Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

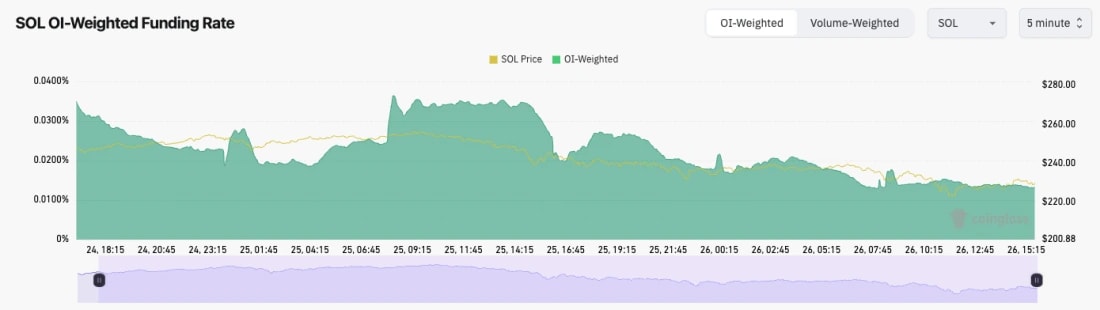

- Like BTC and ETH, SOL's Open Interest is also very high despite its recent shallow pullback from the highs.

- The Funding Rate is interesting. It has more meaningfully reset and is back close to the 0.01% level, indicating even positioning. Longs are not getting overly aggressive here.

- SOL has a much healthier leverage setup than BTC and ETH.

Technical analysis

- SOL was initially rejected from the prior all-time high of $260. This is the new major resistance.

- The price has pulled back, and it's using the prior local resistance of $220 as new local support.

- We expect the zone between $203 and $220 to be significant support, and we don't expect SOL to break below this support zone.

- SOL has pulled back substantially from overbought territory, having been at 77 on the RSI. It's now at 55, which is a significant pullback and a really clean resetting.

- Next Support: $220

- Next Resistance: $260

- Direction: Neutral/Bullish

- Upside Target: $260

- Downside Target: $200

Cryptonary's take

SOL looks like the best setup out of the majors (BTC, ETH, and SOL). It's had a reasonable pullback where the price is now sat on top of a major support zone, and the overbought indicators have also reset substantially. A really nice natural pullback within a larger uptrend.We expect SOL to consolidate on top of/or in and around $220 before moving back up in the coming weeks. We're not looking to sell any Spot SOL anytime soon; we think SOL looks very positive here, even if there is a consolidation in the short term.