Meanwhile, Ethereum is caught between its rowdy range, searching for the saloon. Can it break through the swingin' doors back above $1,660?

Further down the dusty trail, Solana, Chainlink, Thorchain and Arbitrum are also at critical junctions. The next few sunsets could determine which way these tokens swing.

Again, we provide technical analysis and trading insights on 6 tokens in today’s market watchlist. Our analysis identifies potential trading opportunities and key levels to watch for these assets.

Ready to dive in? LFG!!!

TLDR

- BTC - Rangebound between $27,100 and $28,300, waiting for a breakout.

- ETH - Needs to reclaim $1,660 to prove further upside. Otherwise, there’s the risk of a selloff below $1,605.

- SOL - Watching for potential short around $24-$25 if funding resets and bearish divergence forms.

- LINK - Likely to remain rangebound, interested in shorting around $8.07. Expect lower prices in the coming weeks.

- RUNE - An upside to $2.19-$2.28 is possible, but we would look to short.

- ARB - Struggling at $0.86 support after failing to retest uptrend. Selling rallies preferred

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Trading BTC | Bitcoin

From initially rejecting the main horizontal resistance at $28,300, BTC’s price has responded relatively well so far at this point. Let's jump into it.

Technical analysis

Following the rejection at $28,300, it was pivotal for BTC to find some support at the next level, which locally was $27,100. So far, BTC looks to have been able to do that and actually found some support higher up at the $27,300 level, and now is attempting to get a bounce.

RSI

On the daily, we're sat at 60, and so far, we haven't had any bearish divergences put in, so there can be some more upside here. Studying the RSI is good for seeing when things are too oversold or too overbought. Here, we have neither, so there is nothing to worry about here.

