Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

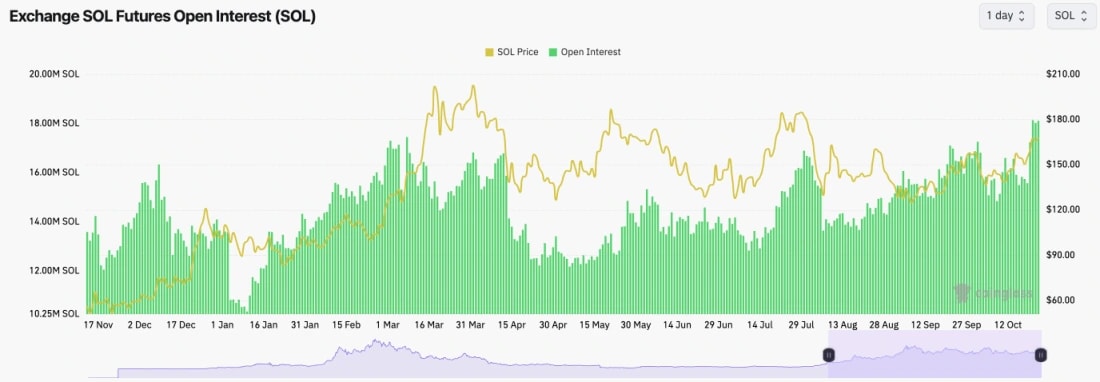

- SOL's Open Interest (measured by number of coins rather than USD value) is now well above the highs we saw back in March as SOL hit this cycle's price high.

- SOL's funding rate is positive and currently at 0.01%; however, it is quite a bit high on fewer liquid exchanges. This suggests that there is a bias beginning to build up in Longing SOL.

Technical analysis

- A really nice move, and what we've waited the last few months for; a break out of the range.

- Price has now broken above the key horizontal resistance of $162, having rejected there a number of times since early August.

- Price has also pulled back slightly and retested $162 as new support, and so far, price is beginning to propel higher from that level; a good sign.

- To the upside, $190 is the next major horizontal resistance.

- On the downside, it's important we continue to see $162 act as new support. Beneath that, we'd expect $155 to provide ample support, although the main level is $143.

- We do note that the RSI is close to overbought, so it's possible that the price will consolidate above $162 for a few more days before potentially pushing for a further move.

- Next Support: $162

- Next Resistance: $190

- Direction: Bullish

- Upside Target: $190

- Downside Target: $155

Cryptonary's take

Patience has paid off on this so far. We finally have a break out of the range, and it's on the upside (as we expected), above $162. It's possible that we will see some consolidation in the immediate term, but we do expect the price to grind higher and get to $190 in the coming weeks. Yes, even with the tricky situation of trading around this election.We remain confident in Spot positions and we'd look to add between $131 and $150, although, we don't feel confident on price visiting those levels in the short or even medium term.

Send it.