The calm before the bull 🐂 | March 2nd

If 5 assets were not enough before, we’ll now be doing analysis on the Top 10 assets by Market Cap every single week! Let’s not waste any more time and see how these assets could perform in the coming weeks! Some may surprise you. 👀

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

TLDR

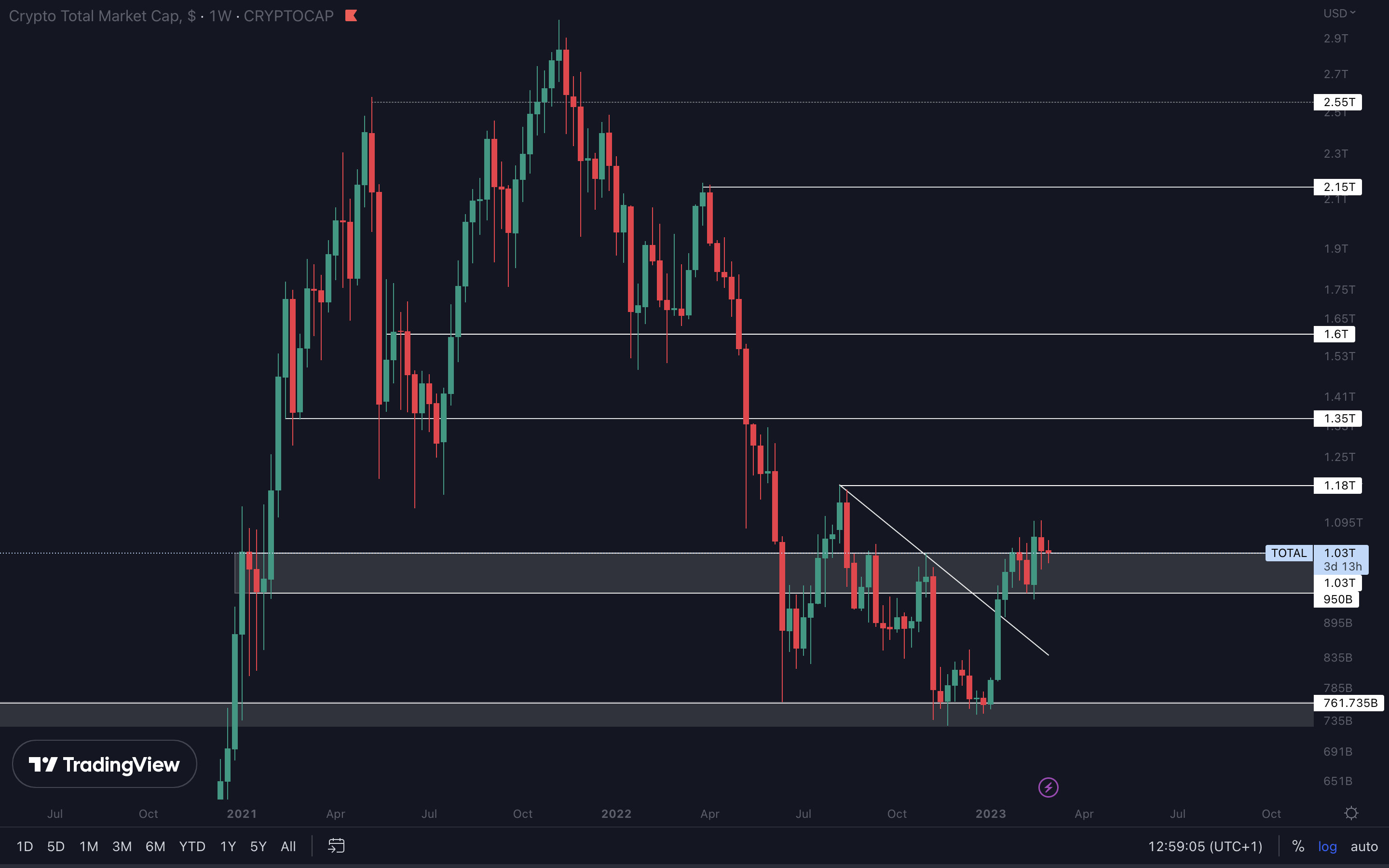

- The Total Market Cap is testing $1.03T as support. Holding this level would be ideal to keep upside on the cards.

