The calm before the storm | February 9th

Downside remains possible. As long as we stay under $1.03T on the Total Market Cap index, the market is at risk of rejection. We have been expecting downside for about two weeks now, and it seems we’re getting closer and closer to this scenario playing out. Taking profits and identifying good entry points on the way down is ideal.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The Total Market Cap is still at risk of rejection. Downside remains possible in the short term.

- ETH and UNI’s previous weekly candles indicate exhaustion and indecision. This is in confluence with the pullback we’re expecting.

- BNB is at resistance and we’re looking at a -6% move in the coming week.

- Although downside is on the cards in the short term, we believe this rally isn’t over, and higher prices will follow during Q1 and Q2.

Total Market Cap

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market cap is still tackling its $1.03T resistance level. As this is a significant level on the weekly timeframe, reclaiming $1.03T is crucial to avoid a pullback at this time.

The Total Market cap is still tackling its $1.03T resistance level. As this is a significant level on the weekly timeframe, reclaiming $1.03T is crucial to avoid a pullback at this time.

Unless we see a reclaim of $1.03T, our view won’t change. The crypto market will likely retrace in the short term, with the Total Market Cap encountering support at $950B. It’s not a huge drop, but it could provide interesting entry points for our top picks.

Altcoins Market Cap

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

Unlike the Total Market Cap index, the Altcoins Market Cap index is above support. This means it will be stronger if a pullback occurs because buyers could step in from support and push the altcoins market higher.

Unlike the Total Market Cap index, the Altcoins Market Cap index is above support. This means it will be stronger if a pullback occurs because buyers could step in from support and push the altcoins market higher.

Our first support level here is $550B. Keep in mind that the altcoins market is highly influenced by BTC. This is why a drop to $950B on the Total Market Cap index could indicate a loss of $550B as support on the Altcoins Market Cap index.

In that case, we’ll need to see a reclaim of $550B to confirm further upside.