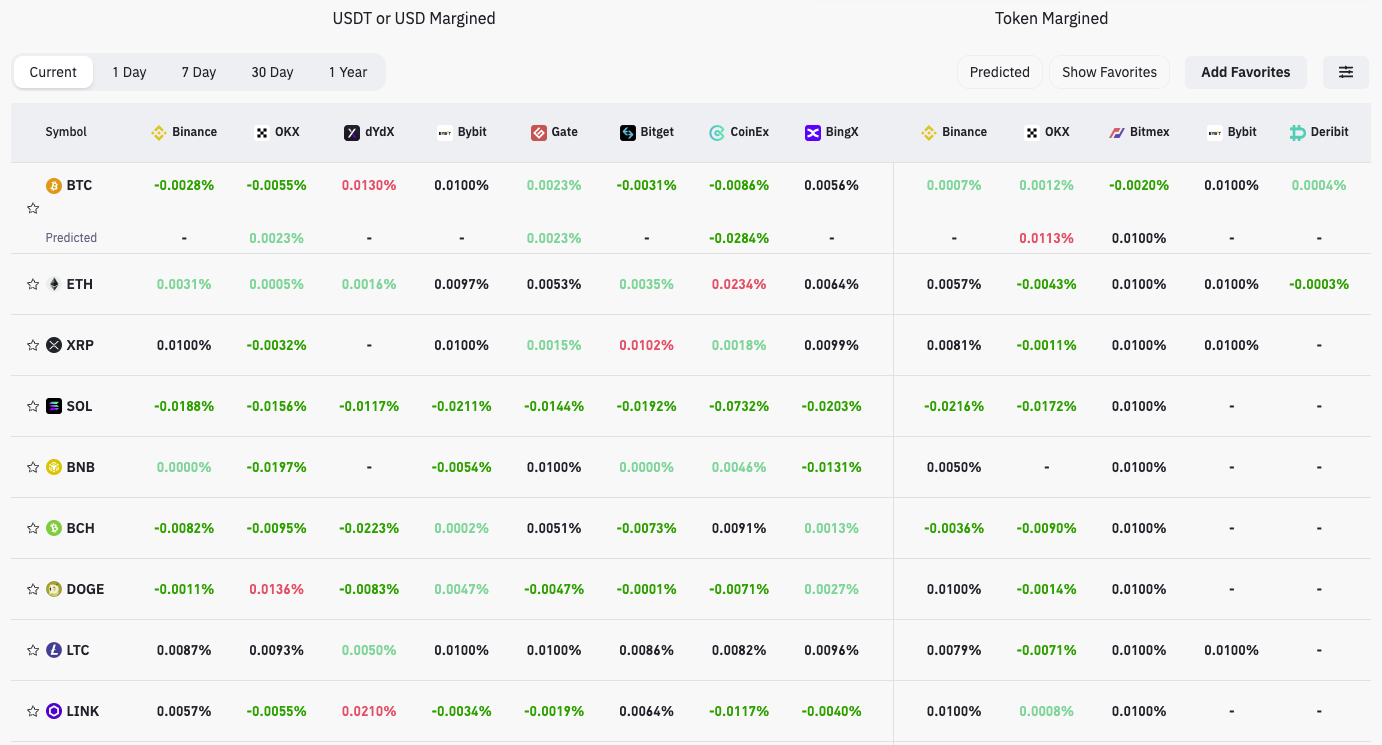

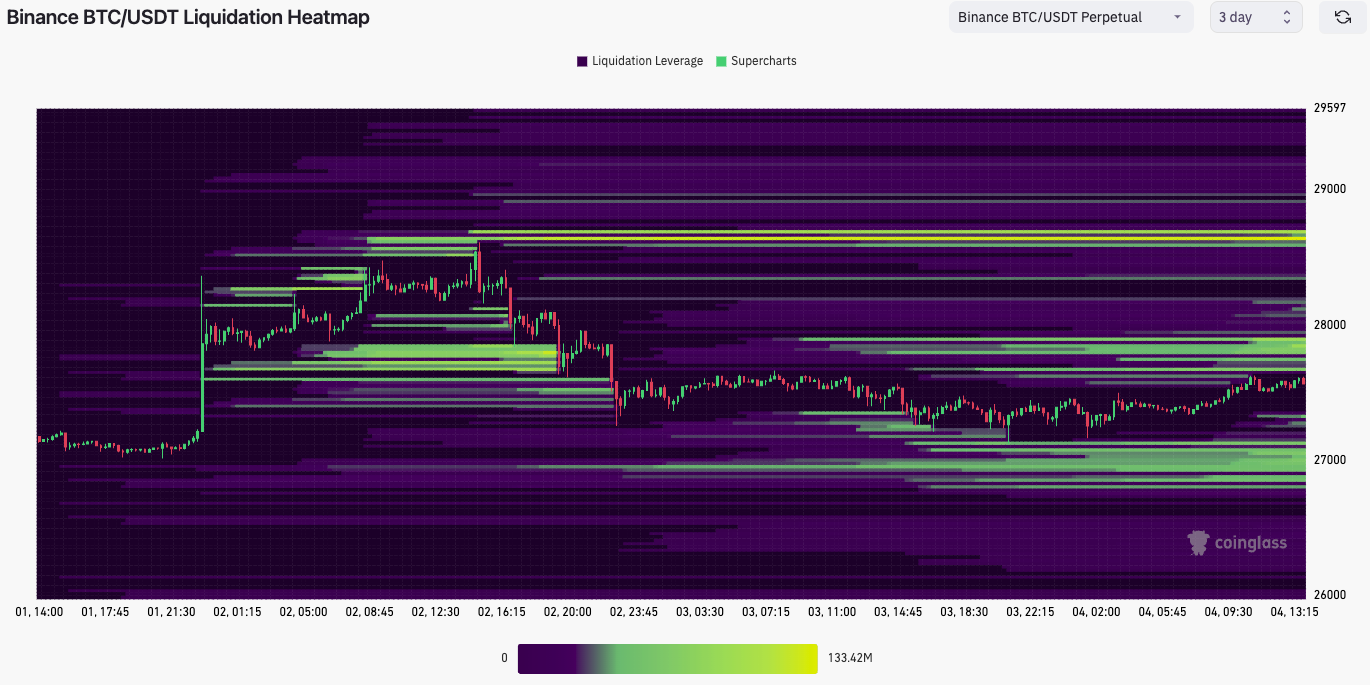

Funding rates and Liquidations map

It’s still negative, not deeply, but we're negative mostly across the board. This indicates that traders are still leaning towards shorting BTC.

Alongside this, there are short liquidations at $27,800. So over the next day or so, we think BTC’s price will go higher and take out these shorts that are just shy of $28,000.

Then, we will see if the price can break above $28,300. If we get this, assessing the Funding Rates will be key. If we get lots of shorts (big negative Funding Rate), then this might be what's needed to drive us past $28,300.

Conclusion on trading BTC

At the moment, it seems BTC is still in a small range, with futures/leverage trading dominating. We remain cautious about a big upside for BTC, but we think we can retest $28,300 over the coming days. The decision point will be there, we imagine.

Action

Doing nothing here, remaining patient until there is a breakout above the main range of $27,100 to $28,300.

ETH | Ethereum

A great example of prior liquidity (support lines) looking to hold prices up on retests. We need to see more here and for a follow-through to occur.

Technical analysis

Our analysis in last Friday's Watchlist was spot on. We said that ETH could get a more major breakout and get up to and test the $1,745 major horizontal resistance. After getting this, the rejection was not great. To be clear, an engulfing daily candle to take out the prior days' gains is not positive at all.

Since then, the $1,625 has acted as the first local support. It would have been more positive price-action-wise if $1,660 had held, but it didn't. We identified in yesterday's stream that the green-boxed area is the area of liquidity. Therefore, ETH’s price should naturally find some support in that area.

It's a good first step for ETH to find some bounce from $1,625, but we need to see that follow-through. This would ideally be a reclaim back above $1,660 and then a move higher from there.

RSI

The was approaching overbought levels. However, following the rejection at $1,745, it has reset to 50. No divergences so far either, so we can move on knowing this shouldn't affect price action too much

Conclusion on trading ETH

The rejection at $1,745 was not good, so we cannot dismiss this. ETH is in a very middle ground here, and we ideally need to let it prove itself to us. For more upside, we need to see the price reclaim above $1,660 at a minimum. If the trading price falls below $1,605, we would expect more of a selloff to ensue.

