The bull and the bear - who wins? | March 13th

The market got blasted last week. Bitcoin and Ether revisited their 2017 ATHs (all-time highs), most altcoins dropped by over 20%, and the bearish sentiment was rampant. However, as sunshine usually follows rain, the market managed to reclaim major levels as support.

In this week’s report, we break down what changed and what are our predictions for the rest of March.

Let’s dive in!

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The assets we cover in the Weekly Digests have changed. Let us know your thoughts!

- Despite dropping as low as $880B and breaking structure, the Total Market Cap closed last week’s candle above $950B. This prevents further downside for the time being.

- The $550B level remains support for the Altcoins Market Cap, and we could see a bounce from here.

- Bitcoin closed above $21,450. Unless we see a weekly closure under this level, further downside isn’t on the cards.

- ETH’s entire selling pressure from last week was invalidated because it closed green. For that reason, Ether is on track for $1740.

- HEGIC held support despite the crypto market dropping over 11%. Upside can be expected for HEGIC.

- DOT is tackling $6 as resistance. A weekly closure above this level is necessary to confirm further upside.

- PENDLE is at resistance, but we believe it may break it this week and head higher.

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market valuation. We track this index to understand where the market is now and to predict where it will likely go next.

The crypto market took a solid hit last week, dropping over 11% in four days. The weekly bullish market structure was invalidated, but the Total Market Cap still managed to close the week above support ($950B). From a technical standpoint, holding $950B as support prevents further downside, and we may see the market perform well in the coming weeks, especially if we manage to close a weekly candle above $1.03T.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire evaluation of the altcoins market (all coins other than BTC).

The altcoins market almost saw a complete invalidation of the selling pressure from last week, so buyers are definitely present now if it's not obvious already. The important thing to note here is that the Altcoins Market Cap index closed above support ($550B). This prevents further downside. In other words, we’re safe for now.

A weekly closure under $550B would invalidate any possibility of upside in the coming weeks. So keeping an eye on this level throughout March is our main priority, and it should be yours as well.

Cryptonary's Watchlist

BTC | Bitcoin (Weekly)

