Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

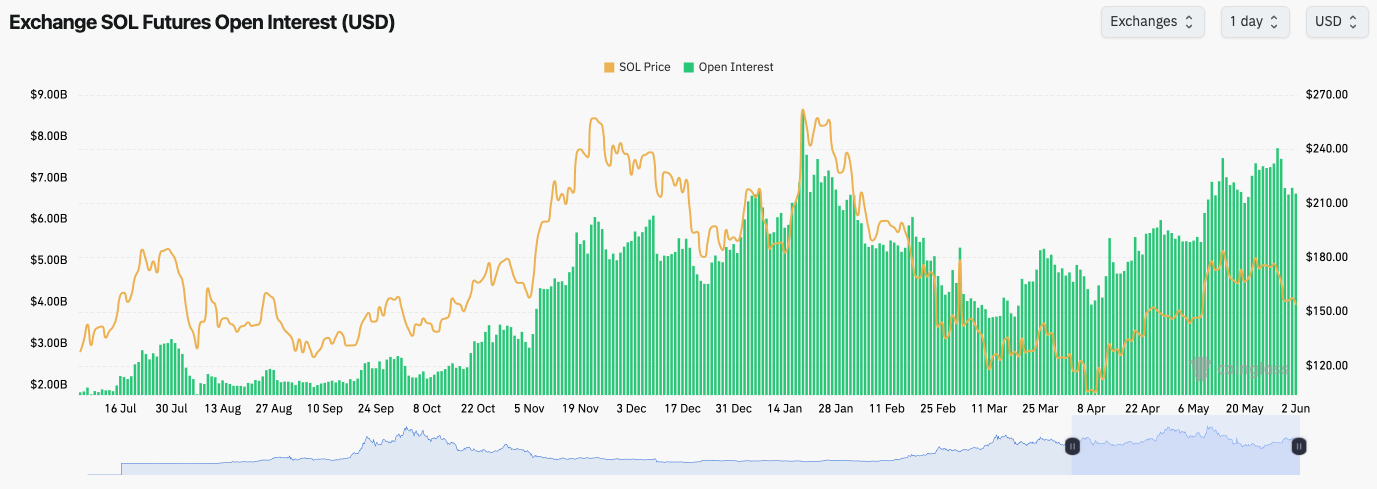

- SOL's Open Interest has pulled back slightly over the last few days following the price pullback, with Funding Rates holding close to neutral, but whipsawing.

- Ultimately, this shows indecision amongst traders.

Technical analysis

- SOL broke below its horizontal support of $162 as we expected it would do, following the loss of its main uptrend line.

- Price is now holding at the prior highs at the $150 level, whilst there is also a main horizontal support just below $150 and $147.

- If price were to lose to the horizontal level at $147, then price would likely pull back to the $120 to $130 zone. If this were to happen, we would consider buying SOL for the long run in that range ($120 to $130).

- It's possible in the immediate term that SOL bounces and retests $162 as a new horizontal resistance. We expect the price to reject there in the short term, and pull back further.

- If price can break above $162, though (as we said, we don't expect it to), then $180 is the next horizontal resistance.

- The RSI has meaningfully reset on this pullback, and it's now in middle territory, so not overbought or oversold.

- Next Support: $147

- Next Resistance: $162

- Direction: Neutral/Bearish

- Upside Target: $180

- Downside Target: $130

Cryptonary's take

SOL has pulled back more substantially, as we expected it would, following the breakdown of the main uptrend line. SOL is now in a critical zone between $147 and $162, where the price will need to show strength if a general uptrend is to be continued. Our expectation is that the price may chop for a few days (potentially even retesting the underside of the horizontal resistance at $162) before breaking below the horizontal support of $147 and moving back down to $130.In terms of our positioning, we'll remain sat in USD for now, although a retest of $120 to $130 would likely encourage us to begin lightly stepping back in (buying). But for now, we're patient and we see little reason needed to rush in here.