So, let's dive underneath the hood of it, break it down, and then translate this into what it means for crypto.

- Yesterday's inflation data came in lower than expected, but why did markets react in such an unexpected way?

- Is a significant shift from mega-cap tech to small-cap companies underway, and what could this mean for crypto investors?

- How might the first instance of deflation since COVID-19 impact the Fed's decisions, and how could this reshape the crypto landscape?

- What do the Crypto Speculation and Breadth Indexes reveal about the potential timing for diversifying back into altcoins?

- Are we on the cusp of a new risk-on environment, and how might this affect Cryptonary's current "barbell portfolio" strategy?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Yesterday's inflation data and what it means

Yesterday, we had downside surprises across the board on the inflation data. The Inflation Rate YoY came in at 3.0%, below the 3.1% consensus and below the 3.3% prior month's reading. Alongside this, the MoM Rate came in at -0.1%, meaning deflation rather than disinflation. This is the first time we have seen this since Covid.Educational note:

- Disinflation: A slowing in the growth of inflation. Prices are still increasing, just at a lesser rate than before.

- Deflation: Prices are actually decreasing.

The market's response to this data

Initially, risk assets (equities and crypto) ripped higher on the release of lower-than-expected inflation data and a continuation of the disinflationary trend. However, S&P and Bitcoin both sold off afterwards. This is despite the Dollar ($DXY) coming down substantially, along with Bond Yields also re-pricing lower. A move lower in the Dollar and Bond Yields has historically been positive/supportive of risk assets (equities and crypto).What was interesting yesterday was that the S&P sold off, essentially because Mega-cap tech (the Magnificent 7 companies: Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) sold off, and these companies account for approximately 30% of the S&P 500.

But what was super interesting yesterday was that we saw Small-Cap Companies (the Russell 2000 Index) make a substantial move to the upside.

Yesterday was potentially the first day of a new macro trend. This macro trend might be broadening out from mega-cap tech to smaller companies. This is because a weaker Dollar and lower Bond Yields are positive for small-cap companies.

The reason for this is that lower Interest Rates (and we now expect the Fed to begin an Interest-cutting cycle following the disinflationary data we've been getting) mean that Small-Cap companies will see a fall in their debt servicing costs, improving their margins and, hence, their companies' stock is bid up.

Big-cap companies bleeding whilst small-caps gain

The above shows us that yesterday, we saw that movement out of Big Tech and into Small Cap companies. This broadening out should aid a risk-on environment (particularly if we begin to see liquidity increase again after the summer), and this will likely carry through to crypto and be positive for crypto.

This is in spite of the fact that crypto sold off yesterday alongside Mega Cap Tech. We still believe the German government's selling and miners' selling are currently adding to a supply overhang. But, in the next month or so, we expect this to clear up substantially.

Below, we can see how the S&P, the Dollar, and Bond Yields sold off yesterday, while the Russell 2000 is up substantially.

S&P 1D Chart:

DXY 1D Chart:

US 2Y Bond Yield 1D Chart:

Russel 2000 1D Chart:

What this means for crypto

If we're right about the above, and this is a slight turning point in the macro and trading landscape—where we get this broadening out from Mega Cap Tech into Small Cap companies—this should positively impact crypto and help crypto and other risk-on assets increase in price.While we're watching the majors (BTC, ETH, and SOL) for potential signs of price breakouts in the coming weeks, we're also considering when it might be best to begin broadening out our portfolios again to more risk-on plays.

This is a diversification out of BTC, for instance, and back into alts, which may then outperform. We're paying close attention to the Speculation Index and Crypto Breadth charts for this.

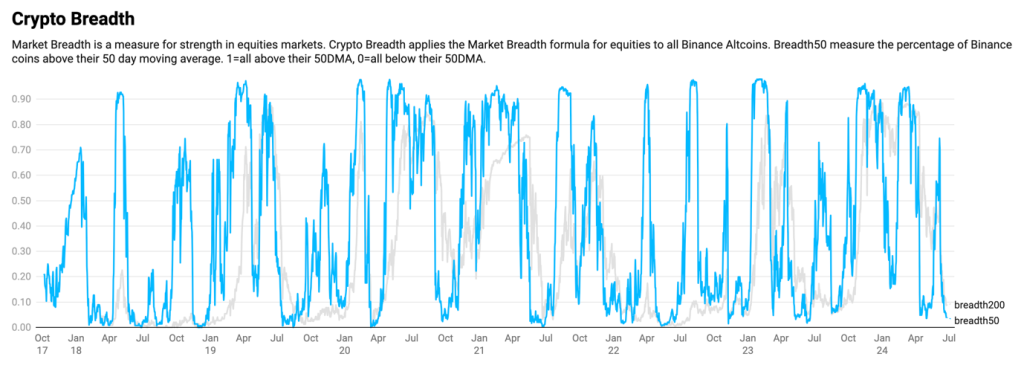

These charts show the percentage of altcoins with 90-day returns greater than Bitcoin. Higher readings suggest mounting speculation, whilst lower readings suggest capitulation and potentially the time to invest back into alt coins.

Crypto Speculation Index

Crypto Breadth Index

Both of these charts are low, indicating that the time to diversify back into alts from the Majors (Bitcoin)—to potentially get the outperformance—may be in the coming weeks and months.

Cryptonary's take

For several months now, we have maintained a tighter, more consolidated barbell portfolio: Majors and Bluechip memes (BTC, ETH, SOL, WIF, and POPCAT). However, the above suggests that the market may be transitioning into a more risk-on environment from mega-cap tech to small-cap companies and, therefore, more risk-on assets such as crypto.But we're first seeing this move in traditional equities markets, possibly before it also moves into crypto. This may take another month or two to really play out, but we do expect that once we're on the other side of the summer and more Interest Rate cuts begin to be priced in (potentially 3 for 2024: September, November, and December), this environment would be very supportive for risk assets.

And, with crypto being towards the furthest end of that risk curve, it should benefit.

This means – prices going up, although this may take another month or two to really play out. Therefore, our strategy, for now, is to remain tight in the barbell portfolio.

However, if we do see more evidence of this broadening out, we will expand more into selected altcoins and other memecoin positions as we expect a risk-on environment to return.

This would be over the coming month or two, assuming our theory is supported by a continuation in the broadening out that we believe we began to see the start of yesterday. We'll look to fund this expansion into more coins by adding USDT to our portfolios or selling down some BTC to free up more cash and to put that cash into opportunities that may be better set up to outperform Bitcoin.

We're sitting tight for now, but we're watching the market here with a keen eye and ready to pull the trigger on building out our altcoins and memecoin positions over the coming weeks.