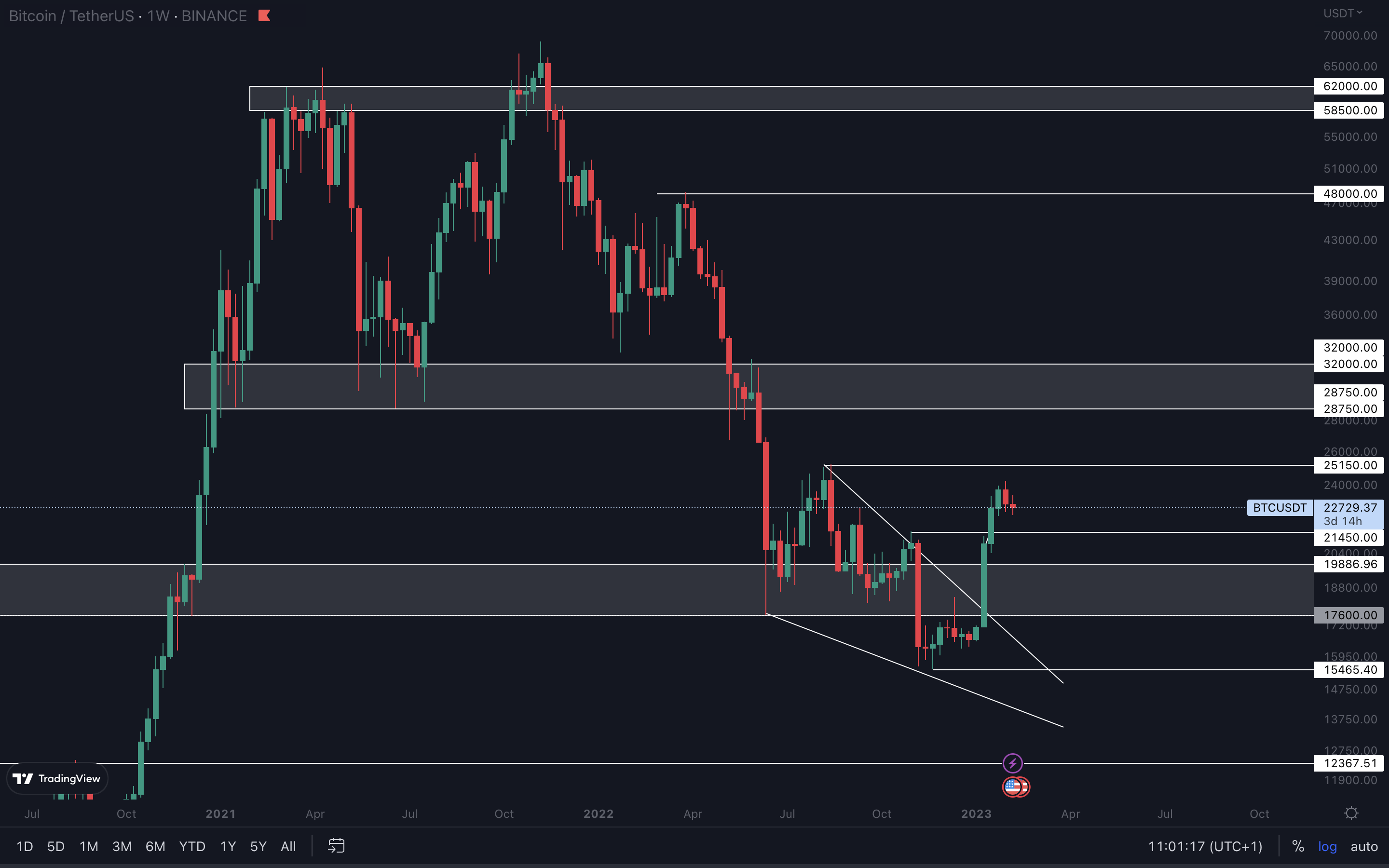

BTC | Bitcoin

Although we could still see BTC shooting to $25,150 from here, we can’t help but think that a retrace to support is the more likely outcome. In that case, Bitcoin could retest $21,450 as support.

This is the first level from which buyers could step in and form a higher low on the weekly timeframe. $21,450 holding as support would suggest we could take a swing at $25,150 next unless the level is lost.

A weekly closure under $21,450 would confirm ~$19,886 as our next line of support. This is Bitcoin’s 2017 all-time high, the second level from which buyers could step in.

We’ll have to wait and see how Bitcoin reacts to both levels if they’re reached. Overall, we’re confident Bitcoin will get to $25,150 and potentially break above that in Q1 or Q2.

Although we could still see BTC shooting to $25,150 from here, we can’t help but think that a retrace to support is the more likely outcome. In that case, Bitcoin could retest $21,450 as support.

This is the first level from which buyers could step in and form a higher low on the weekly timeframe. $21,450 holding as support would suggest we could take a swing at $25,150 next unless the level is lost.

A weekly closure under $21,450 would confirm ~$19,886 as our next line of support. This is Bitcoin’s 2017 all-time high, the second level from which buyers could step in.

We’ll have to wait and see how Bitcoin reacts to both levels if they’re reached. Overall, we’re confident Bitcoin will get to $25,150 and potentially break above that in Q1 or Q2.