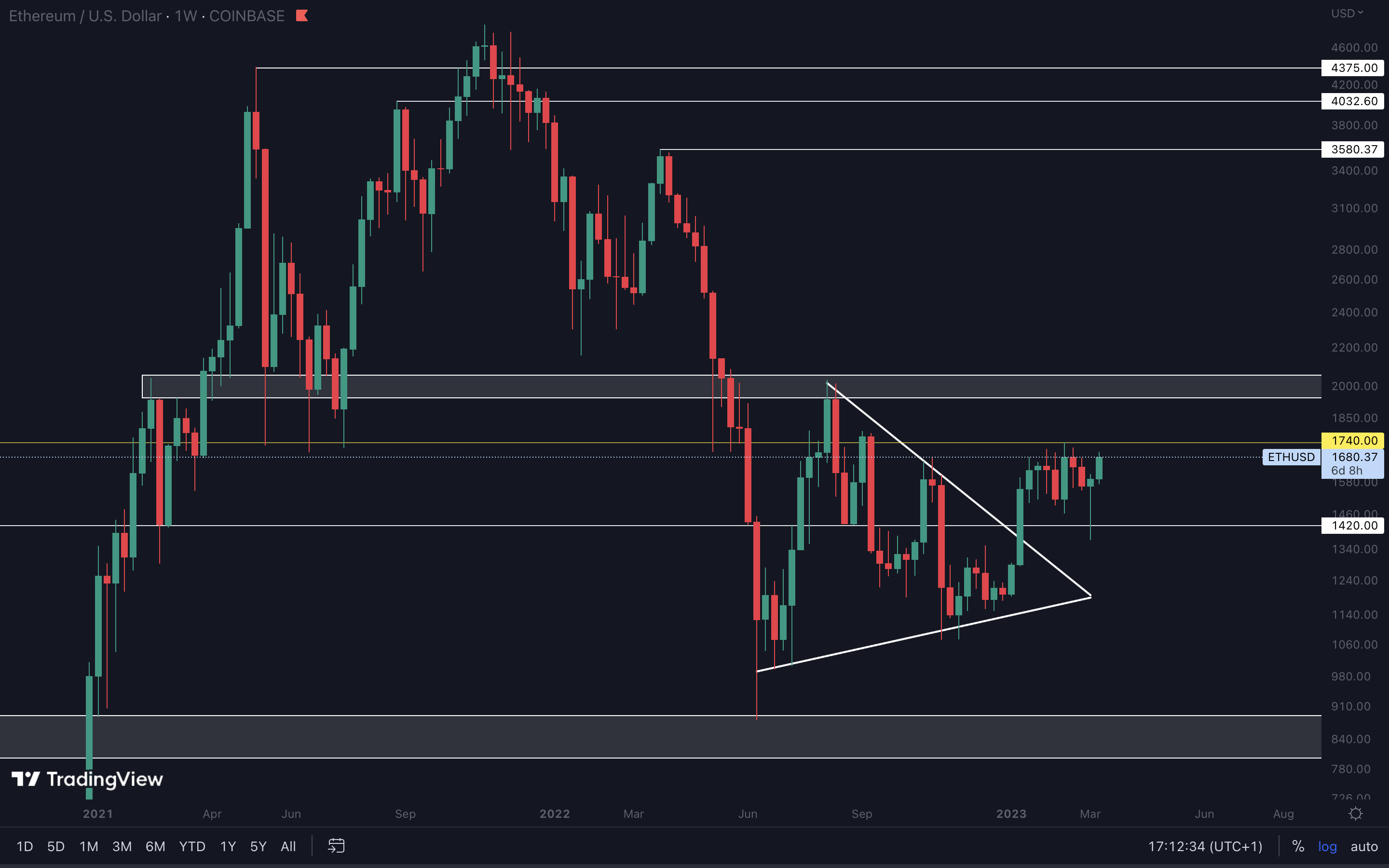

ETH | Ethereum (Weekly)

This is where things get interesting. As a result of the selloff from last week, Ether revisited its 2017 all-time high of $1420. The one thing that surprises us if the fact that Ether closed green last week, despite dropping over 12%. Not only that, but the candle closed as a bullish hammer as well, indicating further upside is possible. Given today's performance, it's safe to assume that Ether is going to test $1740 very soon. A closure above this level will put $2000 on the cards.

DYDX | dYdX (Weekly)

Unfortunately, DYDX remains bearish as $2.50 hasn’t been reclaimed. For it to become bullish, we’ll have to see it close a weekly candle above $2.50. This would put $4 as our next target. In the meantime, expect DYDX to follow Bitcoin’s price action.

There’s nothing of interest for DYDX at this time, so our focus should be on other assets.

LDO | Lido DAO (Weekly)

Although LDO’s selling pressure was almost invalidated entirely, we haven’t seen a weekly closure above $2.50. As long as LDO stays under this level, a rejection (as in going down) is likely. We’ll have to see a weekly closure above $2.50 to confirm further upside. LDO’s weekly market structure remains bullish because the previous low hasn’t been invalidated, so the odds of breaking above $2.50 are high, especially after today's market-wide performance.

HEGIC | Hegic (Weekly)

As we’ve mentioned previously, HEGIC holding the $0.01815 - $0.01590 area as support could result in a weekly higher low. HEGIC has successfuly held this area as support. A well-performing Bitcoin will result in HEGIC forming the weekly higher low we were expecting. The weekly market structure remains intact, and the asset is at support. We remain bullish on HEGIC at this time.

