Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

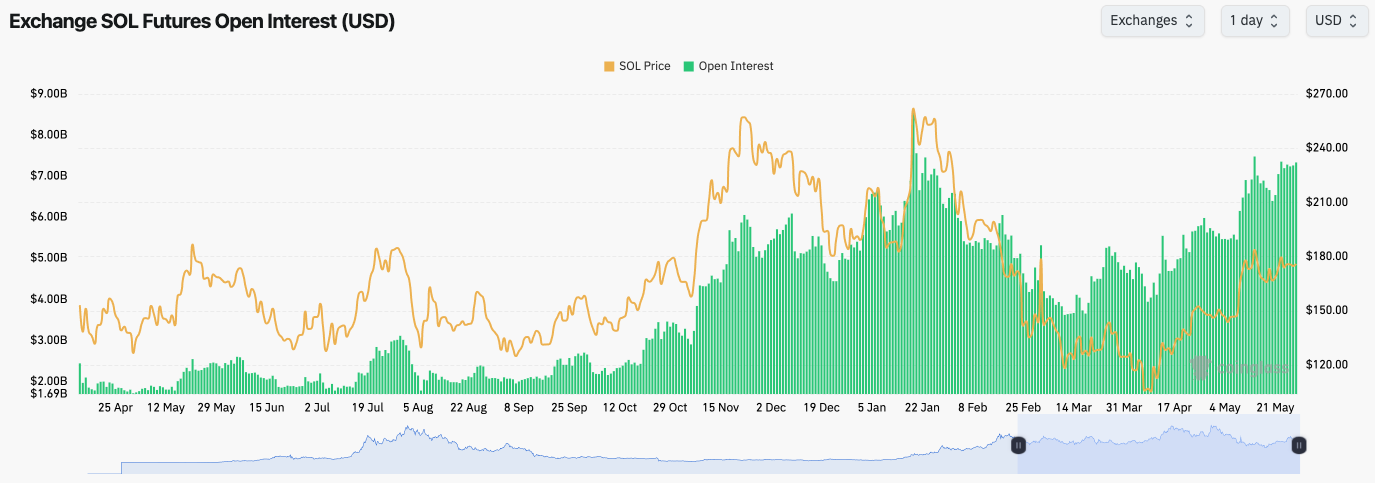

- SOL's Open Interest has increased whilst Funding is now positive, suggesting that the increase in OI is Longs.

- We were seeing periods of negative Funding for SOL, suggesting that there was demand to shorten it. A sizeable amount of those Shorts have been squeezed or closed out, though now.

Technical analysis

- SOL has remained above its horizontal support of $162, but it's still finding resistance at the horizontal level of $184.

- Since the early April lows, SOL has respected its uptrend line, although the price is now squeezing against its uptrend line.

- To the upside, the horizontal resistances are at $184 and then $203.

- On the downside, the horizontal supports are at $162 and $147.

- SOL has consolidated above $162 for the last few weeks. This has allowed the RSI to reset from overbought territory. However, the RSI is now below its moving average.

- Next Support: $162

- Next Resistance: $184

- Direction: Neutral

- Upside Target: $203

- Downside Target: $147