Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

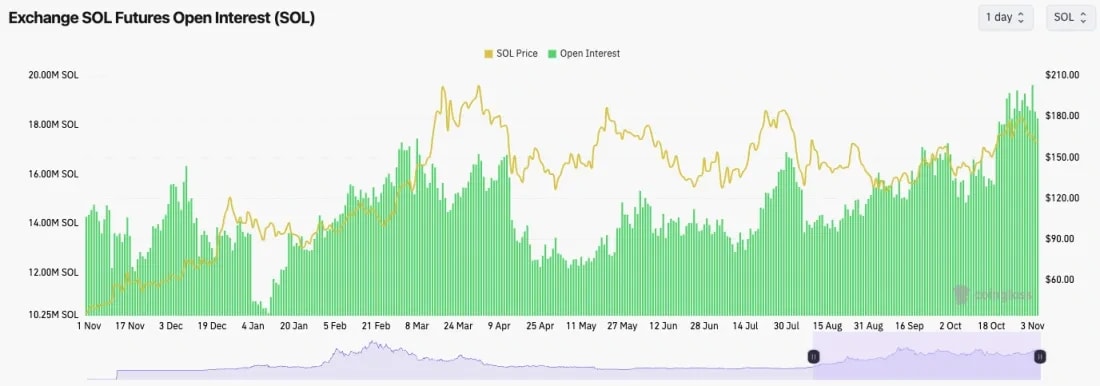

- SOL's Open Interest remains elevated despite the more than 10% price pullback.

- SOL's Funding Rate is also at 0.007% indicating that there is some Short interest despite the bias still being mostly Longs.

Technical analysis

- SOL moved into its higher price range (between $180 and $190) and swiftly rejected from that level as profit-taking began on "Trump trade" assets.

- Price has since pulled back having broken below the local uptrend line and now testing the horizontal area of $162.

- So far, the low $ 160 has acted as support. If that area cannot hold then the price will be back into it's old range (between $143 and $162).

- A break below $160 and a Harris win could see the price retest the next two horizontal supports at $143 and then potentially as low as $131.

- To the upside, $162 is the level to reclaim, and beyond that $180. Very likely we see $180 tagged if Trump wins.

- The pullback from the $180's has more meaningfully reset the RSI which had put in a bearish divergence at the highs. The RSI has now pulled back to the middle territory of 47.

- Next Support: $143

- Next Resistance: $162

- Direction: Neutral

- Upside Target: $162

- Downside Target: $143