- Bitcoin and Ether are both trading in bullish market structures, and we could see them break resistance in the coming weeks.

- BNB is at support. A loss of $300 would invalidate a potential move to $335.

- XRP is trading in a symmetrical triangle on the weekly timeframe. A break will likely come during March or early Q2.

- ADA & DOGE appear to be forming local highs, indicating downside will follow.

- We’ll see LTC test a 1253-day-old level as resistance in March or early Q2, and we don’t believe it will break above it.

- DOT will likely test $6 as support this week (-5%).

Total Market Cap (Weekly)

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

This is the all-father of the crypto market. It’s the most important index of them all because it covers the entire valuation of the cryptocurrency market.

This is the all-father of the crypto market. It’s the most important index of them all because it covers the entire valuation of the cryptocurrency market.

The Total Market Cap flipped its weekly market structure to bullish two weeks ago and then retested the $1.03T level as support last week. From a technical standpoint, the crypto market will most likely perform well in the coming weeks and as long as $1.03T is support, we have an open door to $1.18T and $1.35T respectively.

Only a weekly closure under $950B would invalidate our bullish expectations. 🐂

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The secondary index is above support ($550B). As long as the Altcoins Market Cap index stays above $550B, we have a chance of rising to $650B - $700B in the coming weeks.

Jumping into altcoins might be our best play to maximize gains if the rally continues during March and potentially Q2.

The secondary index is above support ($550B). As long as the Altcoins Market Cap index stays above $550B, we have a chance of rising to $650B - $700B in the coming weeks.

Jumping into altcoins might be our best play to maximize gains if the rally continues during March and potentially Q2.

