideal scenario, we'd prefer to see holders increasing alongside market cap growth, as this indicates confidence from the market participants. While this isn't a major red flag, it does suggest that SCF isn't currently the highest-conviction play when compared to other speculative tokens.

Cryptonary's take

SCF's pullback into a key historical level opens up an opportunity for those who still hold convictions in the asset. However, the deep retrace and slight decline in holders relative to market cap suggest a cautious approach. Meme assets have their own rhythm, and SCF's ability to recover from previous drawdowns gives it some credibility.That said, for those looking for higher-confidence setups, POPCST and WIF are stronger alternatives at this stage. As always, stick to the levels and approach with a measured plan.