Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

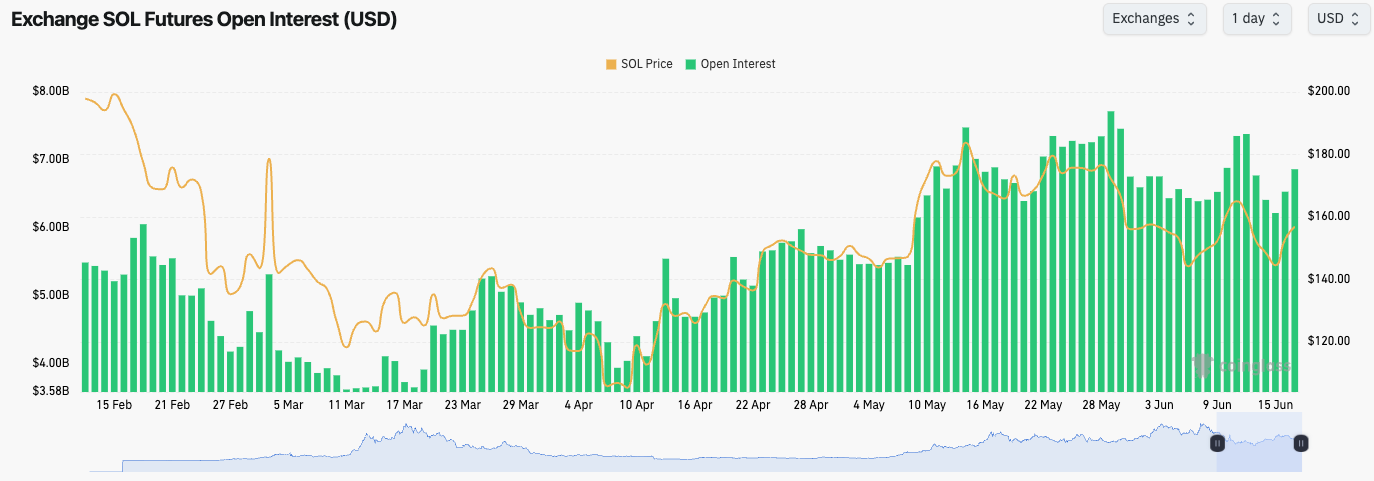

- SOL's Open Interest has increased on today's price bounce, but previously it has decreased as the price has moved lower. This suggests there's a consistent bias amongst traders to Long SOL, hence the unwinding of OI when the price moves down.

- SOL's Funding Rate is positive, but not in frothy territory.

Technical analysis

- We previously identified the Yellow Box as a key area for SOL and its price. Above the Yellow Box, and price action should remain bullish; below it, and we can see further downside.

- SOL has pulled back to a key horizontal support at $144 where price has then bounced from.

- Price is now retesting the underside of the Yellow box, which is a local resistance at $157.

- SOL could now potentially be range-bound, like ETH, between the $144 support and the $164 horizontal resistance.

- If the price breaks down from the $144 horizontal support, then $135 is the next local support. If the price breaks out of $164, the next upside target is $184.

- The RSI is in a healthy position. It's in middle territory, but above its moving average.

- Next Support: $144

- Next Resistance: $164

- Direction: Neutral

- Upside Target: $184

- Downside Target: $144

Cryptonary's take

Like ETH, SOL may stay range-bound between $144 and $157 for now, with upside bias above $157. We're watching for signs of a convincing breakout in either direction, although we'd expect the breakout to be to the upside rather than the downside. The key upside levels for price to clear above are $157 and then $164.If price were to fall below $144, we'd look to add SOL to our long-term bags, between $120 and $144. However, our expectation is that the price remains range-bound between $144 and $157 in the short term.