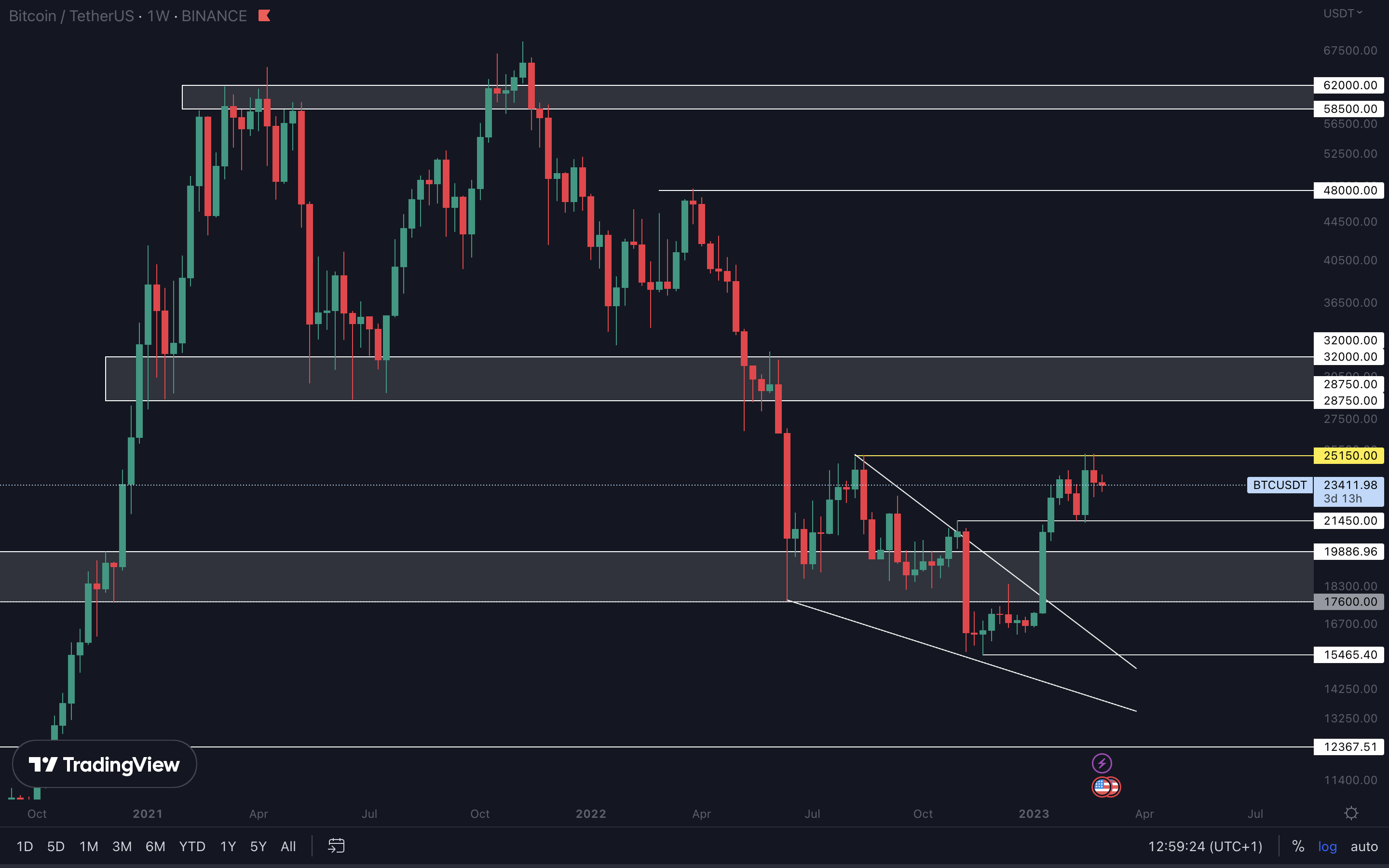

BTC | Bitcoin (Weekly)

Bitcoin has been ranging between $21,450 and $25,150 for the past 40+ days. Something’s definitely cooking.

Bitcoin’s weekly market structure is bullish, and only a closure under $21,450 would invalidate that. As long as this structure remains intact, Bitcoin will continue to make higher highs and higher lows and at some point, it will break above $25,150.

We view $25,150 as the confirmation level for the continuation of this rally. As soon as that level is reclaimed is exactly when you need to act. In the meantime, Bitcoin will range between levels.

Bitcoin has been ranging between $21,450 and $25,150 for the past 40+ days. Something’s definitely cooking.

Bitcoin’s weekly market structure is bullish, and only a closure under $21,450 would invalidate that. As long as this structure remains intact, Bitcoin will continue to make higher highs and higher lows and at some point, it will break above $25,150.

We view $25,150 as the confirmation level for the continuation of this rally. As soon as that level is reclaimed is exactly when you need to act. In the meantime, Bitcoin will range between levels.

