Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

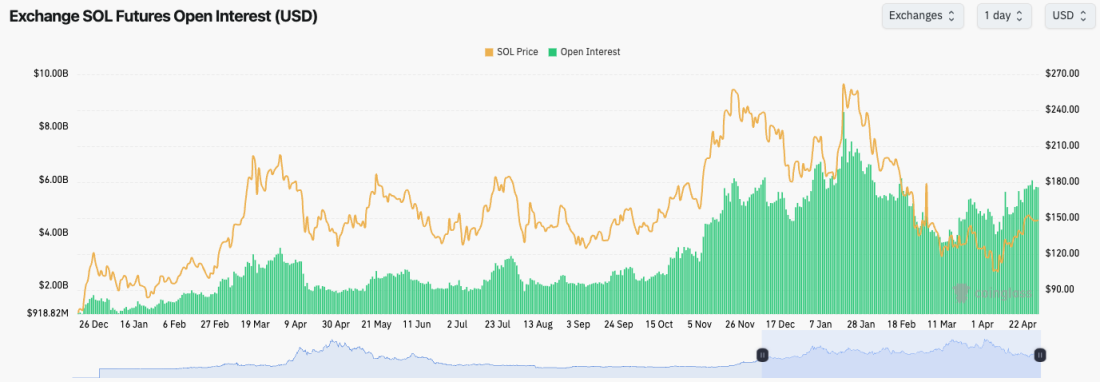

- SOL's Open Interest has kicked up quite substantially, suggesting that traders still have an appetite to take risks.

- The Funding Rate is flat, however, suggesting that Longs are matching Shorts. A move to $155 could potentially lead to a short squeeze.

Technical analysis

- Price broke above the prior high (March high), which was positive to see, and price is now battling at a key horizontal level of $148.

- To the upside, the key resistances are at $162 and $180.

- To the downside, $134 is a local support, with $120 a more significant support below that.

- Interestingly, price was in a local uptrend, and it has recently lost that local uptrend line, as we can see.

- The RSI isn't overbought, but it's not really in middle territory either. It is, however, currently sitting on top of and supported by its moving average. It'll be important to see if this metric holds as support.

- Next Support: $148

- Next Resistance: $162

- Direction: Neutral/Bearish

- Upside Target: $162

- Downside Target: $134

Cryptonary's take

Its possible SOL can move up to $162, but we expect that might be all that's left in this move, and we're expecting a local top to either be in or be put in this week close to $162.So, we think the next week can still give some upside, but limited upside; however, beyond that, we're not confident, and we expect $120 to be revisited again over the coming 4-6 weeks. Beyond that, and the $100 level, we do still expect that level to be in play, for June time.