SUI & NOS at critical levels: Dead or primed for a short play?

SUI and NOS are at critical levels—on the brink of collapse or ready for a short play? Both assets are stuck in bearish trends, but will they break or bounce? The next move could change everything. Stay tuned to find out.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

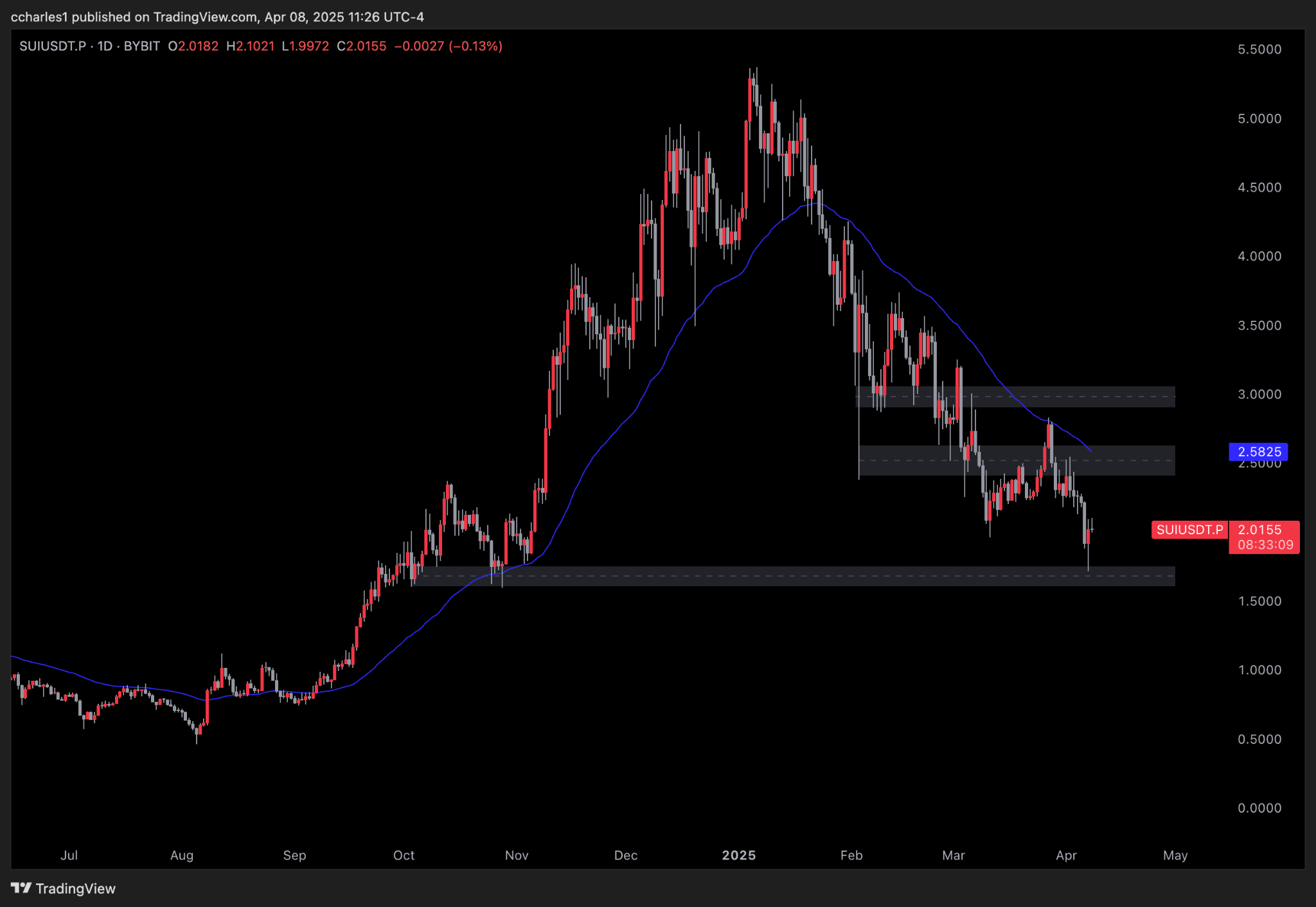

SUI:

Overview

- SUI has, in the past month, tried to rally over resistance; however, after meeting the daily 50EMA, it was smacked down through the resistance

- It then failed to break above the resistance and, as we can see, failed many times at the 2.48 level.

- It has now made a new lower low and bounced off the lower 1.75-1.6 support level.

- The market structure, along with the EMA, is bearish

Key levels

Support zone- $1.75-$1.58 - The market has bounced off this zone three separate times and was the support zone for the 200% move-up in late 2024.

- $2.63-$2.37 - The market has bounced/rejected in this zone 5+ times, each time resulting in larger moves away from it.

📘 Strategic Playbook

Range trading setupAs we are in a large down trend, buys are not suggested; however, sells around the 2.4 level, targeting the 1.7 level, can be good areas for a range trade.

If we were to approach the 2.4 level with a bearish trend in the overall market still intact, we would look to sell and place our stops above the resistance level, targeting the $1.7 level.

Cryptonary's take

SUI as an asset remains extremely bearish, with no valid signs of a bottom in sight. Pair this with the bad macro outlook for now and BTC remaining neutral/bearish; we believe it is still time to steer clear of this asset until risk on returns along with better price action.Once that environment returns, SUI could still be a decent alt coin bet as it managed to 4x last year in such a short amount of time.

NOS:

Overview

- NOS has been in a bearish trend for the past couple of months, and almost nothing has happened bullishly in price.

- As of today, we remain sitting on the last line of support, which is a combination of the 2022 highs and the swing low of late 2023.

- For tides to change from extremely bearish to bullish on this asset, we would look for a bounce in this 0.55-0.26 level and a flip of the $1 mark.

- Until that happens, we will steer clear of this asset from an investing perspective.

Support zone (Weekly Levels)

- $0.26-$0.6 - The market peaked around this level in 2022 and spent a bit of time consolidating in this range before moving up 2,000% in 2024.

- $1.44-$0.98 - The market rejected off this level for a bit in the 2024 run-up, then on the way back down, it bounced aggressively from it before going higher. Because of that, we see this as a new resistance level.

📘 Strategic playbook

Range trading setupAs we are in a large down trend, buys are not suggested; however, sells around the $1 level, targeting the $0.4 level can be good areas for a range trade. If we were to come to the $1 level (assuming the market is still bearish), we would look to enter short and place stops above the resistance level, targeting back below a $1 into the $0.5 territory.