Tariff chaos returns: GDP slips, BTC cracks, and risk assets stall

Markets are holding their breath. Despite good news on tariffs and solid income data, the reaction was muted - or worse, reversed. Crypto has cracked key trendlines, jobless claims are rising, and uncertainty is growing.

When markets stop rising on good news, the next move is rarely quiet. Are we on the edge of something bigger?

TLDR:

- Tariff uncertainty lingers as courts pause rulings and rhetoric escalates.

- Economic cracks are emerging with rising jobless claims despite solid income data.

- Crypto rally stalls as BTC, SOL, and TOTAL3 break key trendlines.

- Risk assets are losing steam, suggesting a pullback may be near.

- Appeals Court Pauses a Ruling Against Trump Tariffs.

- Data This Week.

- Chart Overview.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Appeals court pauses a ruling against Trump tariffs

Over the last few days, we've seen a Trade Court rule against Trump's tariffs as it suggested that President Trump exceeded his authority. The market's reaction was risk-on despite the Dollar also reversing higher, but the gains fully reversed, so the market essentially stopped going up on good news.The next day, however, an Appeals Court temporarily paused this ruling against Trump's tariff, which then saw the move lower continue. But the takeaway for us is that the market stopped reacting positively, which usually results in the next move being a more substantial pullback.

Tariffs/tariff policy is still a mess, and we expect the Trump administration to hold strong and maintain their tariff policy agenda, as there are a number of ways in which the Trump administration can implement tariffs irrespective of the court's ruling against them.

Alongside this, Trump has just said (on Friday, 30th) that "China has completely violated its agreement with the US on tariffs", whilst Treasury Secretary Scott Bessent also said yesterday that negotiations with China have "stalled".

All put together, tariff policy uncertainty is still with us, and the overall level of uncertainty is likely to remain elevated, which can eventually end up weighing on the economy. And perhaps we have begun to see small signs of that this week…

Data this week

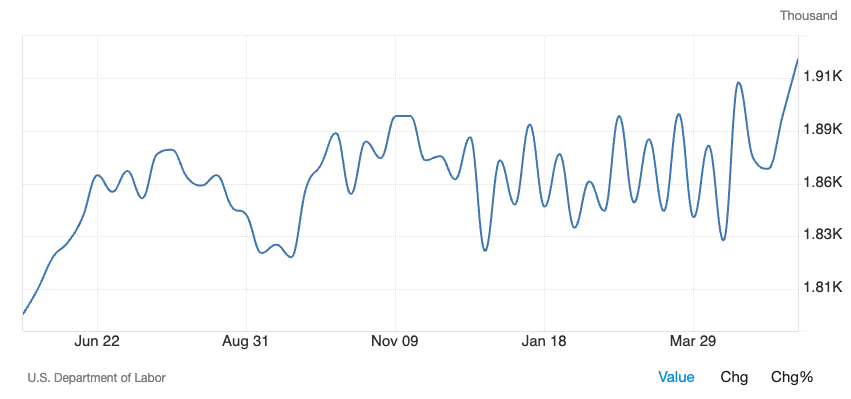

This week, we have had a plethora of macro data with the standouts being GDP, Jobless Claims, Core PCE, Personal Income and Personal Spending. On Thursday (yesterday), we saw the second GDP estimate come out at -0.2%, however, this would have been looked through and put down to tariff front-running. But we also had Jobless Claims and Continuing Jobless Claims.Jobless Claims ticked up slightly to 240k, which is slightly elevated, but it isn't a huge concern. However, Continuing Jobless Claims, on the other hand, moved up to multi-year highs.

This is likely one of the early signs that there might be some pressure on the labour market, and perhaps we see this materialise more next Friday (the first Friday of the month), where we get Non-Farm Payrolls and the Unemployment Rate data.

Continuing Jobless claims:

Today, we had Core PCE, which came in at 0.1% and 2.5% on the Yearly. The FED and the market will like this figure, although the markets' focus is likely less on inflation and more on growth now, hence we saw a minimal reaction.

Personal Income came in strong at 0.8%, but Personal Spending remained subdued but still positive at 0.2%. This suggests that the workforce is still earning, but they're being more cautious with their spending. This is despite the fact that Consumer Sentiment has improved recently, but that might just be due to lower prices at the pump.

For now, the macro data is holding up, although there are signs that a more material weakening might be beginning, and perhaps we'll see this develop more over the coming weeks. We will reassess our positioning on a daily/weekly basis based on the data.

