Should you sell? | April 3rd

Friends, the market is ready for a pullback. You might want to take your foot off the gas in the short-term. The time will come to jump head-first into the market, but for now, take those profits and wait to reinvest lower. As the saying goes… better safe than sorry!

With that said, let’s dive in!

TLDR

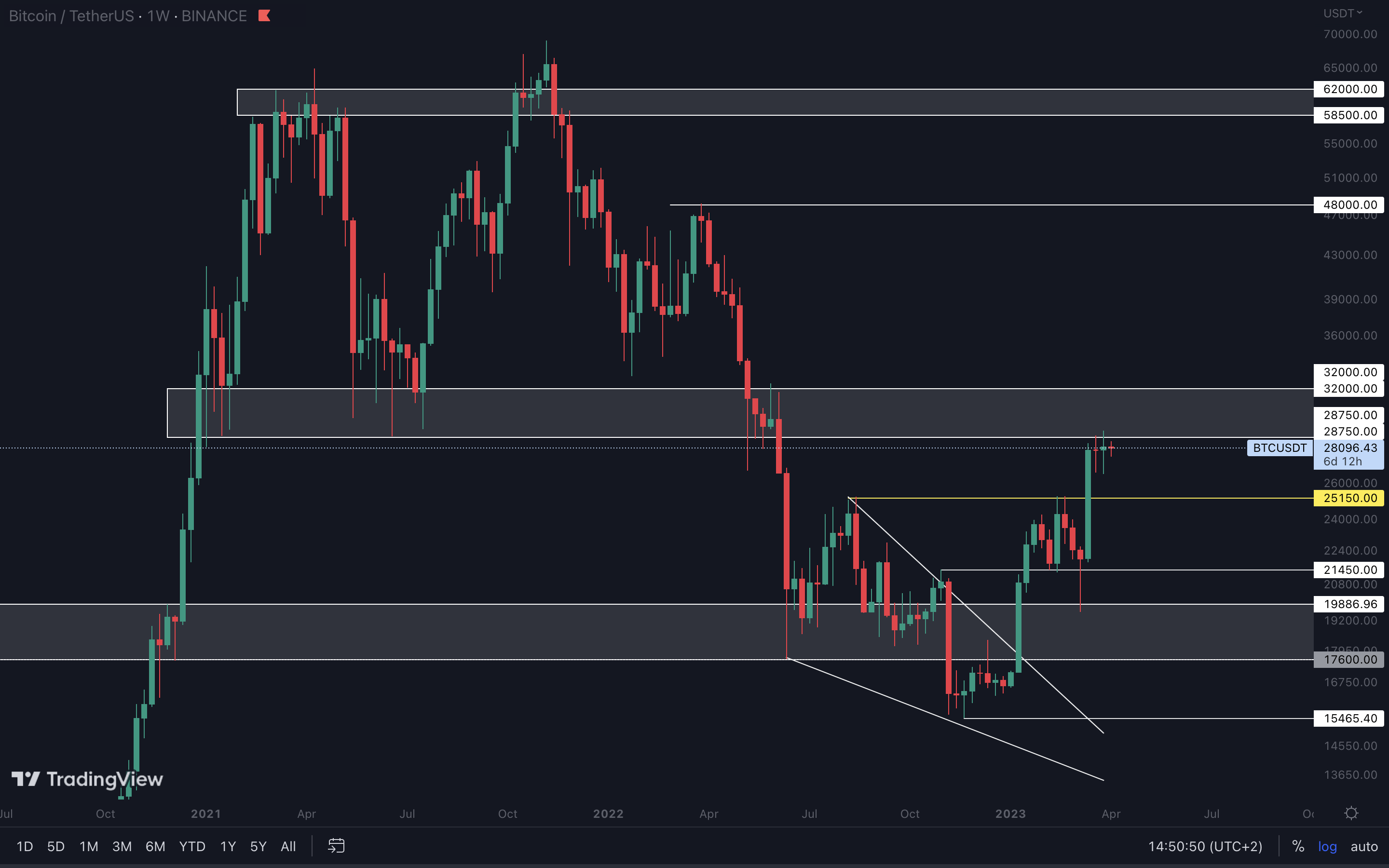

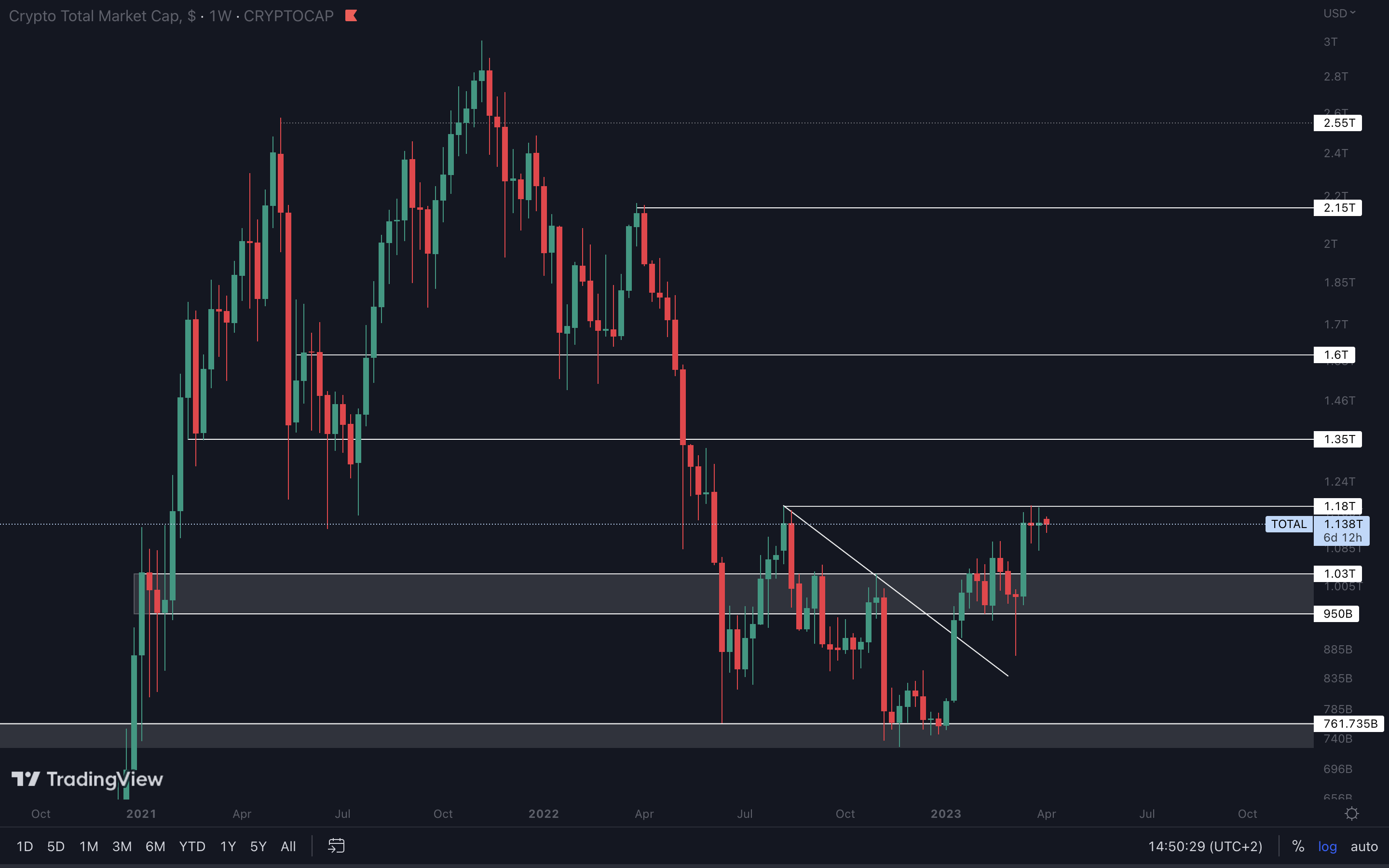

- Unless the Total Market Cap closes a weekly candle above $1.18T, a pullback is the most possible short-term outcome. It’s a good idea to take profits now.

