Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Interestingly, SOL's Open Interest (by number of coins) is down substantially but this is potentially due to the price now being much higher.

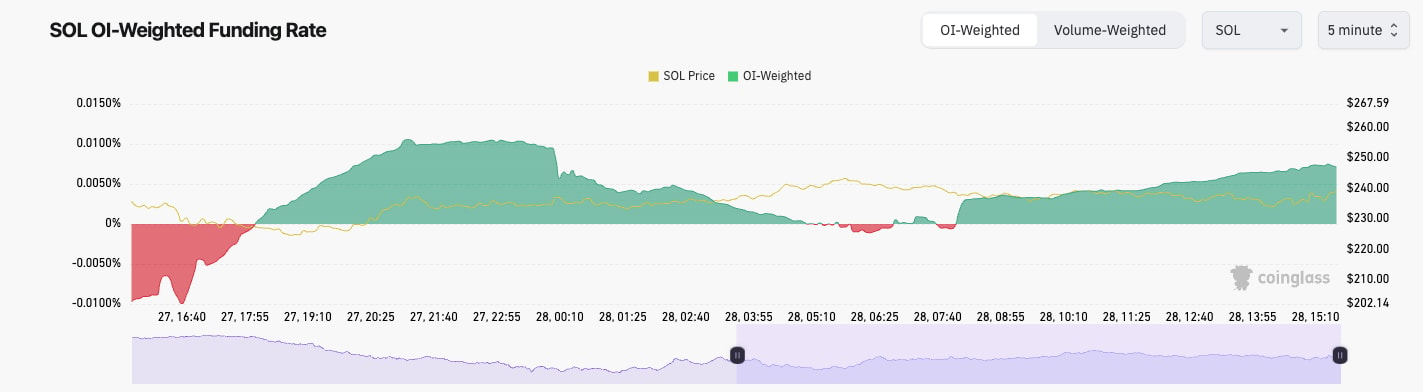

- SOL's Funding Rate has been very choppy, flipping from positive to negative. This has likely been due to traders playing the range between $220 and $260.

Technical analysis

- SOL formed a pennant pattern but into the horizontal resistance of $263.

- Unfortunately, the price was rejected from the pennant and broke down to the horizontal level of $220, where bids came in and the price bounced. These key horizontal levels we have marked are really solid and tend to work regularly.

- Like many of the coins, the price is now in the middle of a larger range, between the $220 horizontal support and the $263 horizontal resistance.

- The RSI is in the middle territory, but it's below its moving average, although again, this isn't a major concern for us currently.

- Next Support: $220

- Next Resistance: $263

- Direction: Neutral

- Upside Target: $260

- Downside Target: $200

Cryptonary's take

Again, like BTC and ETH, SOL is in its larger range now, and we'll be waiting for the price to show us the way. However, we will also be a bit more practical with SOL in that if SOL pulls back into the $200 to $220 zone (particularly if it's around $200), we'll add to our long-term Spot positions.In the meantime, we'll remain patient and let price action show us the way. For now, we still have a short-term bearish tilt amongst the Majors, but let's stress the short-term point.