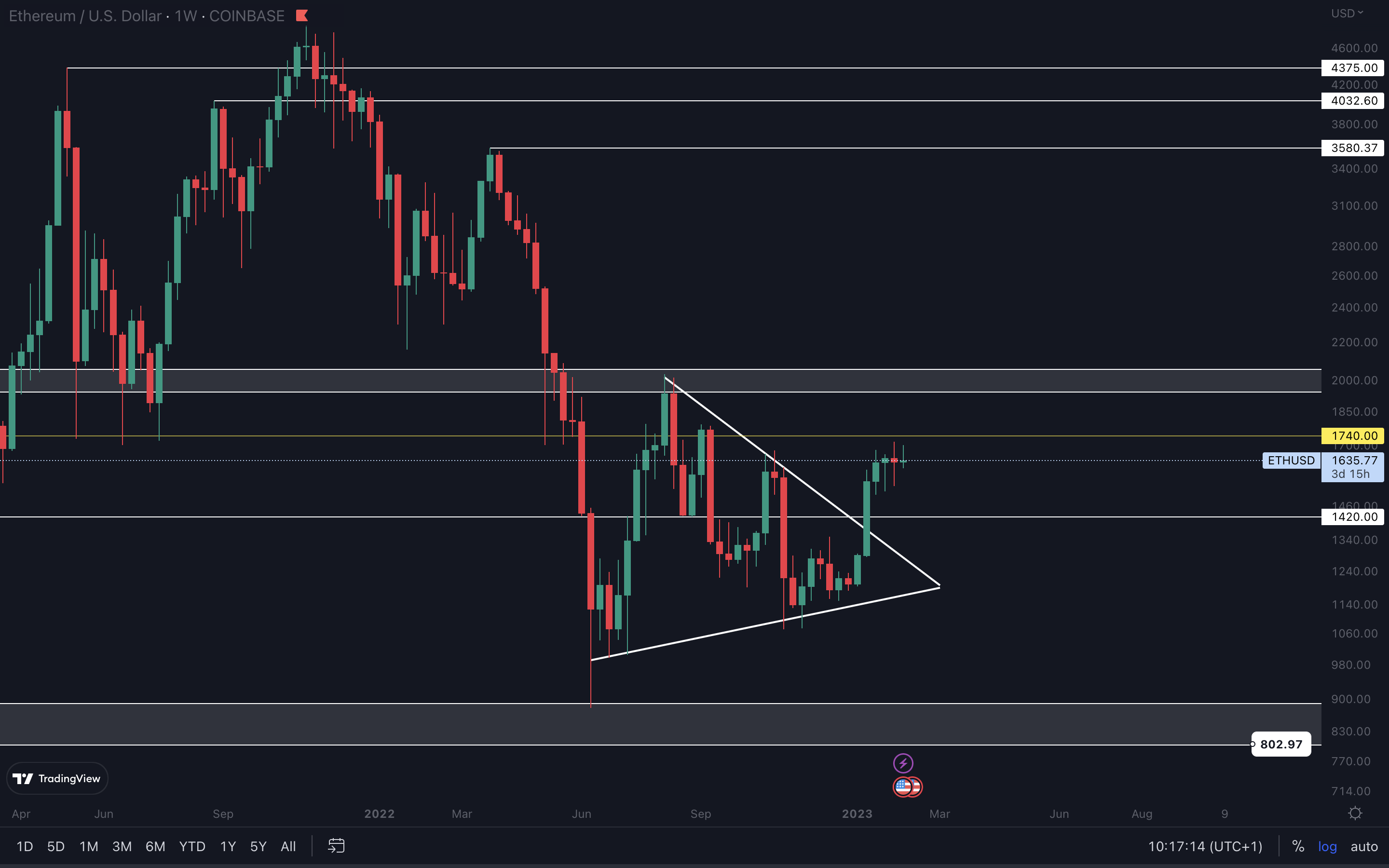

ETH | Ethereum

We can see Ether’s price action has reached exhaustion. Neither buyers nor sellers are in control. This indecisiveness can be seen in the wicks and short candle bodies.

We can see Ether’s price action has reached exhaustion. Neither buyers nor sellers are in control. This indecisiveness can be seen in the wicks and short candle bodies.

A last push to $1740 isn’t out of question, but Ether will likely go down and retest support, like Bitcoin. There are no technical levels until $1420, Ether’s 2017 all-time high. From its current price, a move to $1420 translates to ~-12%. This drop reinforces the belief that the Altcoins Market Cap index will lose its $550B support level and head lower.

If Ether does reach $1420 in the coming weeks, it’s crucial that it also holds this level. For upside to continue, we cannot lose $1420 as support.

SOL | Solana

SOL registered a bearish engulfing candle last week and is now testing support at $22. What matters here is that SOL doesn’t lose $19 as support. This is the bottom of the $22 - $19 support area on the weekly timeframe.

SOL registered a bearish engulfing candle last week and is now testing support at $22. What matters here is that SOL doesn’t lose $19 as support. This is the bottom of the $22 - $19 support area on the weekly timeframe.

A loss of $19 would lead to a test of $15 as support next. This would slow SOL’s upside continuation, and we’d require another break of the $22 - $19 area to confirm further upside.

BNB | Binance

BNB is still battling with $335 as resistance. As the market could see some downside in the short term, BNB may fail to break above $335. Instead, we could see it coming back down to retest the grey box around $300 - $307 soon.

A loss of the grey box would likely lead BNB to its next local support level at $260.

BNB is still battling with $335 as resistance. As the market could see some downside in the short term, BNB may fail to break above $335. Instead, we could see it coming back down to retest the grey box around $300 - $307 soon.

A loss of the grey box would likely lead BNB to its next local support level at $260.

UNI | Uniswap

UNI’s previous weekly candles show the same thing as Ether’s - indecision. The candles are short-bodied and large-wicked, indicating neither buyers nor sellers are in control.

UNI’s previous weekly candles show the same thing as Ether’s - indecision. The candles are short-bodied and large-wicked, indicating neither buyers nor sellers are in control.

UNI’s exhaustion forced by the majors (Bitcoin and Ether) could invalidate the move to $7.80 and push its price down in confluence with the rest of the market. Overall, we should expect UNI to follow how the majors react. Its volume is not large enough to sustain a move to $7.80 on its own.

Cryptonary's take

For a trend to remain healthy, an occasional pullback isn’t a bad thing. It always comes down to market structure, a series of higher highs and higher lows that continue until the structure is broken. For now, there are no signs that the rally is over. Instead, we view a potential pullback as an opportunity to enter at lower prices. It’s a way to leave room for even more upside, not a reason to pack our bags and go home for the rest of the year.

Action Steps

- Taking profits is recommended, even though upside might follow. Taking profits gives you security in case things don’t work out as expected.

- We’re preparing capital for lower entries, to seize short term opportunities.

- If you want to accumulate for the long term, using a DCA strategy periodically will save you lots of time and effort.