Shorts squeezed, bulls trapped? BTC, ETH, SOL & HYPE are setting up for a major pivot

The market is on edge. BTC’s rejected its highs, ETH’s coiling, and multiple altcoins are flashing setups we haven’t seen in weeks. Big moves are brewing — and they’ll punish late entries. Here’s what we’re watching.

BTC:

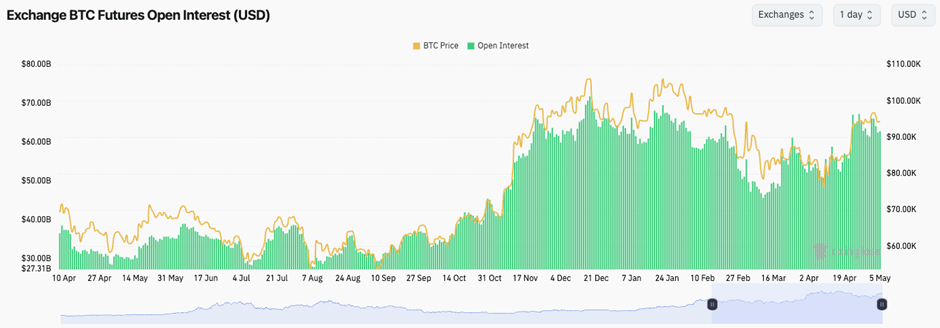

- On the price move up to $97,000, the negative Funding reset to neutral (a Short-squeeze), but the Open Interest remains relatively high in USD terms. This suggests that the build-up in Shorts has mostly been squeezed, but with OI still high, there's more room for this to potentially develop.

Technical analysis

- BTC has seemingly rejected through the $97,500 level, with price now below, but battling at the mid-level of the range at $95,700.

- If the price falls below the local low of $93,400, it will likely reach $90,000. This is a major psychological support that we're watching, and if lost, then $86,00 is on the cards.

- If the price recovers to $95,700, then it's possible we will see a move higher to the major resistance level at $98,900. If this were to happen, we'd expect that to be a local top, and likely an area where we'd strongly consider a more sizeable Short.

- The RSI did briefly pop into overbought territory, but since it has pulled back, and it's now beneath it's moving average. It's possible we see a move higher in price that then potentially puts in a bearish divergence (higher high in price and lower high on the oscillator) in overbought territory, and price can then pull back from there.

- Next Support: $91,700

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $86,000

Cryptonary's take

We move into a pivotal week with a FED Meeting on Wednesday, 7th, where we expect Powell to be somewhat hawkish and keep his optionality open. This might lead to a pullback in risk assets as rate cut bets are potentially pushed out to July, maybe even September.We're expecting BTC to have either put in a local top, or for a local top to be very close here. We're not looking to add to Spot bags at the current price, and we're expecting a pullback over the coming 2-6 weeks to take the price back to at least $86,000.

What's next

BTC may be topping — but ETH, SOL, and HYPE are where the real plays are setting up. Exact entries, stop zones, and where we’re aiming next... one of these could run hard. Access the plan.ETH:

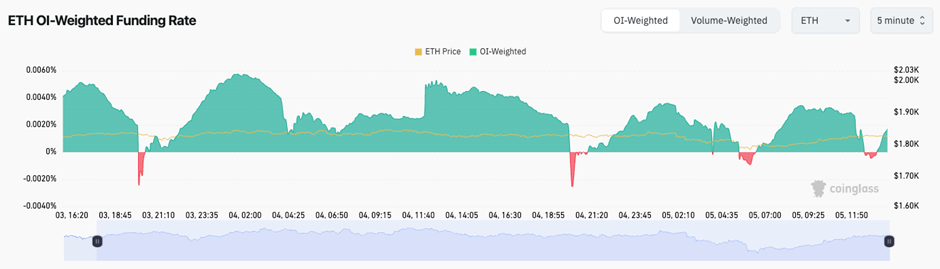

- ETH's Funding Rate has fluctuated, but it has mostly remained positive, whilst its Open Interest (by number of coins) remains very high. This suggests that there's a big demand for the 'cash-and-carry' trade. This distorts the data, meaning OI and Funding become less of a signal for ETH.

Technical analysis

- ETH has broken out of its main downtrend line, and it's holding above its horizontal level of $1,745. If price loses this level, then we'd expect a move back to $1,600.

- To the upside, the key horizontal resistances are at $2,000 and $2,160.

- The RSI is in middle territory, and it's now sitting on top of its moving average; this is a support level for ETH.

- Price has remained in a tight range between $1,745 and $1,850. We are expecting a breakout, and likely to the upside, assuming the general market doesn't dramatically sell off.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

Overall, we're relatively sceptical on the market now as we are expecting a pullback over the coming days/weeks. However, ETH is the setup that looks best for a move higher, if that's directionally how you want to bet. If the market can hold up, then ETH can break out and move higher, potentially to $2,000. However, due to our bearish stance on the market currently, we're not looking to play ETH here.If ETH were to pull back to $1,530 to $1,600, it may be worth beginning to accumulate a very small bag for the long run, even if we do believe more in SOL and HYPE as outperformers over the coming 6-12 months.

SOL:

- SOL's Funding has fluctuated a lot recently. This suggests huge indecision and low conviction amongst traders as to the next direction.

- SOL's Open Interest remains very high, suggesting that there is still appetite amongst traders to take on leverage.

Technical analysis

- SOL is at a really interesting level here, battling at the horizontal level of $148, with price currently falling below, but battling at the key horizontal level.

- To the upside, the major horizontal level is the $162 level.

- To the downside, the local support is at $135, and the major support is at $120.

- Price has broken below its local uptrend line, and since then, it has struggled for upside. We do expect a move into $136 to eventually be a landing spot for SOL, although we are watching the potential bull flag pattern, which we see a breakout to $150-$160 first. But again, we wouldn't be looking to bet on upside here.

- The RSI is back in middle territory and well below its moving average. This suggests a move higher is possible to retest the underside of that moving average.

- Next Support: $135

- Next Resistance: $162

- Direction: Neutral/Bearish

- Upside Target: $162

- Downside Target: $120

Cryptonary's take

There's the potential for a small move higher in the short term for SOL, but we expect it to pull back to $135 either first or after retesting $150. Beyond that, we do expect a further breakdown to $120, even if that takes more weeks.For now, we remain out of the market, and we still hold the strong view that this is a relief rally, and that we'll get our entry prices over the coming 1-2 months. For now, we're still patient. If price gets to $150-$162, we may consider fresh Shorts for SOL, but we probably prefer BTC for a Short should it move into $98-99k.

HYPE:

- HYPE has broken out of its main downtrend line, with price now finding a sticking point at the local resistance of $21.20.

- Beyond $21.20, the major resistance is at $23.10.

- On the downside, the support is at $18.50, with $17.00 at the key level below that.

- The RSI has been close to overbought territory a few times recently, with its moving average also high, and the RSI using that average as support currently.

- Next Support: $18.50

- Next Resistance: $23.00

- Direction: Neutral/Bearish

- Upside Target: $23.00

- Downside Target: $14.50