Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

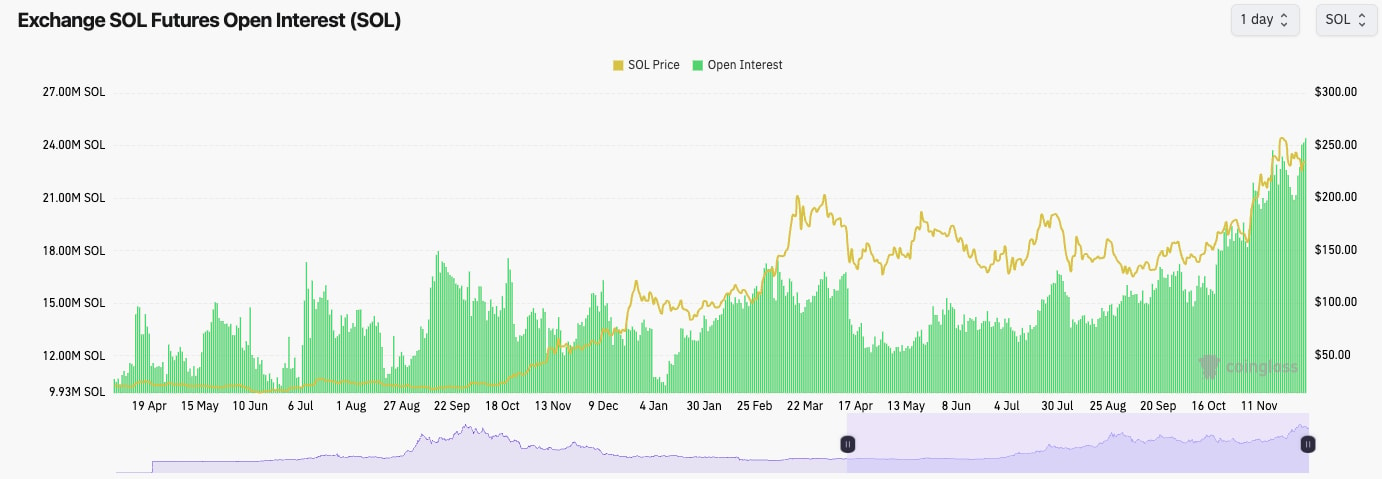

- SOL's Open Interest has increased by north of 20% over the last 3-5 days.

- SOL's Funding Rate is also at high levels, close to 0.06%. This means there's a strong bias amongst traders to be Long here, and with Open Interest where it is, SOL is becoming more vulnerable to a potential flush-out.

- Price can perform with Funding Rates at these levels, but it would be a warning sign to us if Funding Rates spiked much further from here.

Technical analysis

- From a TA perspective, SOL is showing a different story - a bullish setup.

- SOL is currently forming a descending wedge that would have a break-out target to the upside, with a target of $290 - $300.

- The price is also nicely above major horizontal support at $220, with a large support range beneath that, which is down to $200.

- On the upside, $250 to $260 remains the price resistance zone.

- Another positive point with regards to SOL's price pulling back from the highs here is that the RSI has pulled back substantially and is now in the middle territory, nowhere near being overbought.

- Next Support: $220

- Next Resistance: $260

- Direction: Bullish

- Upside Target: $260

- Downside Target: $220

Cryptonary's take

From a mechanics perspective, SOL does look overheated here. But the TA setup is great/bullish, and the narrative and momentum continue to be positive.We expect SOL to hold above $220, but if there is a drop below, we expect it to be aggressively bought up, especially if this kind of move sees small leverage flush out. We're looking for SOL to move higher in the coming week/weeks, although in the immediate term, we're expecting more range-bound price action.