Market Direction

SOL is at a crucial level here - trying to maintain the uptrend and hold the $61 support, which was the prior resistance.

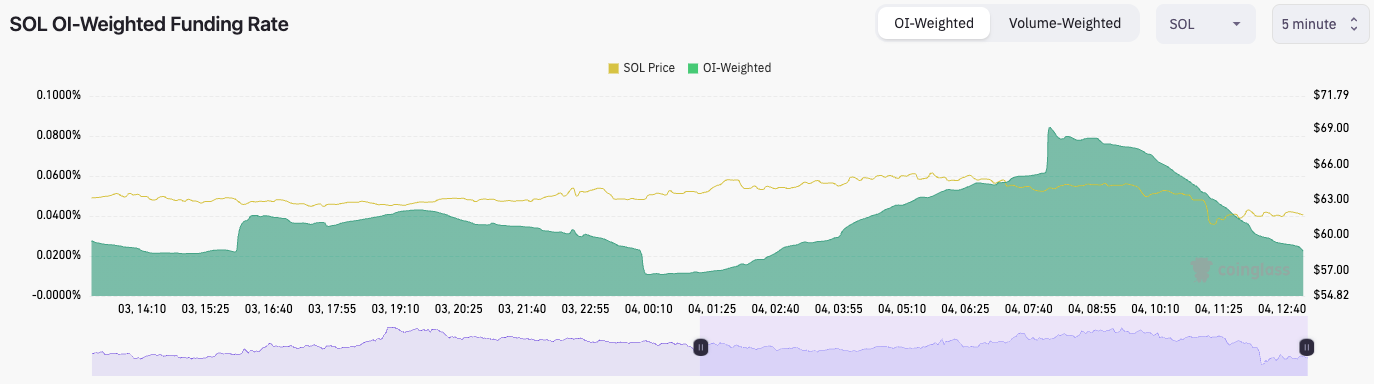

SOL's Funding has reset substantially, having been massively positive last night. OI at new highs.

TLDR

- SOL is at a critical juncture; for it to maintain an uptrend, the $61 support must hold.

- Funding for SOL has reset significantly, with massive positive spikes now balancing the equation.

- Technical analysis indicates a delicate balance at the $61 level; a breakdown could mean finding support at $56 and possibly $51.

- We will DCA in at $56 for light buying and be ready to make aggressive buys at $52.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

SOL 12hr

Technical analysis

- SOL managed to break above its prior resistance of $61 but rejected into the $66 level.

- SOL is now at a convergence point of the $61 level (prior resistance, now potentially new support) and the uptrend line, which should act as support. SOL can break lower here, particularly if it loses this key level.

- $56 would be the major support to the downside. Beneath this, it’s $51.

- The RSI is relatively healthy on all timeframes except the 3D and the Weekly, both of which remain majorly overbought.

- If SOL breaks down to the low $50s, we’d be DCA Spot buyers for the long term at that price point.

Market Mechanics

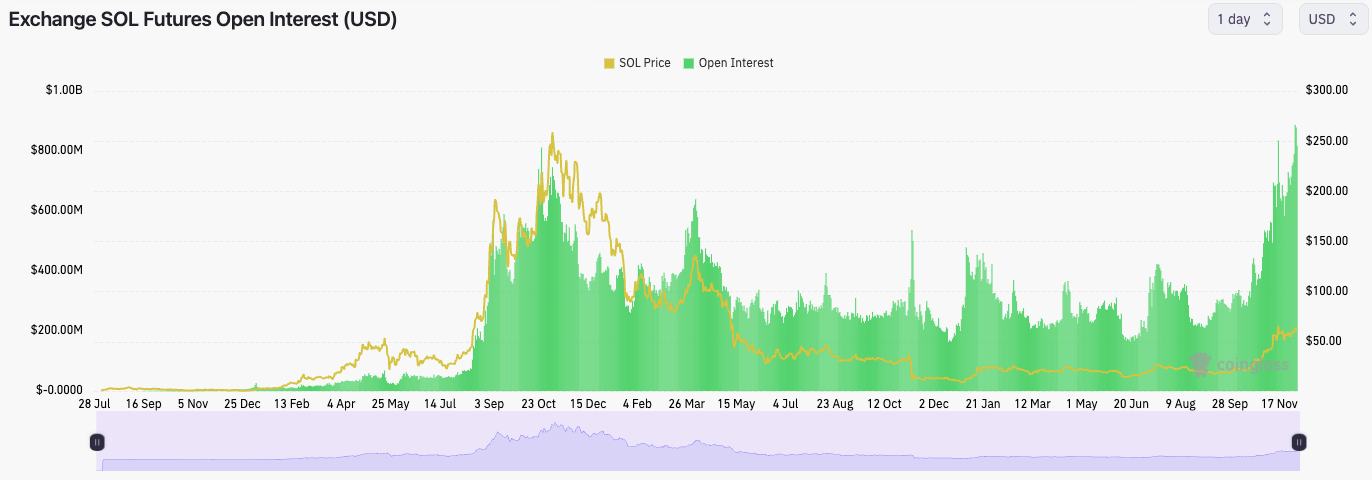

- Open Interest has increased to a new high at $993m.

- The OI-Weighted Funding Rate has been very volatile. It has come down significantly since the early hours of this morning, but it remains at relatively high levels. Longs are paying a substantial premium to Shorts to be Long.

- The Long/Short ratio at 0.9429, indicating more participants have piled into Shorts than Longs in the past 8 hours; this is perhaps why the Funding Rate has decreased from 0.0844% to 0.0263%.

Cryptonary’s take

SOL is at a crucial point here. Price is currently at the convergence area of $61, which was the prior resistance and potentially new support, along with the support of the uptrend line. If this level is lost, then we may see price go down to $56.The mechanics were overheated, but with the slight price pullback from $66 to $61, we've seen that late Shorts chased the move down, and many Longs were liquidated.

If price were to pull back, we’d be pleased to see this as we would take advantage of lower prices by DCA’ing more into SOL and increasing our Spot bags. We would be DCA buyers of SOL if price pulled back to $52, and we would be light DCA buyers of SOL if price pulled back to $56.