Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- SOL's Open Interest (by number of coins) has been generally downtrending since early January, and since the price spike, it's remained flat. This essentially means that there aren't many signs of froth currently.

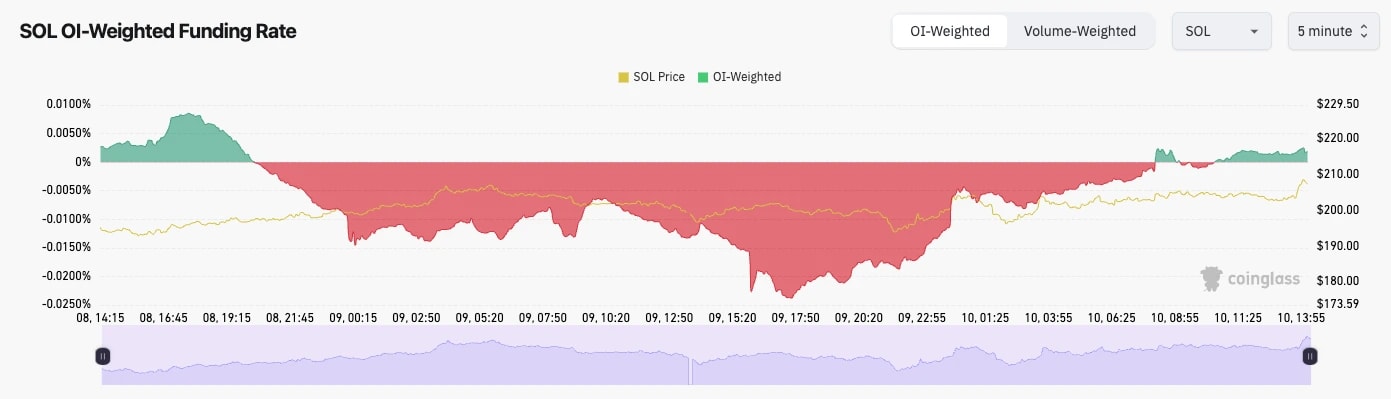

- SOL's Funding Rate has fluctuated between slightly negative and positive, showing real indecision amongst traders. Funding was negative, and as price has ground higher in the last days, it's reset back to slightly positive.

Technical analysis

- SOL has found some support in the short term from an old level between $180 and $190.

- SOL is now attempting to break out of its downtrend line, and also reclaim the horizontal level of $203.

- If SOL can break out that might mean we see a further move higher, however, we think this might stall out around the horizontal level of $220 (the next horizontal resistance).

- The major supports are at $180 to $188, and then at $162.

- The RSI remains in a downtrend and it is now butting up to its moving average. The moving average and the downtrend may provide too much of a resistance from the price to break out from.

- Next Support: $180

- Next Resistance: $222

- Direction: Neutral/Bullish

- Upside Target: $222

- Downside Target: $180