Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

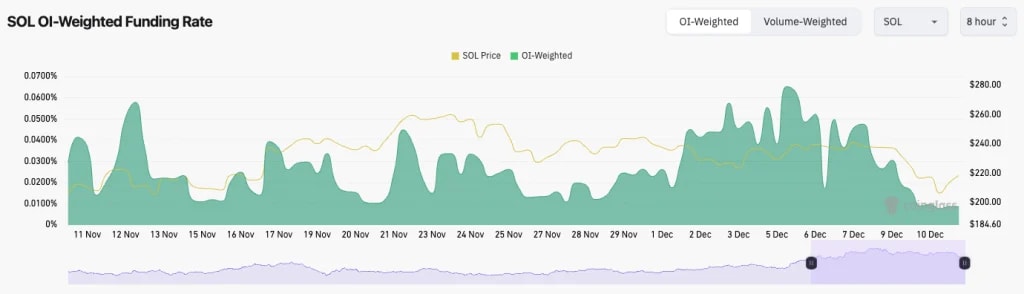

- SOL's Open Interest has pulled back by 12%, so we have seen a deleveraging here, which is good.

- SOL's funding rate has reset substantially, having been at 0.07% 5-6 days ago, and is now back to a healthy level of 0.01%. This indicates that over-levered Longs have been flushed or closed out.

Technical analysis

- SOL attempted a breakout of its descending wedge, and unfortunately, the leverage flush outcome and the price swiped down to the major support of $203.

- The price bounced at $203, and it is now trying to reclaim back above the local horizontal level of $222. However, it is also meeting the underside of a local downtrend line.

- The RSI has also pulled back substantially, and it's in the middle territory, but it does remain beneath its moving average. We'd be looking for it to flip that and turn the MA into support.

- Next Support: $200

- Next Resistance: $250 - $260

- Direction: Neutral

- Upside Target: $300 (then $330)

- Downside Target: $200

Cryptonary's take

It's possible that the price is rejected at these local levels here and retests the $210 to $220 area. But, if the price does retest this area, we'd expect it to be bid up quite heavily. We believe it's only a matter of time before SOL breaks out of these local downtrends, flips the $250-$260 level, and $300 to $330 is achieved relatively swiftly.We're not sure when that might be, and we're expecting more chop in the coming days/week. But, we're holding all SOL and we're looking to sell it at prices much higher than current prices.