Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

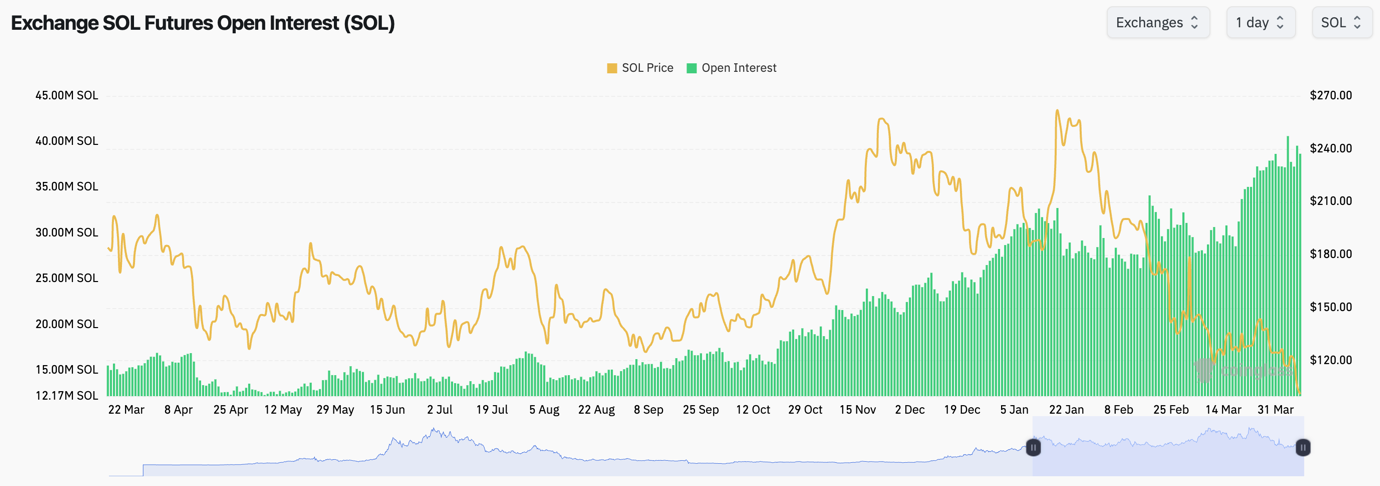

- Like ETH, SOL's Open Interest (by number of coins) is up, due to the price of SOL falling and it becoming cheaper to leverage 1 SOL. However, the USD value of OI is down substantially.

- Funding is fluctuating between slightly positive and slightly negative, but it's more on the side of slightly negative. This suggests more appetite amongst traders to Short.

- Ultimately, there is less appetite to leverage a bet on SOL here, but what appetite there is there is slightly weighted toward Shorts.

Technical analysis

- Chart-wise, we're looking at SOL on the 3D timeframe.

- Price broke below the major horizontal support at $120, and it swiftly headed down to the next horizontal and psychological level of $98/$100.

- If the $98/$100 horizontal support is broken to the downside, the next major horizontal level is at $81. At that point, we'll see where we are on the macro front, but we might consider chipping in with buys at $81 (assuming price can get there).

- If the $81 level is lost, then $52 is next. If we did get that, it'd be a strong buy.

- The RSI is entering oversold territory on the Daily timeframe, and it's also very close to oversold territory on the 3D timeframe, whilst also putting in a bullish divergence.

- To the upside, the major horizontal resistances are at $120 and $148. We'd struggle to get bullish before a reclaim of $120. That may take time.

- Next Support: $81

- Next Resistance: $120

- Direction: Neutral/Bearish

- Upside Target: $120

- Downside Target: $81

Cryptonary's take

In keeping this really 'short and sweet', SOL has broken a really key level of $120, and the price has swiftly moved down to $100. We expect the $81 level to be tested in the coming weeks. If the price trades at $81, we'll consider buying at that level. However, we'd want to see less retaliation on tariffs and deals starting to be done.There seems to be more to the tariff uncertainty and markets responding with downside. For SOL, we're not looking to buy yet.