PENDLE | Pendle (Weekly)

The team invested in PENDLE in February’s Skin in the Game with a short-term target of $0.30. This level has been reached, and we’ve now taken profits. We’ll let the rest run to higher prices. We’ve highlighted all the important levels for PENDLE, and we can see that it is currently testing resistance. Given Bitcoin’s recent performance and it closing the week above $21,450, we’re confident that PENDLE will break resistance and head toward $0.52 during the coming weeks. An obvious sign that gives PENDLE the “outperformer” title is the fact that it pumped ~25% last week, in spite of the crypto market dropping over 11%, so further upside can be expected.

Cryptonary's Watchlist

DOT | Polkadot (Weekly)

Although DOT also saw upside days before the weekly closure, invalidating most of the selling pressure from last week, it wasn’t able to close the week above $6. For that reason, DOT will need to close a weekly candle above $6 for us to confirm further upside. Otherwise it is at risk of rejection (as in it will likely go down from here).

RUNE | THORChain (Weekly)

Like most altcoins, RUNE’s weekly bullish market structure has been invalidated. However, the asset closed last week’s candle above $1.25, and a loss of this level is now required to confirm further downside. As long as RUNE stays above $1.25, testing $1.43 soon was possible, and we can already see it approaching this level. A closure above $1.43 is required to confirm further upside to $1.67.

SOL | Solana (Weekly)

Our main priority for SOL was holding $19 as support. This kept the door open for $30, and it still does. However, its weekly market structure was changed after marking a lower low last week. Until we see a change in market structures, SOL will likely range in confluence with the market. Where Bitcoin goes, SOL will follow and we might not see it performing well on its own. As for the negative side of things, a weekly closure under $19 will put $15 as our next target.

SNX | Synthetix (Weekly)

SNX saw a decrease of 35% last week, from which 24% has been recovered after Bitcoin’s pump from the past few days. From a technical standpoint, closing the week above $2.50 prevents further downside.

SNX saw a decrease of 35% last week, from which 24% has been recovered after Bitcoin’s pump from the past few days. From a technical standpoint, closing the week above $2.50 prevents further downside.

As long as SNX stays above $2.50, upside can be expected. It would also provide a solid buying opportunity if it gets there once more.

MINA | Mina Protocol (Weekly)

MINA slightly closed under $0.69 last week, which means we will have to wait for a proper closure above this level on the weekly timeframe to confirm further upside. In the meantime, paying attention to this week’s closure should be your priority if you are invested in MINA. A closure under $0.69 will increase the odds of rejection, which will result in further downside. Based on today's performance, that might not be the case anymore, and MINA will close the week above $0.69.

ASTR | Astar Network (Weekly)

ASTR held $0.05550 as support. This retest of support will mark a weekly higher low, putting ASTR on track for $0.082 - $0.10 once again. Bitcoin reclaming $25,150 would reinforce this possibility even more.

THOR | THORSwap (Weekly)

THOR was unable to close last week’s candle above $0.20, so a weekly closure above this level is now needed to prevent further downside. As long as THOR stays under $0.20, it remains on track for $0.13.

OP | Optimism (Weekly)

For upside to continue, OP will have to close a weekly candle above $2.50. A reclaim of this level will put $3 as our next target.

Because OP is usually known to outperform, Bitcoin reclaming $25,150 will result in OP breaking above $3 and continuing its rally into new territory.

Cryptonary’s take

The market probably sensed that we were getting bored. This should be a lesson for us to be careful what we wish for. 😂 Because we closed above major support levels on the weekly timeframe despite dropping double digits in percentages last week, the market should be considered “saved” from any further downside, at least from a technical standpoint.Action points:

- Say no to FOMO. It could be one of the best decisions, or it could be the worst one. We don't think taking that chance is wise, so staying on the sidelines for the time being is recommended.

- Due to exhaustion (too much buying in too less time always leads to a drop), prices will come down eventually, so waiting for better entries is recommended.

- Caution is advised. The market is more volatile than usual, and trading without experience could result in losses.