Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- SOL's Open Interest is also at record highs in USD value. This is mostly due to the rising price of SOL; however, open interest by the number of coins is also at highs.

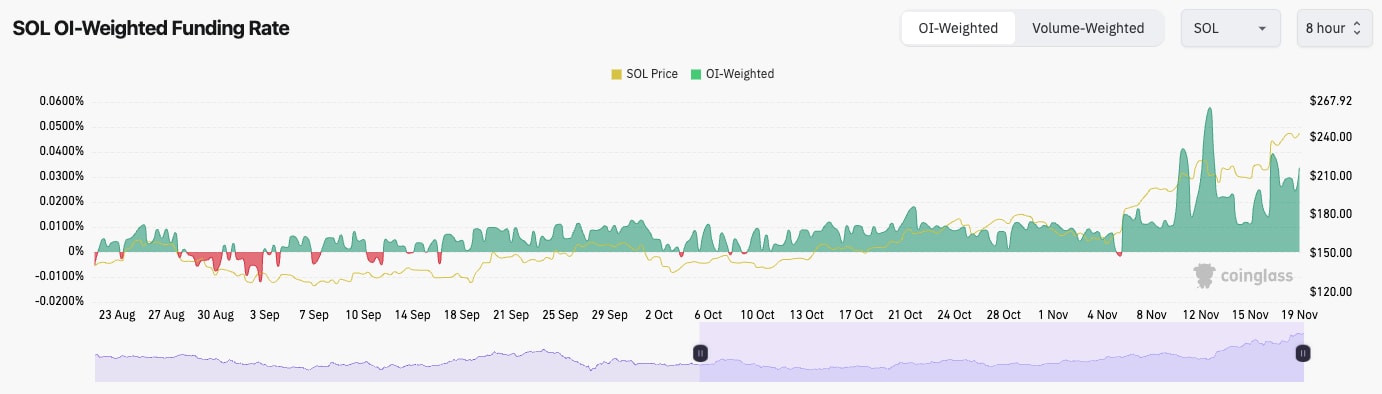

- SOL's Funding Rate is also kicking higher. It's not quite as overheated as it was a week ago, but it's up, and it's moving in that direction. If this increases more substantially, then it's possible we will see a leverage flush out.

Technical analysis

- As we expected and called for the bullish pennant to use the horizontal support of $103 to bounce from, the price broke out of the pennant to the upside.

- Price has now increased by 52% in just less than 2 weeks. This is a large move in a short period of time.

- Price is currently quite overheated, and we can see this in the RSI, which has put in a bearish divergence (higher high in price, lower high on the oscillator) in overbought territory.

- The area between $245 and $260 is a resistance area for price.

- If there is a price pullback, we'd expect $203 to $220 to act as a major support zone.

Stay updated on Solana price prediction—explore our full analysis for the latest market insights.