Tariffs, Yields, and Fed policy shape market outlook

Choppy markets ahead? BTC sees a volatile week as inflation expectations soar, the FED’s stance remains uncertain, and tariffs shape investor sentiment. With the S&P and Nasdaq holding, here’s what to expect in the coming weeks.

In this article:

- Last Friday's Data.

- This Week's Data.

- Tariff Affects, Market Uncertainty & Index's.

- H1 Vs H2 Story.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Last Friday's data

Last Friday, the markets looked to the labour market data as the key data point, but the Inflation Expectations print was what the markets ended up reacting to. Non-farm payrolls came in slightly softer than expected at 143k, but jobs are still being added.Unemployment came in lower at 4.0%. This was somewhat of a mixed data set, but ultimately, the market took the 'strong labour market' view as positive, and risk assets began to move higher, even though there was a hint of higher inflation with Average Hourly Earnings MoM coming in at 0.5% (consensus was for 0.3%).

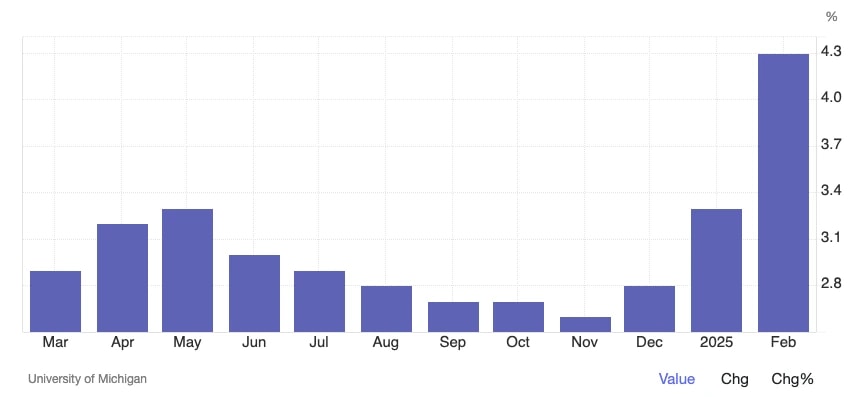

However, just 90 minutes later, Michigan Inflation Expectations came out at 4.3%. This was dramatically higher than the prior print of 3.3%, and it also showed a drastic 3-month uptrend since the election back in Nov.

Significantly higher Inflation Expectations are the opposite of what the FED would want to see and hence risk assets sold off following this print. But, BTC just gave back the gains it put in following the labour market data. Essentially, traders were whip-sawed by the data.

But the takeaway we can take from this is that the labour market is robust/strong, so that shouldn't be a concern for us in the immediate term. However, the inflation prints will and have become increasingly important again.

What the market will be looking for is to not see Inflation Expectations run away, as that'll extend the FED's pause way out into later in the year potentially.

Michigan inflation expectations:

This week's data

With the above as context going into this week, we have an important set of Inflation data out this Wednesday. The market was expecting the inflation data to come in potentially slightly lighter than the forecasts, however, that has now had some doubt thrown over it considering the large upside print we saw in Inflation Expectations that came out last Friday.If this Wednesday's (tomorrow's) print comes in with downside surprises, risk assets will likely see a move higher. However, if it comes in hotter (higher numbers), then risk assets will potentially sell down.

Tariff effects, Market uncertainty and indexes

In the first few weeks of the Trump administration, the threat and then gradual implementation of tariffs have been what has spooked the markets most - although granted we haven't seen a major sell-off, off the back of it as of yet.Since the inauguration, we've begun to see tariffs being implemented, but they're less aggressive than the initial expectations. But, the key thing to the tariffs is that market participants are currently viewing them as a negotiation tool, rather than something more permanent.

Now, we do believe that a lot of the proposed and imposed tariffs will remain, but we expect the stronger initial stance to be used as a tool to get country leaders to the negotiating table with Trump.

Once deals are agreed, we expect the tariffs that went on and are going on, to be reduced, or even removed.

Whilst this is playing out, and negotiations take time, we expect markets to remain choppy during this period of uncertainty. We expect the Dollar ($DXY) to remain relatively high, and for the US10Y to remain between 4.4% and 4.7% for the coming weeks.

However, with this environment, you'd expect the S&P and the Nasdaq to potentially be struggling, but both are holding their high relatively well. This is likely due to the market being uncertain but participants are not overly fearful of tariffs and they're looking through them.

S&P500:

Nasdaq:

H1 Vs H2 story

Our current view of the market is that this year is likely to be a year of two halves. First half of the year, we think we'll be choppy, and potentially see more downside (although we don't think it'll be substantial for BTC). We then expect the second half of the year to be a really great few quarters (Q3 and Q4). Are reasons for this are as follows:1. Uncertainty around Trump and his policies, probably at least for Q1 and maybe even going into Q2. This likely caps material risking-on and therefore upside. But we expect once there is more clarity/certainty, investors will increase risk exposure off the back of it.

2. The Dollar and Bond Yields are likely to remain high in the coming months, before beginning a new downtrend post-Trump deal-making with other countries.

3. A more material improvement in liquidity. Globally speaking, this stimulus might come from China.

4. It'll take time (probably Q1 and Q2) for the US10Y Yield to more meaningfully come down, but once it does, that'll put pressure on the FED to cut. We still expect 1-2 Interest Rate cuts this year, but we don't think they'll happen until the second half of the year.

Cryptonary's take

From a zoomed-in viewpoint, things can get very messy and noisy in the day-to-day. So, in the above, we have zoomed out and reduced it down to the core thesis of the market as we stand today (listed bullet points above).We'll continue to monitor the day-to-day to see if anything changes the above points. Ultimately, for now, the right play is to be relatively risk-off in the portfolio, see how the above points develop, and remain intent on re-adding positions/to positions at range lows.

As many of you know, we still expect an extremely positive year for BTC, but we think the bulk of the gains come in H2 (the second half of the year).