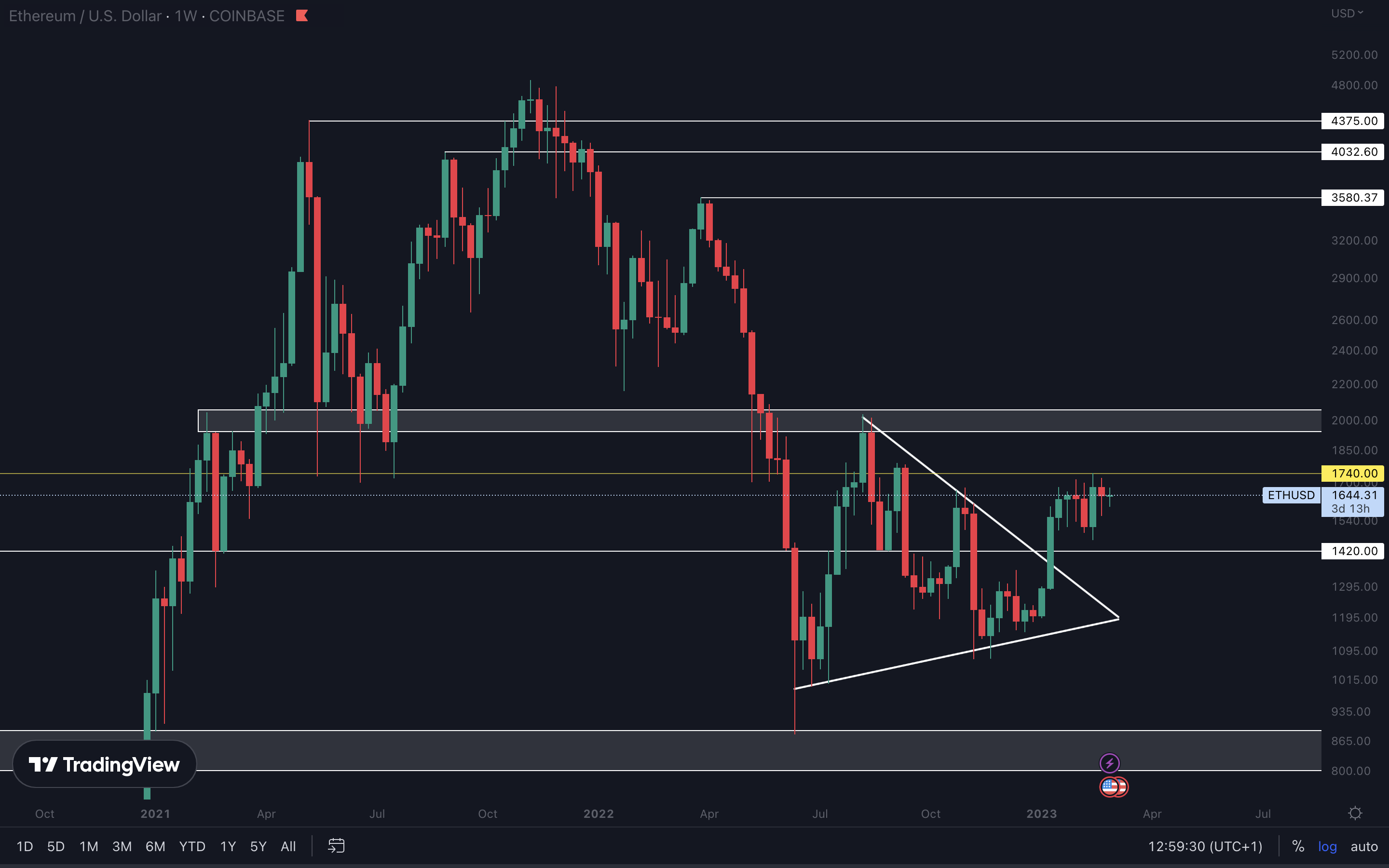

ETH | Ethereum (Weekly)

Ether has been ranging between $1420 and $1740 for the past 40+ days, and we’ll need to see a break of resistance or support to confirm where it will go next.

Ether has been ranging between $1420 and $1740 for the past 40+ days, and we’ll need to see a break of resistance or support to confirm where it will go next.

Ether is trading in a bullish market structure on the weekly timeframe, so further upside should be expected.

BNB | Binance (Weekly)

BNB has been experiencing increased selling pressure in the past few weeks, even when Bitcoin closed green three weeks ago.

BNB has been experiencing increased selling pressure in the past few weeks, even when Bitcoin closed green three weeks ago.

It is now testing support at $300. A weekly closure under this level would put $283 on the cards. This is a local level with less strength than usual larger-timeframe levels, so we don’t have much faith that BNB will get there.

If BNB holds $300 as support $335 is possible, but a weekly closure under it would invalidate this scenario and push its price lower.

XRP | XRP (Weekly)

XRP is trading inside a potential symmetrical triangle. To identify this pattern, we look at the market structure itself - continuous higher highs and lower highs, forming this kind of rotated V shape.

Symmetrical triangles are neutral patterns, so there’s no specific direction it could follow. So, we’ll need to wait for XRP to break the pattern in either direction to determine its future direction.

A break to the upside would put $0.5 - $0.6 as our next target, whilst a break to the downside would put $0.22 - $0.25 as our next target.

XRP is trading inside a potential symmetrical triangle. To identify this pattern, we look at the market structure itself - continuous higher highs and lower highs, forming this kind of rotated V shape.

