SOL has broken out of its local downtrend. However, the 3D and Weekly RSI's still remain very overbought.

Big inflection point here for SOL.

TLDR

- Solana bounces off $52 support, now facing resistance at $58-59.

- This area coincides with the underside of the head & shoulders pattern neckline.

- Indicators mixed - RSI reset, but 3D and weekly timeframes overbought.

- At the inflection point that may depend on whether Bitcoin breaks the range.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

SOL 4hr

Technical analysis

- Following the breakdown from the head and shoulders pattern, SOL bounced well from the local support of $52.

- SOL is now finding resistance at the underside of the neckline of the head and shoulders.

- There is local support at $56 and $52, and beneath that, $48 and $44. A break of $52 would see a price break beneath the main uptrend line, which may cause a deeper sell-off.

- $44 - $48 would be a good area for long-term DCA buys.

- The RSI has reset on all timeframes; however, the 3D and Weekly both still remain extremely overbought.

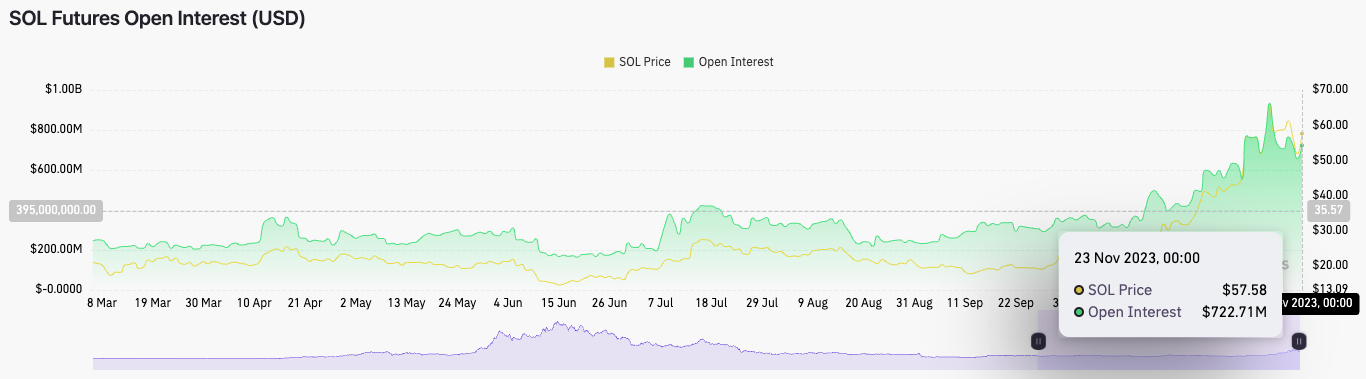

Market mechanics

- Open Interest has increased again back into the $722m level. This is arguably still overheated and may need to come down to the $500m mark to flush out some excess leverage.

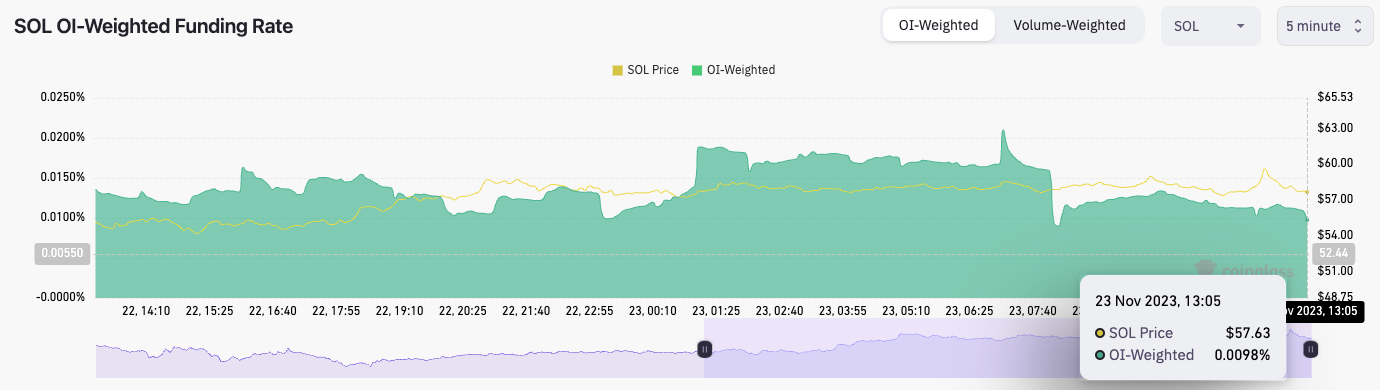

- The OI-Weighted Funding Rate is flat at 0.01%, indicating there is a slight bias to be Long but that Longs and Shorts are in even balance.

Ideally, you’d want to have seen a slight decrease in Open Interest over the past few days on the price movements lower, which would likely come if price moved down to $48. However, the setup is relatively healthy here, with neither side (Longs or Shorts) being majorly offside.

Cryptonary’s take

SOL, like several coins, is at an inflection point. Many coins have moved higher, breaking out of local downtrend lines and now running into local resistances.We remain cautious on SOL, particularly whilst Bitcoin is beneath $38,000. However, if Bitcoin can get the breakout, SOL will likely retest its highs at $67.

If SOL breaks down, we will be DCA buyers at $48 and aggressive DCA buyers at $44, with a 12 to 18-month time horizon.

Currently, SOL is very hard to call; if we had to choose a direction, we would say that a breakout is more likely. But it’s very difficult to call, and we’re currently 50/50 on short-term direction.