Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

SOL

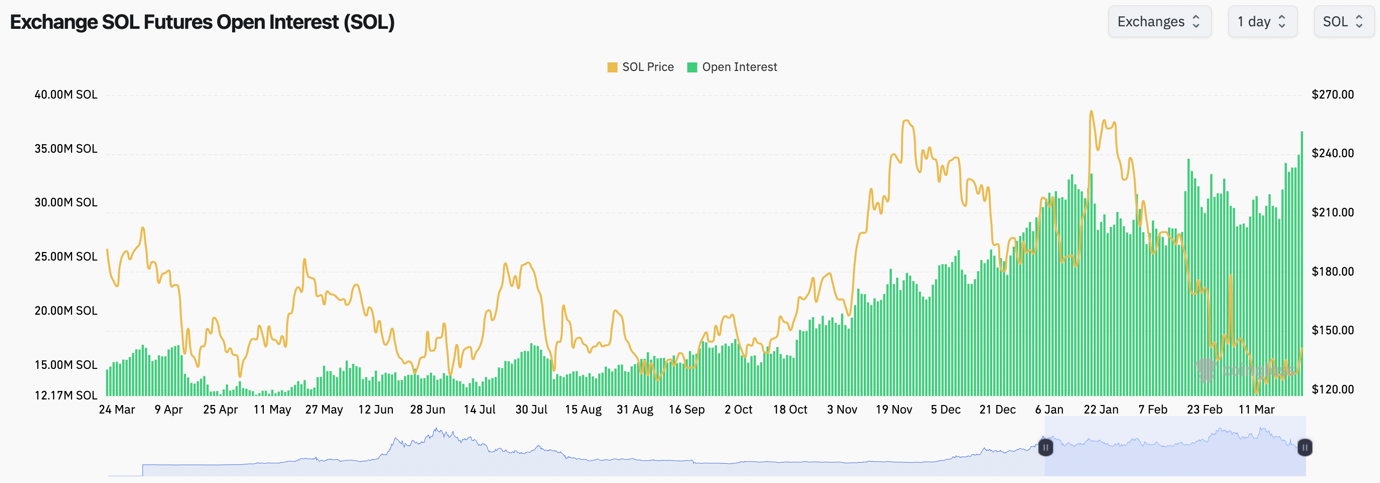

Market metrics:- SOL's Open Interest has also hit new OI highs (by number of coins), showing us that there is still the appetite to leverage trade. However, note SOL is half the price of where it was a few months ago, hence less $ is needed to leverage 1 SOL.

- SOL's Funding Rate is mostly positive but it is still relatively contained, indicating that there isn't this huge appetite to rush into Longs.

Solana Open Interest hitting new highs, though with lower dollar value due to price decline

Solana Open Interest hitting new highs, though with lower dollar value due to price decline

Technical analysis

- SOL has found support and bounced from the main horizontal support level at $120.

- Price is now breaking above the local horizontal resistance of $136, with the next major horizontal level being at $162. We don't expect price to clear above $162, and we're not confident if it'll get there.

- The RSI has cleared above it's moving average, however it is now very close to putting in a hidden bearish divergence (lower high in price, higher high in the oscillator).

- The major horizontal supports remain at $120 and if that is broken to the downside, then $98.

Solana technical analysis showing support bounce at $120 and next resistance at $162 SOL 1D Timeframe - Key Levels:

Solana technical analysis showing support bounce at $120 and next resistance at $162 SOL 1D Timeframe - Key Levels:

- Next Support: $136

- Next Resistance: $162

- Direction: Neutral/Bullish

- Upside Target: $162

- Downside Target: $120