Market Direction

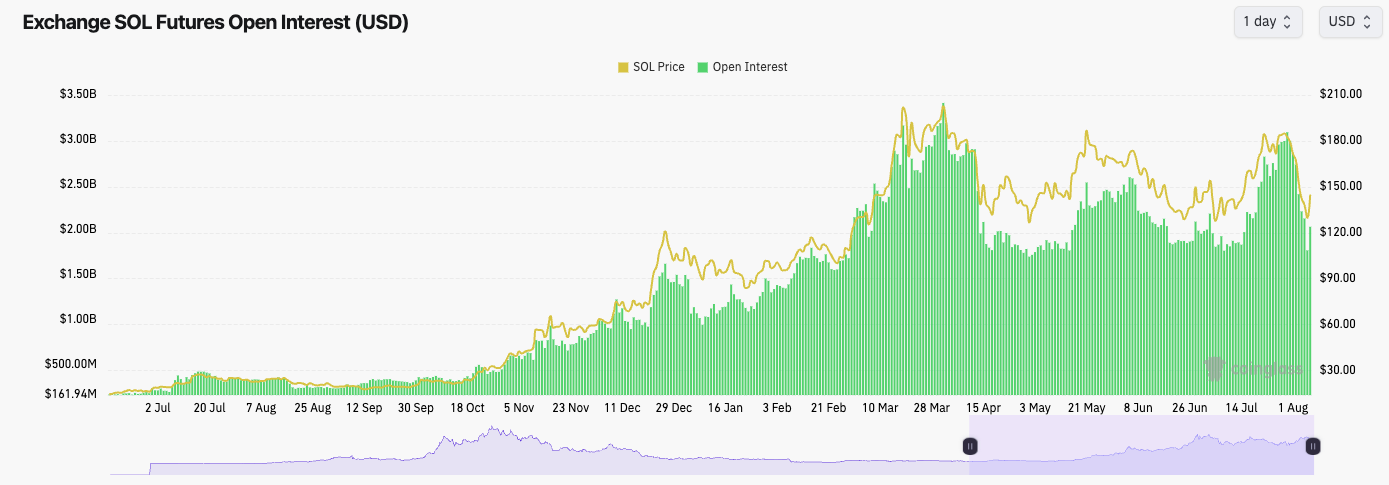

- SOL has also seen a resetting in its Open Interest. Again, this is healthy.

- SOL has a positive Funding Rate, but it’s relatively flat, indicating there is more balance between Longs and Shorts.

- Overall this is a healthy resetting for SOL from a mechanics perspective.

Technical analysis

- SOL also rejected at its local horizontal resistance of $190, so it is not able to push on to the major resistance of $205.

- With a brutal drawdown from $190, price was finally able to catch a bid as it moved into old horizontal support of $120. Price managed to close above the major support level of $131.

- Price is now bouncing from the lows, and SOL has shown more strength (in this bounce) than other plays despite not being as oversold initially.

- In the short-term, it’s possible that the horizontal level of $162 acts as a local resistance.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Cryptonary’s take

This is currently looking like a V-shaped recovery. However, we are skeptical of this for now, and our thinking is that we can’t rule out a retest of the $130 area.For SOL, it’s possible the lows are already in. We’re not sure we’d add to our SOL bags unless there was a more substantial move lower, maybe to say $100-$110, but again, we’re not sure that we’ll get this.

Ultimately, the opportunity looks better on ETH in terms of picking up a good play in a better value territory simply because ETH is so oversold, whereas SOL isn’t.

That doesn’t mean we necessarily prefer ETH over SOL for this cycle because we don’t. But we’re trying to identify a play for right now (if we retest lows) where we see better value. And, for now, that lies with ETH over SOL here in the very short-term. In the long term, we think SOL will drastically outperform.