Action

Again, we are not taking any action here. We are waiting patiently for the market to show itself to us whilst it's in this middle territory. When trading, you want to get in around range lows or range highs (longs or shorts). What you don't want to be doing is entering into trades when prices sit on middle ground.

SOL | Solana

Solana is holding up at the peak of the move. we think this could present some opportunities. Let's jump into it.

Technical analysis

We've had the burst higher smashing through the horizontal resistances (in the low $20 area) and now found the liquidity box (green box area).

So far, we haven't put in any bull flags or pennant-like patterns, but we do really need more days of price action to establish this. We can immediately notice the bottom-heavy daily candles (lengthy seller wicks) over the past 3 days, i.e., selling into the $24 area.

RSI

RSI is back below overbought territory now at 67. If the price gets a move back into the $24 area, maybe even the $25 area, we will get another move higher on the RSI. What we'll be looking for is a higher high in price and a lower high on the RSI - bearish divergence. If we get this, this will likely encourage us to take a short. BUT....

Funding rates

Funding is currently very negative, so there are more shorts than longs. This could fuel a short squeeze, taking us into the $24 - $25 area. If we get this, and the funding rate resets to a more neutral/positive level, we may take the short in the $24 - $25 level.

Conclusion on trading SOL

We’re waiting on a few things to play out here, but we feel they will. Overall, it was a fantastic move higher that – SOL may still have one last exhaustive move higher left in it.

Action

This is the one we are really watching for a potential short trade. We need the above indicators to come to fruition for us to take it. But TLDR, this SOL trade is what we are currently paying attention to.

LINK | Chainlink

As mentioned in the last watchlist, LINK is beginning to show some signs of exhaustion at $8.07 point. Since then, we have seen a 10% downswing in price.

Technical analysis

Having been rejected from the horizontal resistance at $8.07, LINK’s price made a sizeable move lower, breaking the uptrend line.

We think it would now be natural for the price to want to move higher and retest the underside of the uptrend line and potentially even push to $8.07 again.

However, we don't feel that confident on LINK here and would expect that we get a rejection higher up or a rejection from this kind of price level. Not confident.

RSI

Again, like the other assets in today’s watchlist, the move down has meant that LINK has majorly reset the RSI to a more neutral territory of 57. No divergences to concern ourselves with here.

Funding rates

The funding Rate is mixed. There’s actually not much to interpret from it here.

Conclusion on trading LINK

We think LINK might remain in a tighter range for the next few days, at least between $7.20 to $7.80. We will become interested if we get back up to $8.07, and then we will re-assess for a short. Over the medium term (next 4-12 weeks), we expect to see LINK back down to at least $6.40.

RUNE | Thorchain

The bulls are still showing some strength to hold up at these higher price points, but RUNE is currently in a key battle.

Technical analysis

A significant and important battle going on at the horizontal resistance (now potentially support) of $1.97. RUNE is at a real make-or-break point here, in our opinion.

We still think the upside potential can be $2.19 to $2.28, and if this really has legs, then $2.46. However, we wouldn't hold out for that level. The downside would be a break of the uptrend line that would take us to $1.50.

Neither direction is really too clear here, but we would be interested in a short if we get to $2.20 to $2.28 again.

Conclusion on trading RUNE

We are currently sitting and waiting here, but we will become very interested if RUNE can return $2.19 to $2.28 for potential shorts.

Even though this could make another leg slightly higher, we think the meat of the move has been had here and again. In the next 4 - 10 weeks, we'd expect price back between $1.36 to $1.50.

Trading ARB | Arbitrum

Really crucial point here for ARB.

Technical analysis

Getting above the horizontal resistance of $0.86 and then $0.92 was huge, in our opinion. We particularly love the breakout of the main downtrend line.

We were then looking for a move back down to retest the uptrend line as support, bump it, and run up higher from there. So far, it doesn't look like ARB has been able to do this.

We're now back at the $0.86 horizontal support. It's really key that ARB holds this level and ideally bounces from here, although we now have the $0.92 horizontal support above us.

Conclusion on trading ARB

This could attempt a move back up again, particularly if BTC can hold up. But, our feeling is that in any meaningful move higher, sellers of ARB will emerge, which will be detrimental to getting higher prices.

Overall, we don't feel confident in ARB here. We'd be a seller of rallies if we had a bag of it. Currently, at a really crucial level at $0.86, let's see how that battle commences. If that level is lost, we see $0.75 being retested in the coming 4-10 weeks.

Cryptonary’s take

And that's a wrap, friends! Bitcoin and Ethereum are still locked in their standoffs, awaiting the next draw. Meanwhile, Solana, Chainlink, Thorchain and Arbitrum sit at fateful forks in the trail ahead.

As big as the crypto market is, it will never be big enough for bulls and bears to coexist peacefully. But if you read the charts correctly, DYOR, and place strategic bets, you can claim your piece of the frontier.

Our advice? Mind your margins, watch those ranges, and be ready to draw at the first sign of trouble or opportunity.

As always, thanks for reading.

Cryptonary out!