- Bitcoin closed March just under $28,750. This level is part of a bigger area between $28,750 and $32,000, which was the previous bull-run’s support (during 2021 and 2022). You wouldn’t want to buy now.

- Ether is ranging above support ($1740). Unless we see a weekly closure under this level, it remains on track for $2000. If a market-wide pullback occurs, Ether will lose $1740 as support.

- RUNE closed right into resistance ($1.43). We need to see a proper closure above this level to confirm upside.

- SNX reclaimed $2.50 as support. We could see a bounce in the coming weeks, unless Bitcoin takes on the pullback route. This would result in SNX losing $2.50 as support again.

- DYDX closed under resistance ($2.50). Expect more downside unless it closes a weekly candle above this level.

- SYN, LDO, THOR, and MINA all need to reclaim their respective resistance levels to avoid further downside.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will likely go next.

The Total Market Cap is still struggling with $1.18T as resistance. In the last two weeks, we’ve seen its price fluctuate around this level, with wicks in both directions. This is a signal of indecision between buyers and sellers. It’s not yet clear who is in control. Think of it this way: buyers and sellers are fighting for victory. Right now, they’re equal in force, but every battle has a winner in the end. That winner will help us understand where the market is going - up or down. We believe sellers will win in the short-term, as the market hasn’t seen any significant downside since it dropped under $950B in early March. So, we’re expecting a retest of $1.03T next.