Symmetrical triangles are neutral patterns, so there’s no specific direction it could follow. So, we’ll need to wait for XRP to break the pattern in either direction to determine its future direction.

A break to the upside would put $0.5 - $0.6 as our next target, whilst a break to the downside would put $0.22 - $0.25 as our next target.

ADA | Cardano (Weekly)

ADA has been in a downtrend for over 540 days, forming continuous lower highs and lower lows. Only a change in market structures would turn ADA bullish, but there are no signs of that yet.

ADA has been in a downtrend for over 540 days, forming continuous lower highs and lower lows. Only a change in market structures would turn ADA bullish, but there are no signs of that yet.

As for the coming weeks, ADA may form a local high after failing to break above the $0.40 - $0.445 resistance area. When paired with the downtrend and the bearish market structure, it looks like ADA might have some downside in store.

DOGE | Dogecoin (Weekly)

Although DOGE flipped its market structure at some point, it is now trading in a bearish market structure again. We’ve highlighted the previous highs and lows to show you where this change occurred.

Although DOGE flipped its market structure at some point, it is now trading in a bearish market structure again. We’ve highlighted the previous highs and lows to show you where this change occurred.

Now, it looks like DOGE is forming a lower high. When paired with the market structure, we might see DOGE going down in the coming weeks.

Keep in mind that Bitcoin’s price action and many other external factors will influence DOGE’s price. We all know exactly how volatile DOGE can be at times.

MATIC | Polygon (Weekly)

Two weeks ago, MATIC broke its previous weekly higher which keeps the bullish market structure intact. However, for upside to continue, MATIC needs to hold $1.30 as support.

Two weeks ago, MATIC broke its previous weekly higher which keeps the bullish market structure intact. However, for upside to continue, MATIC needs to hold $1.30 as support.

We can see that MATIC closed under $1.30 last week. For now, this invalidates any upside and we’ll need to see a weekly closure above this level to confirm a move higher. If $1.30 is reclaimed, expect MATIC to reach $1.75.

SOL | Solana (Weekly)

Unless SOL closes a weekly candle under $19, the road to $30 remains open. This is the only thing that can invalidate SOL from going higher.

Unless SOL closes a weekly candle under $19, the road to $30 remains open. This is the only thing that can invalidate SOL from going higher.

DOT | Polkadot (Weekly)

Because DOT was unable to hold $7 as support and closed last week’s candle under this level, it is now heading back to $6, the bottom of the $6 - $7 area. We could see this level being tested this week, or potentially next week based on how it is doing right now.

Because DOT was unable to hold $7 as support and closed last week’s candle under this level, it is now heading back to $6, the bottom of the $6 - $7 area. We could see this level being tested this week, or potentially next week based on how it is doing right now.

LTC | Litecoin (Weekly)

This is a logarithmic chart for LTC’s weekly timeframe. If you’re on mobile, you might need to switch to desktop for a better look at what’s going on.

This is a logarithmic chart for LTC’s weekly timeframe. If you’re on mobile, you might need to switch to desktop for a better look at what’s going on.

Since 2019 and up until May of 2022, LTC has been trading above this large supporting trend line and has been forming macro (larger timeframe) higher lows. However, the macro trend was broken in May of 2022 when LTC closed under the trend line.

For the past few months, LTC has been slowly going back up and is approaching the trend line. The major difference now is that it now acts as resistance instead of support, and we’re not talking local, we’re talking a 1253-day-old level.

For the coming weeks and months, we should expect LTC to continue rising toward the trend line. It will be difficult for LTC to break above this resistance given its magnitude, so chances are that LTC will not be able to break above it and instead start a new downtrend.

Cryptonary's take

Although the market has some obstacles left to tackle, it looks nothing but bullish for the coming weeks and months. With less than 30 days left until the end of Q1, we believe Q2 will also bring great returns if you know what to look for.

Here are a few action steps for you:

- While Bitcoin tries to break resistance ($25,150), you should prepare for anything that might come in the future and spot opportunities before they emerge. That’s exactly what we’re here to do.

- Once Ether breaks above $1740, moving your attention to altcoins will help you maximize your gains in the short-term.