Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

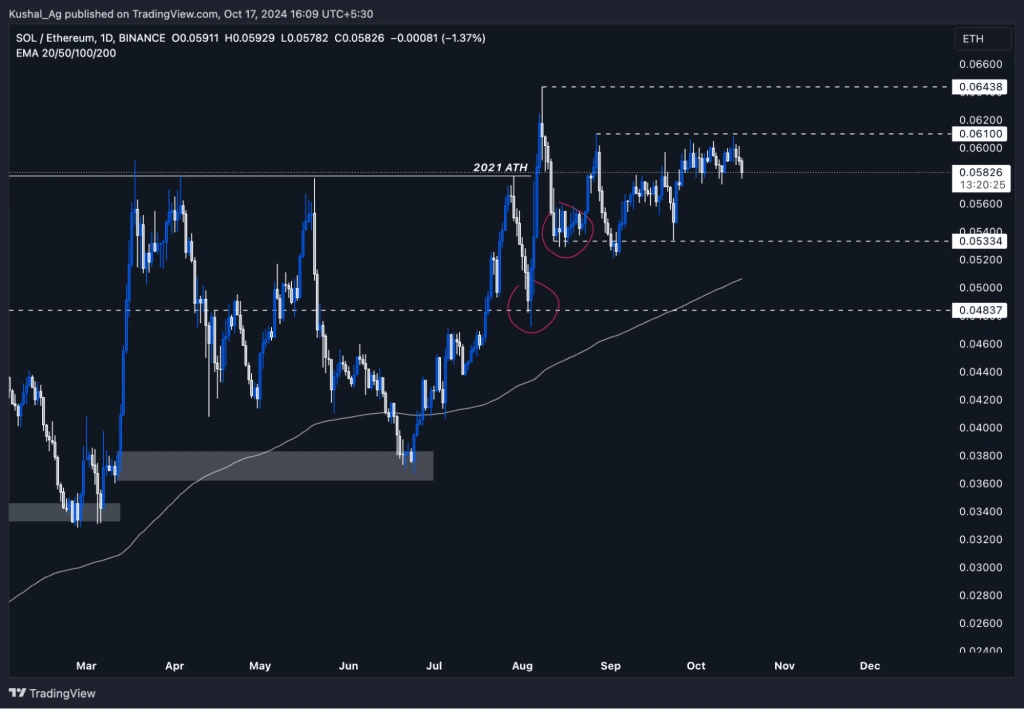

Solana versus Ethereum is shaping up to be a battle of titans. SOL/ETH has been consolidating just under the 0.061 resistance level, preparing for what looks like its next major move. While Solana has held strong against Bitcoin, it's also quietly positioning itself to challenge Ethereum.

- Support: The 0.0533 level remains a key support, with the 200 EMA around 0.05 acting as a solid backup if we see any deeper pullbacks.

- Resistance: Solana is knocking on the door of the 0.061 resistance. If it breaks above this level, the next target is the 0.064 all-time high (ATH), which could be the launchpad for another major rally.

- Potential scenario: If SOL/ETH manages to push through the 0.061 resistance, we could see Solana outperform Ethereum in the short term, moving towards 0.064 ATH and possibly higher.

Conclusion

SOL/ETH is on the verge of breaking key resistance levels. If Solana manages to push through 0.061, it could be poised to outperform Ethereum, setting the stage for a major rally in the coming months. Apart from technical analysis, let's look at fundamentals a little bit for a better picture.

Apart from technical analysis, let's look at fundamentals a little bit for a better picture.

Inflation rate of SOL vs ETH

- Ethereum (ETH): Post-EIP-1559, Ethereum's inflation has been dynamic due to its burn mechanism. As of October 2024, Ethereum's inflation rate has stood at approximately -0.054% since the merger, with a significant supply reduction of 136K ETH over the last two years. Ethereum's deflationary mechanism, especially during high transaction periods, creates a supply scarcity that positions it as "ultrasound money," a narrative strengthened by the network's growing staked supply.

- Solana (SOL): In contrast, Solana has a much higher inflation rate. Its current inflation rate is 5.1%, which will gradually taper by 15% annually until it reaches a terminal rate of 1.5% in 2031. Further, Solana's burn mechanism, while active, has had a more limited effect compared to Ethereum. Only 1.1M SOL has been burned YTD, offsetting about 6% of the gross issuance. This fixed schedule makes Solana more inflationary in the short term but predictable for long-term investors.

Unlock vs. Pectra upgrade

- Solana's upcoming unlocks: One of the significant unlock events is expected in March 2025, which will release 7.5M SOL (worth $1.1B) into the market. Such unlocks typically can lead to sell pressure.

- Ethereum's Pectra upgrade: At the same time, Ethereum's next upgrade is scheduled for early 2025. The Pectra upgrade aims to enhance Ethereum's staking system, increasing validator staking limits from 32 ETH to 2,048 ETH. The upgrade will also improve gas efficiency, rollup scalability, and smart contract functionality, positioning Ethereum as a more scalable and secure platform. These enhancements are key for Ethereum's future dominance, especially in the growing institutional adoption of its Layer 2 solutions.

Layer 2s thesis: Ethereum vs Solana

- Ethereum's Layer 2 Ecosystem: Ethereum's success with Layer 2s is evident, with major institutions like Coinbase and Sony integrating their operations. Ethereum's rollups dramatically reduce gas fees and improve scalability, drawing more projects and users into its ecosystem. This institutional growth further reinforces Ethereum's leadership in decentralised applications (dApps), and the upcoming Pectra upgrade will only bolster this position.

- Solana's Scaling Strategy: Solana focuses on base-layer scaling, notably with its Firedancer initiative, which could enable the network to process over 1 million TPS per core. Unlike Ethereum's reliance on Layer 2s, Solana's core network is optimised for speed and low-cost transactions, giving it an edge in high-frequency trading and gaming sectors.