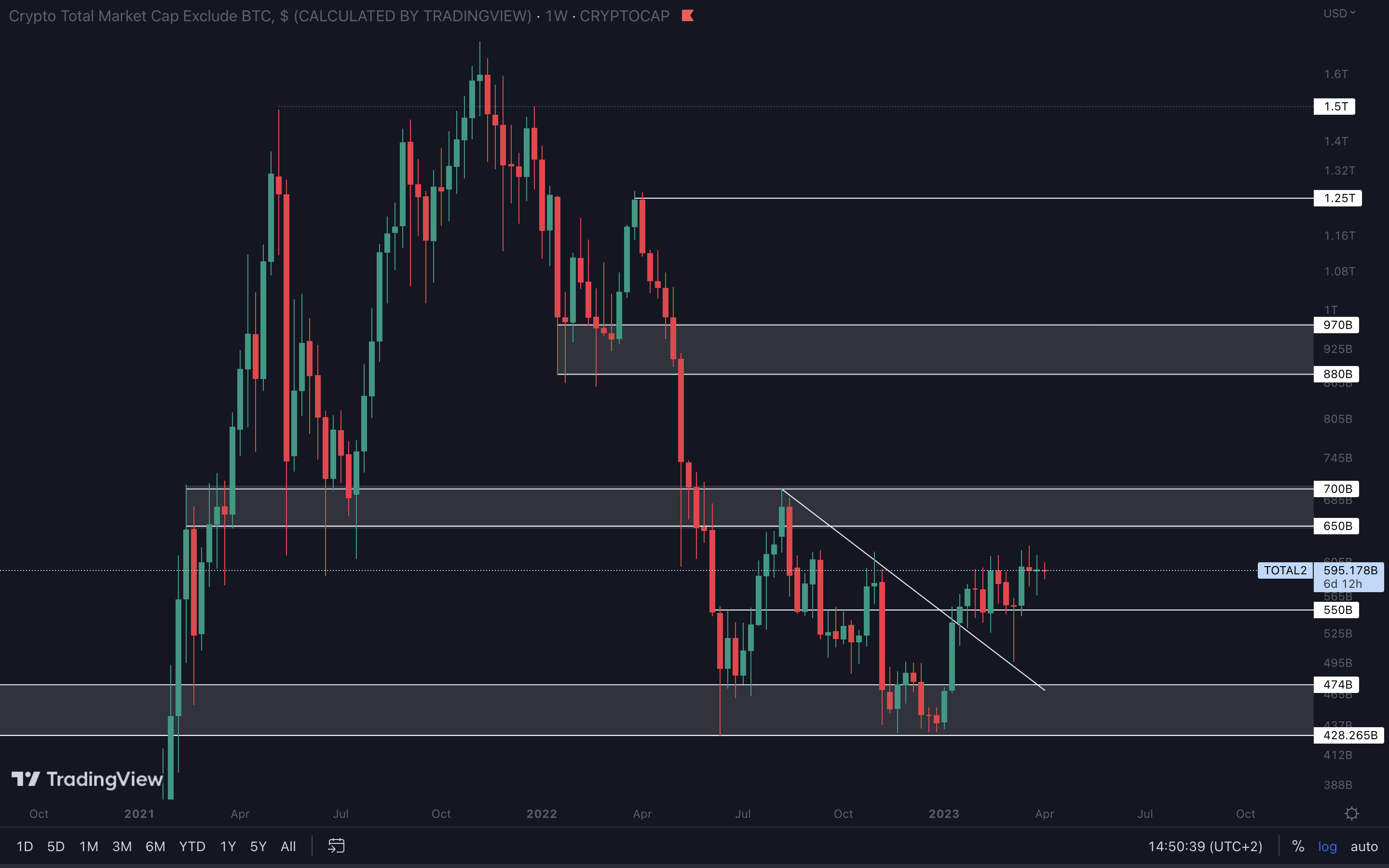

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire evaluation of the altcoins market (all coins other than BTC).

We can’t say much about the Altcoins Market Cap at this time, other than the fact that it’s above support ($550B) and only a weekly closure under that level would invalidate upside. If Bitcoin drops to $25,150, the Altcoins Market Cap will retest $550B but unless we see a loss of this level, we’reconfident it will reach the $650B - $700B resistance area at some point during Q2.

Cryptonary's Watchlist

BTC | Bitcoin (Weekly)

ETH | Ethereum (Weekly)

From a technical standpoint, Ether holding $1740 as support would keep the door open for $2000. But unfortunately, that might not happen just yet. If Bitcoin drops to $25,150, Ether will lose $1740 as support and bottom at the same time. An estimation for that is around $1600 - $1650. If Bitcoin breaks $28,750 on the weekly timeframe, this scenario is invalidated and Ether will likely go to $2000.

DYDX | dYdX (Weekly)

Two weeks ago, DYDX closed under support ($2.50). Last week, buyers tried to reclaim this level, but were unable to do so. $2.50 is now resistance. Unless we see a weekly closure above $2.50, DYDX will go down. This is in confluence with our expectations for the market in the short-term.

LDO | Lido DAO (Weekly)

Similar to DYDX, LDO tried to reclaim $2.50 as support last week, but failed. This increases the odds of it dropping to $1.9775 - $1.85 next.

HEGIC | Hegic (Weekly)

Nothing has changed for HEGIC. The asset remains at support ($0.01815 - $0.01590), and we’ll likely see it range inside this region until Bitcoin picks itself back up. From a risk/reward perspective, buying anywhere in this region is a good idea.

PENDLE | Pendle (Weekly)

We’re proud to say that PENDLE is one of our best investments since the launch of Skin in the Game, and it seems it has even more gains to give us. Last week, the asset bounce from its $0.27750 support level and isnow heading to $0.52. Reaching this level might be difficult as a market-wide pullback is on the cards. However, we’re confident PENDLE will reach $0.52 and even above at some point in Q2. Buying inside the $0.22750 - $0.27750 region might be a good play if you’ve missed the ride so far.

Cryptonary's Watchlist

DOT | Polkadot (Weekly)

DOT has been ranging above $6 since the start of 2023, so that’s the only level you should be watching right now. Its current price action revolves around Bitcoin, and given how close DOT is to $6, it could easily lose this level if Bitcoin goes down. So, we wouldn’t view $6 as a good level to buy from yet. The best thing to do here is let DOT do its thing and wait for opportunities to come naturally.

