The funding rate is positive, suggesting that the leverage used in the past few days has been mostly on Longs.

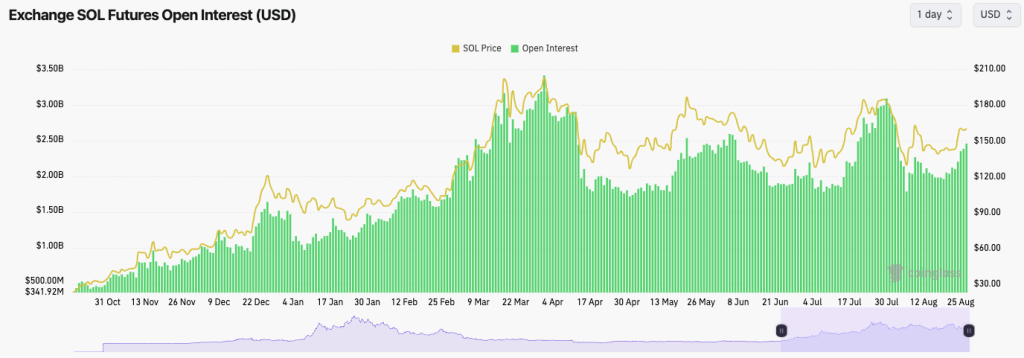

SOL Open Interest:

Technical analysis

- There has been a really nice 15% or so move up in the last few days, which has seen SOL spike above the main downtrend line.

- However, SOL has encountered resistance at the horizontal resistance level of $162, which we have marked as a key level for a long time.

- However, SOL is also forming a pennant/bull flag pattern (we're not sure which one yet; we'd need more days' worth of price action), but it looks like a bullish pennant. These tend to have a bias to break to the upside.

- There is a lot of support below the current price, with the first zone between $140 and $145. The second zone would be between $120 and $131, although we wouldn't be confident about price retesting this level.

- The RSI is at 57, so SOL is not currently in or even near overbought territory on the Daily, meaning there's the potential for further upside in the short term.

Cryptonary's take

SOL has now moved into a more significant horizontal resistance area, so we may see a slight pullback in the immediate term, but likely just a shallow pullback.However, we believe that in the coming week or two, we can see a break out above $162, and that may be enough to ignite the bullish reversal that sends price back to $200.

For now, we remain patient, having had months to accumulate in the $120s and $130s—assuming you weren't here in 2023 when we accumulated in the $20-$40 range.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Solana: Solana (SOL) is a high-performance blockchain designed for fast and scalable decentralized applications and cryptocurrencies. Launched by Solana Labs in 2017, Solana is celebrated for its ability to process thousands of transactions per second with low fees, making it a popular choice for developers and users alike. At Cryptonary, we are most bullish on Solana for this cycle, considering it the play of the cycle due to its robust technology and growing ecosystem.

Solana's ATH is $260.

How to buy SOL:

- Via Phantom Wallet:

- Deposit Solana tokens by copying your Phantom wallet address and transferring funds.

- Use the ‘deposit’ button for other purchase options, though fees may be higher.

- Swap tokens within the wallet by selecting the type and amount, setting slippage tolerance, and confirming the swap.

- Via Centralized Exchange (CEX):

- Choose a CEX like Binance, Coinbase, or Kraken.

- Create and verify your account.

- Deposit fiat or other cryptocurrencies.

- Navigate to the SOL trading section and complete your purchase.