Chart overview

Over the last fortnight, Bitcoin has broken out to new highs, and it has led the market higher. But we have been watching a few key charts that might give us a greater indication as to whether this is the beginning of a new bull market/trend, or if it's just a bear market rally.Our expectation was that tariff de-escalation might be enough of a catalyst for a bull trend to continue, however, it seems the level of uncertainty is still very elevated, and that keeps the outlook still somewhat 'up-in-the-air". We'll therefore divert to the charts and look at it from a technical perspective.

The first chart we'll look at is BTC.D (Bitcoin Dominance). It has bounced from its main uptrend line, but it has seemingly found resistance at the underside of its local uptrend line. Dominance has moved back up to 64%, and this local high level is now a key decision level for it.

BTC.D 1D timeframe:

When looking at the BTC.D chart, you'd hope to then turn to TOTAL3 to hopefully see that staging a breakout to the upside, which would then likely see BTC.D breakdown. Unfortunately, that doesn't look to be what we're seeing.

TOTAL3 1D Timeframe:

In the above chart, TOTAL3 has broken through the horizontal resistance at $930b, which has been a key level that we previously identified. Price has also now broken below its main uptrend line, and unless we see it quickly recover, the chances are that we will see a pullback into support from here. That first level of support is at $784b.

If we now turn to the Majors, we can see that both BTC and SOL have broken below their main uptrend lines. For BTC, there is support between $105,000 and $106,900, but beneath this, the next major support is at $95,700, although $98,900 is a local level of support. However, a break below the psychological level of $100k likely sends BTC into that $95k area.

BTC 1D timeframe:

SOL has also broken below its main uptrend line, and now the price is battling at the horizontal support of $162. It's possible that price puts in a small bounce here, although we do expect it to be sold into and for price to then revisit the $147 level over the coming 1–2 weeks.

We will reassess our positioning if/when price revisits $147. For now, there's no need to dive in at the first sign of a pullback.

SOL 1D Timeframe:

On the TradFi side, both the S&P and the Nasdaq are squeezing into their main uptrend lines, and both look to be losing momentum, having had close to no significant pullbacks on this aggressive move higher. If you then pair this with the fact that both are relatively well priced (21x Earnings multiple on the S&P), and the US2Y and US10Y Bonds have both seen a more decisive bid over the last 48 hours, then it's very possible we see a pullback in risk assets across the board.

We will be closely monitoring this over the coming 1–2 weeks, and for now, we're not looking to rush in and pull the trigger on bidding certain assets.

S&P 1D timeframe:

Nasdaq 1D timeframe:

Cryptonary's take

Policy and economic uncertainty still remain, which might hinder risk assets from breaking out to new highs and pushing into price discovery. Of the risk assets, only Bitcoin has really broken out to new highs, although this has more been on the 'hard assets' narrative.What we do know is this:

- Policy and economic uncertainty remain high.

- The hard macro data is holding up, although there are pockets of weakness that are slowly coming to the forefront.

- The market has moved back to pricing for two interest rate cuts in 2025 following this week's data (previously 1.5 cuts).

- The S&P and the Nasdaq are squeezing against their uptrend lines, and upside momentum looks to be stalling.

- Both BTC and SOL seem to be breaking down from their main uptrend lines.

- TOTAL3 also looks to be breaking below its uptrend line, whilst Dominance is making a new move higher.

All the above suggests we should be careful over the coming 1–2 weeks as we expect a more meaningful pullback to now take place. Ultimately, until we see Interest Rate cuts, there isn’t going to be that huge stimulus in markets that sends markets well above their all-time highs and therefore, markets likely just remain in a trading range for the time being.

We do expect a meaningful pullback in the short term (coming weeks), but for now, we're not looking to rush in and buy it.

The current market is a phenomenally tricky environment, and just when you think you have it figured, a single tweet can spin the outlook upside down again. Whilst it's possible that BTC doesn't revisit its lows, it is possible that other coins do, or at least more majorly retrace from current levels.

For now, there is no need to chase prices following this substantial rally we've seen over the last 6–8 weeks, when the outlook does still remain as uncertain as it does.

We will keep reassessing, which is pivotal to do in a Trump market, but for now, we're looking to stay in stables, and we're expecting a more meaningful pullback over the coming weeks.

As of right now, we're not sure we'll look to bid a more meaningful pullback; we'll reassess based on the data and sentiment, but there's no rush to get in early right now. This, of course, can change, and unfortunately, being flexible is not ideal, but it's important in a Trump market, and so that is what we'll do.