Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Technical analysis

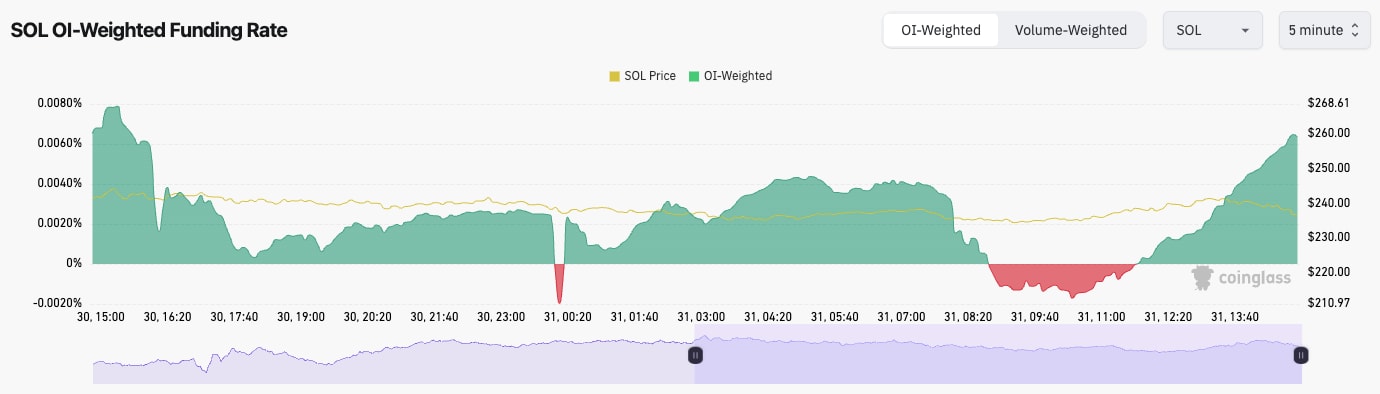

- SOL bounced off the main horizontal support of $220, and the price has now bounced up to the local horizontal level of $240.

- Price is in a larger range here between $220 (horizontal support) and the major horizontal resistance at $263.

- The RSI is in the middle territory, but it's below its moving average.

- Next Support: $220

- Next Resistance: $263

- Direction: Neutral

- Upside Target: $263

- Downside Target: $220