RUNE | THORChain (Weekly)

Last week, RUNE closed right into $1.43. This isn’t enough to confirm more upside, we’ll need a proper weekly closure above this level before we could say “RUNE will go up”.

SOL | Solana (Weekly)

Unfortunately, SOL isn’t doing great when compared to other assets. Its volume is minuscule, which can be seen in the candles alone. We can’t expect anything more than ranging here, between $22 - $19. If Bitcoin takes the pullback route, we’lllikely see SOL lose $19 as support. If that happens, expect $15 next.

SNX | Synthetix (Weekly)

SNX managed to reclaim $2.50 as support last week, because it closed above it. From a technical standpoint, it should be heading to $3.50, but we all know that’s not happening yet.

SNX managed to reclaim $2.50 as support last week, because it closed above it. From a technical standpoint, it should be heading to $3.50, but we all know that’s not happening yet.

The market needs to be in a much better state for SNX to reach $3.50, any bounces from $2.50 will be short-lived. This would be a good asset to trade with in the short-term, but don’texpect $3.50 to be reached anytime soon - not until Bitcoin breaks above $28,750.

SYN | Synapse (Weekly)

Despite being in control for a while last week (see the wick), buyers were unable to keep control and sellers got the upper hand, closing the candle under support ($0.90). This means that unless we see a weekly closure back above $0.90, SYN will drop to $0.57 in the coming weeks.

Whether this level is achieved or not remains to be seen. We don’t believe it will be. Instead, a local bottom will form somewhere in mid-range between $0.90 and $0.57, when Bitcoin reaches $25,150.

Despite being in control for a while last week (see the wick), buyers were unable to keep control and sellers got the upper hand, closing the candle under support ($0.90). This means that unless we see a weekly closure back above $0.90, SYN will drop to $0.57 in the coming weeks.

Whether this level is achieved or not remains to be seen. We don’t believe it will be. Instead, a local bottom will form somewhere in mid-range between $0.90 and $0.57, when Bitcoin reaches $25,150.

MINA | Mina Protocol (Weekly)

MINA reached the $0.69 - $0.72 support area after losing $0.79 last week. Holding $0.69 as support is necessary to prevent even more downside. A loss of this level would put $0.58 on the cards. That’s -21% away from. Considering Bitcoin’s potential pullback, MINA will likely lose support and head to $0.58. So buying now isn’t ideal.

ASTR | Astar Network (Weekly)

ASTR is slowly dropping to $0.05500 andwe’re still expecting this level to be reached soon (couple of weeks at most). The orange box above is an 8-month-old accumulation area from which ASTR broke out in February. Holding $0.05500 on the weekly timeframe would prevent ASTR from entering this range again. So, as long as we stay above $0.05500, we could see it test $0.08200 - $0.10 in Q2.

THOR | THORSwap (Weekly)

To everyone’s surprise, THOR closed green last week, despite experiencing some serious selling pressure. This might be a sign that it could go for a $0.20 retest. However, the chances of closing above this level are slim, especially with a market-wide pullback on the cards. On a larger scale, THOR retesting $0.20 would likely result in a rejection, after which it will drop to $0.13 in the coming weeks.

OP | Optimism (Weekly)

OP has been stuck between $3 and $2 for a while now, so our priority should be tracking a break above or under these levels. In the meantime, OP will likely go back to $2. Keep in mind that Bitcoin reaching $25,150 would result in OP losing $2 as support on the weekly timeframe. A loss of $2 could give us a nice opportunity to short, with a take-profit level anywhere between $2 and $1.40 - that depends on your risk appetite and strategy.

Cryptonary’s take

We’re not always right - this is something we actually take pride in, because it shows that we aren’t promoting BS. The reality right now is that there are more signals for a pullback than there are for the market to go up. You can do with that information what you will.Action points:

- Take profits. The market will likely experience a pullback, so you’ll need capital to get in lower. If it goes up after you sell, you’d have lost an opportunity. If it doesn’t, you’d have saved your capital. Which one sounds better?

- Stay up to date with the market in our Discord (if you’re not doing so already). We share alpha there on a daily basis.