Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

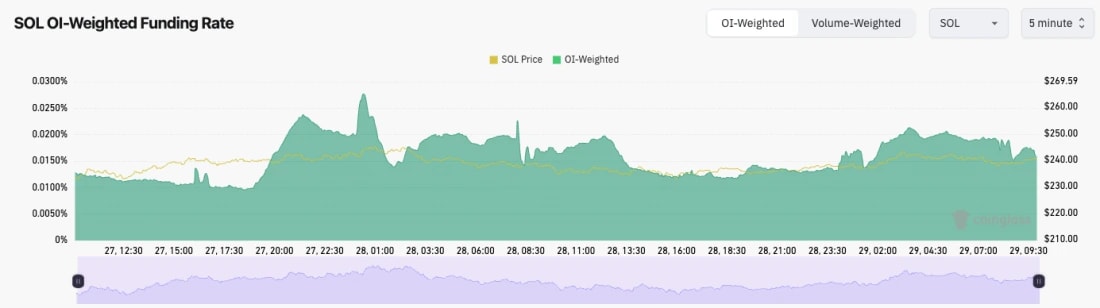

- SOL's Open Interest is down slightly from the highs, indicating that some leverage was flushed out on the pullback to $220.

- SOL's Funding Rate is positive, but it isn't elevated at just 0.0158%. This indicates that positioning is tilted Long, but it's close in balance between Longs and Shorts.

Technical analysis

- We're looking at this chart from a zoomed-out perspective, but we remain on the daily timeframes.

- SOL moved into its all-time highs at $260, rejected, and pulled back to the prior horizontal resistance, now turning new support at $220.

- SOL was able to bounce well at $220, with this pullback to $220 really resetting the RSI, now being significantly below overbought territory.

- We expect the $210 to $220 area to act as strong support for SOL in the short term.

- To the upside, the main horizontal resistance is the prior all-time high, $260.

- Next Support: $220

- Next Resistance: $260

- Direction: Neutral/Bullish

- Upside Target: $260

- Downside Target: $220