Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

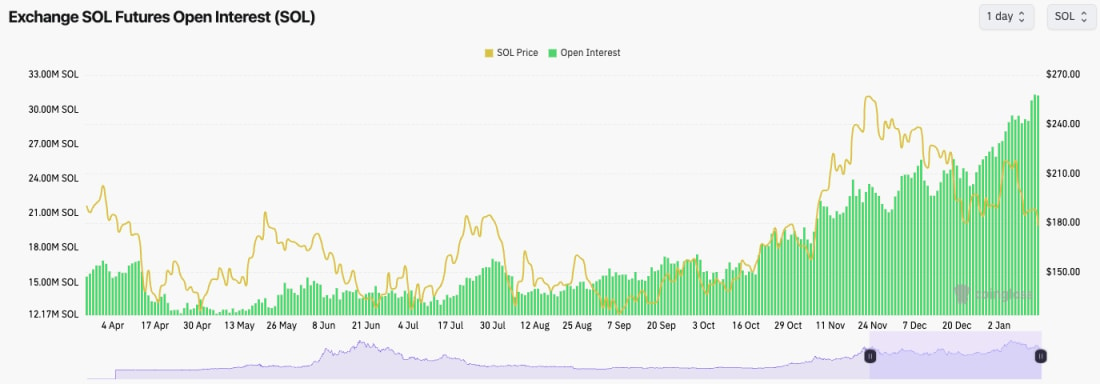

- SOL's Open Interest also continues to grind higher, indicating that there is a large build-up of leverage.

- SOL's funding rate is close to flat, at 0.00%, indicating there is an even balance between Longs and Shorts currently.

Technical analysis

- SOL broke out of its main downtrend line, but the price was rejected at the horizontal level of $222. Price then broke below the horizontal level of $203, formed a bearish pennant and broke down again.

- Today, the price broke down to $170, but we've seen bidders step in and push the price back close to $180 currently. $178 is new local support for the price, with the major horizontal support beneath the current price at $162.

- The Yellow Buy Box is currently between $120 and $145. We will be majorly interested if SOL visits that area, although we're not expecting this in the immediate term.

- The RSI is at 37, which is just above overbought territory, although there is room to still go lower. A retest of 30 on the RSI would likely put in a bullish divergence (lower low in price, higher low on the oscillator). We'd potentially be buyers of this.

- Next Support: $162

- Next Resistance: $184 - $190

- Direction: Neutral

- Upside Target: $203

- Downside Target: $145 - $162