Market Direction

Despite some relief in market conditions like open interest and funding rates, SOL remains overstretched on larger timeframes - spelling danger for further downside ahead. Where does SOL go from here?

TLDR

- SOL has formed a bearish head and shoulder pattern.

- Price broke below the neckline, and it rejected on the retest of the underside.

- Market mechanics like open interest are more balanced, but SOL is still overbought on higher timeframes.

- SOL will likely drop to test supports at $55, $52 and potentially $48.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

SOL 4hr

Technical analysis

We’ve looked at SOL on the 4-hour timeframe to get a clearer perspective on the setup.- SOL is currently in a head and shoulders pattern that looks to have broken beneath the neckline. Price has retested the underside of that neckline and has initially rejected from that level.

- Local supports are at $55 and $52, but the major horizontal support is between $47 and $48.

- For SOL to see more considerable upside, it must first reclaim above the head and shoulders neckline.

- If the $48 support is broken, the next target would be $44.

- If price does break down, a key level to watch is the main uptrend line (thicker yellow line), as this should act as a support, at least locally.

Market mechanics

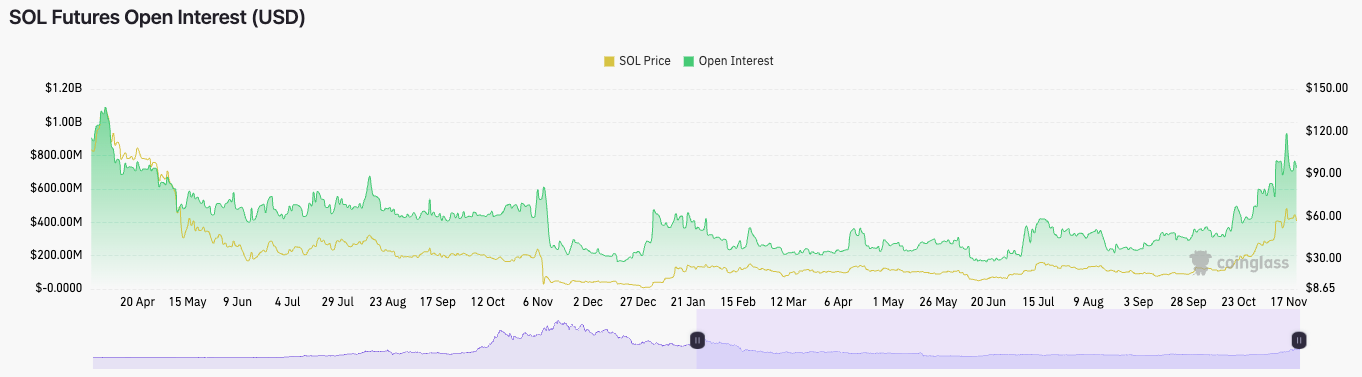

The mechanics for SOL are interesting here. Let’s take a look:- Open interest remains really high, currently at $730m, well above the $200-300m average we’ve had over the past year.

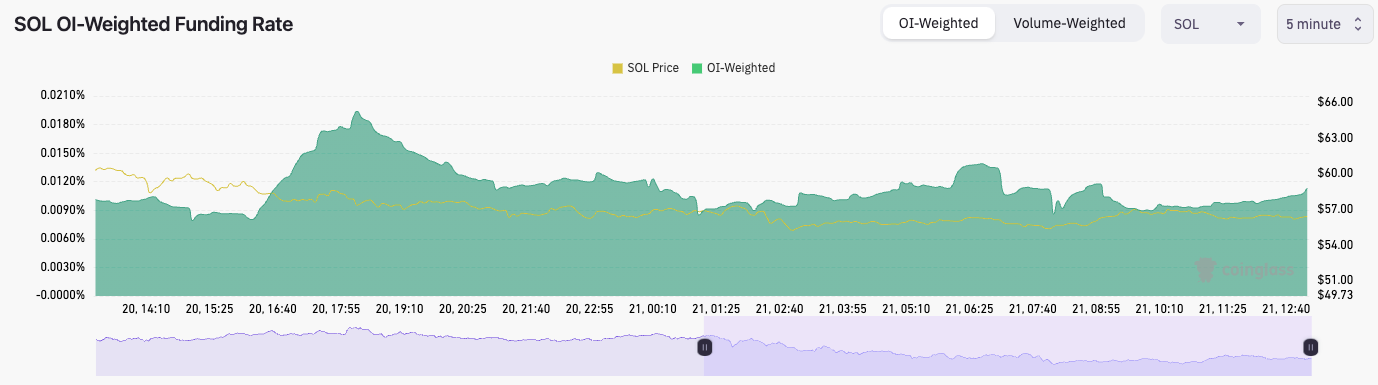

- The OI-weighted funding rate is at 0.0113%. This means longs and shorts are in much more of an even balance - this is a healthy setup. However, the funding rate is turning up, so we will need to see if this continues, as it may indicate that longs are beginning to pile in after more participants went short yesterday. The long/short ratio is at 0.9406.

There is still a large build-up of leverage in SOL, but there is a more even balance now between longs and shorts.

Cryptonary’s take

The mechanics’ setup is certainly better than what it was a week or so ago. However, the technical setup looks as if more downside is needed. On the major timeframes (3D and Weekly), SOL is very overbought, and a pullback in price would be healthy.SOL will likely hold up if Bitcoin does. However, BTC seems to be rejecting from the key resistance of $37,700 to $38,000, which could help bring SOL down further to at least testing the $55 level and then the $52 level beneath that.

We expect SOL to see more downside in the coming week, with $52 as a minimum target.

We would be DCA buyers of SOL at $48, whilst we’d be aggressive DCA buyers sub $44 if given this price.