SOL isn't slowing down: Will it shatter $50 and soar to $80?

We are all witnessing SOL’s relentless ascent and are in awe of its remarkable rally. The question on everyone's mind: can SOL break through the formidable resistance zone between $48 and $50, opening the door to the significant $80 mark? Right now, it's hard to bet against SOL.

TLDR

- Solana (SOL) eyes a break above the $48 to $50 resistance level.

- Overbought RSI signals caution as SOL continues its upward march.

- High leverage and strong long bias in market mechanics raise concerns.

- We advise long-term SOL investors to stay put and consider increasing exposure at lower levels.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

The monster continues and looks primed to potentially break above the $48 to $50 resistance area. If SOL can break higher, there is relatively clear headway for SOL to push up to $80, although there’s a local resistance at $58.The next supports to the downside are at $42.50 and then $38.

The RSI’s on the daily, 3D timeframes are as overbought as they’ve ever been. There will need to be a pullback at some point. However, the key is identifying the level from which SOL eventually decides to pull back. The weekly RSI is also now well into overbought territory.

SOL 1D

Market mechanics

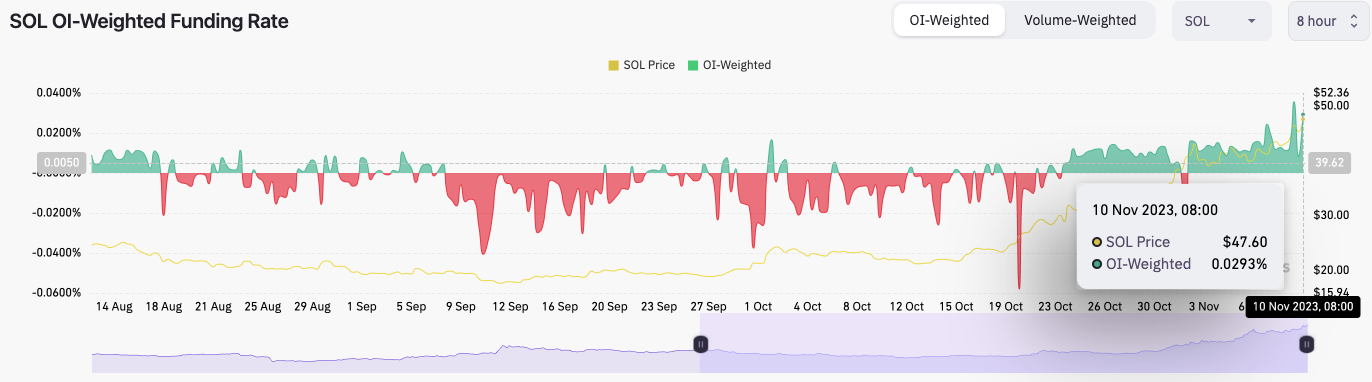

The funding rate for SOL has moved higher to being very positive again, indicating a strong bias to be long. Now, longs are willing to pay a substantial premium to be long. However, the open interest has actually come down over the past few days. However, it does remain at a high level - the highest it's been since August 2022. This suggests that the leverage market is well overheated here, and it’s once again heavily sided towards longs - usually resulting in some form of flush-out if price can decline enough to trigger long liquidations.

Cryptonary’s take

Even though SOL can continue to move higher, we are more cautious now than we have been recently due to the magnitude of the move up and the overheated derivatives market.We love SOL long-term, and if you’re in from a low-cost entry, we won’t encourage selling your SOL, as we also look to ride it for the bull market. We would look to increase exposure under $42.50 and become more aggressive in DCA buys sub $38 if SOL moves lower in the coming weeks/months.

We would suggest not aggressively trading SOL simply due to the amount of volatility and its capability of chopping traders up in the volatility.