Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

SOL:

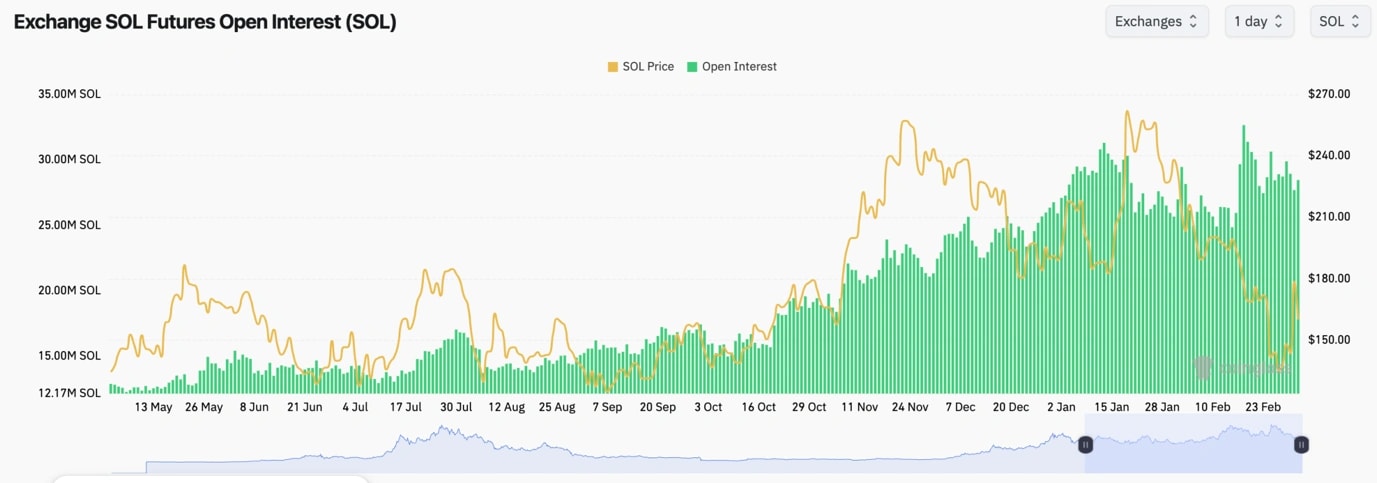

- SOL's Open Interest spiked when the price collapsed in mid-February. This is mostly just due to it then being much cheaper to leverage 1 SOL coin. This Open Interest is now decreasing again though, suggesting there's less confidence amongst traders to use leverage.

- SOL's Funding Rate has fluctuated between slightly positive and slightly negative, again indicating indecision amongst traders.

Technical analysis

- SOL bounced perfectly from the Yellow Box, and the price broke out of the downtrend line.

- Price also broke above the key horizontal level of $161, with price now having pulled back to this horizontal level and testing it as new support.

- If the $161 horizontal support can't hold, it'll be important for the $143 level to hold, as to then put in a higher low.

- To the upside, $182 and $203 are the next major horizontal resistance levels.

- The RSI has broken out of it's downtrend line, which is a positive, but it has run potentially further than expected.

- Next Support: $143

- Next Resistance: $182

- Direction: Neutral/Bearish

- Upside Target: $182

- Downside Target $120

Cryptonary's take:

SOL has broken out of what was a drastic downtrend. However, we don't expect this break out to last or push higher from here in the short-term. Our current expectations are that SOL will battle at the $161 level for a day or so and then likely break down to $143.In the short and medium term, we're not expecting any fireworks from SOL. Of course, there is the possibility that Friday's Summit might bring some news, but we are expecting it to be a 'sell the news' event.