Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

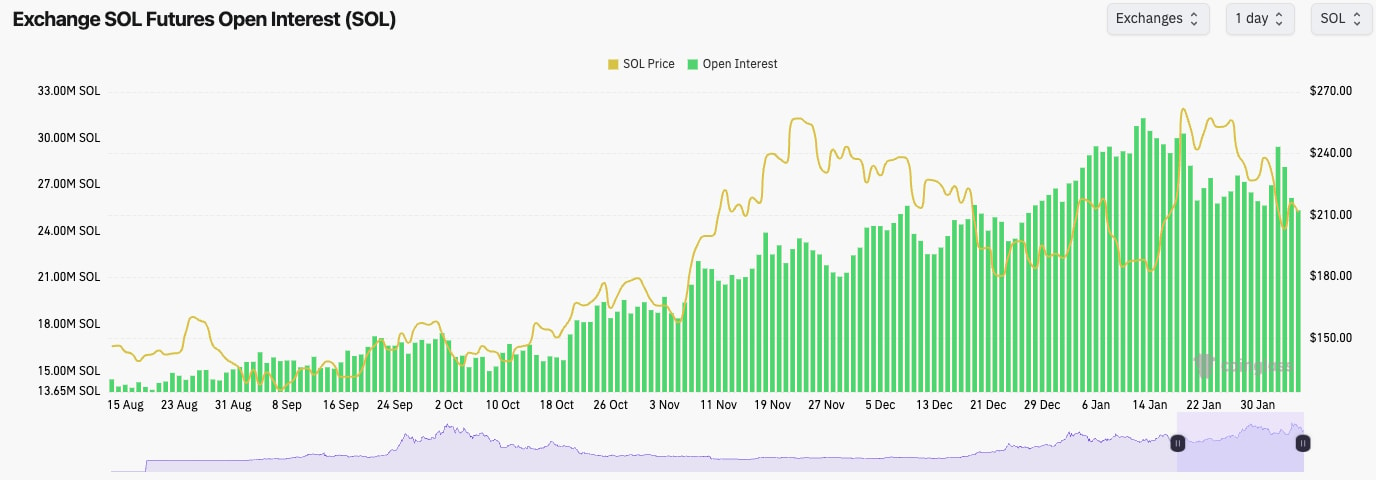

- SOL's Open Interest kicked up but then pulled right back down again as the Sunday/Monday liquidation event unfolded. Ultimately, the OI has remained in a downtrend since the start of the year.

- Like ETH, SOL's Funding Rate fluctuates from positive to negative, indicating indecision amongst traders who are likely also being whip-sawed by the price action.

Technical analysis

- SOL did really well in bouncing aggressively and recovering at the $203 horizontal level.

- Today, the price has moved lower and bounced off $203 as new support.

- For now, the price remains below the horizontal level of $222. A reclaim of that level would be the bullish reversal we'd be looking for.

- If the price breaks back below $200, the key level to then hold will be $182.

- The RSI is in the middle territory, but it's currently well below its moving average, which may mean the price can rebound higher in the short term.

- Next Support: $203

- Next Resistance: $222

- Direction: Bearish/Neutral

- Upside Target $240

- Downside Target: $183