As bulls are left wondering when their day will come, the bears are sipping Mai Tais, patiently waiting to get in lower.

The market has room to fall, and that’s exactly what we believe is going to happen in the coming weeks. It seems the bears are going to enjoy their cocktails for just a little longer.

In this week’s report, we go over the targets and levels you should look for when accumulating and trading!

TLDR 📃

- Yesterday’s CPI data shook the market with volatility. This resulted in a new low, so we remain bearish.

- BTC is on a crystal-clear path to $25,150. If you’re planning on accumulating, this would be a good level to DCA at.

- Most altcoins have about 10% of downside room left in store until they hit support.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

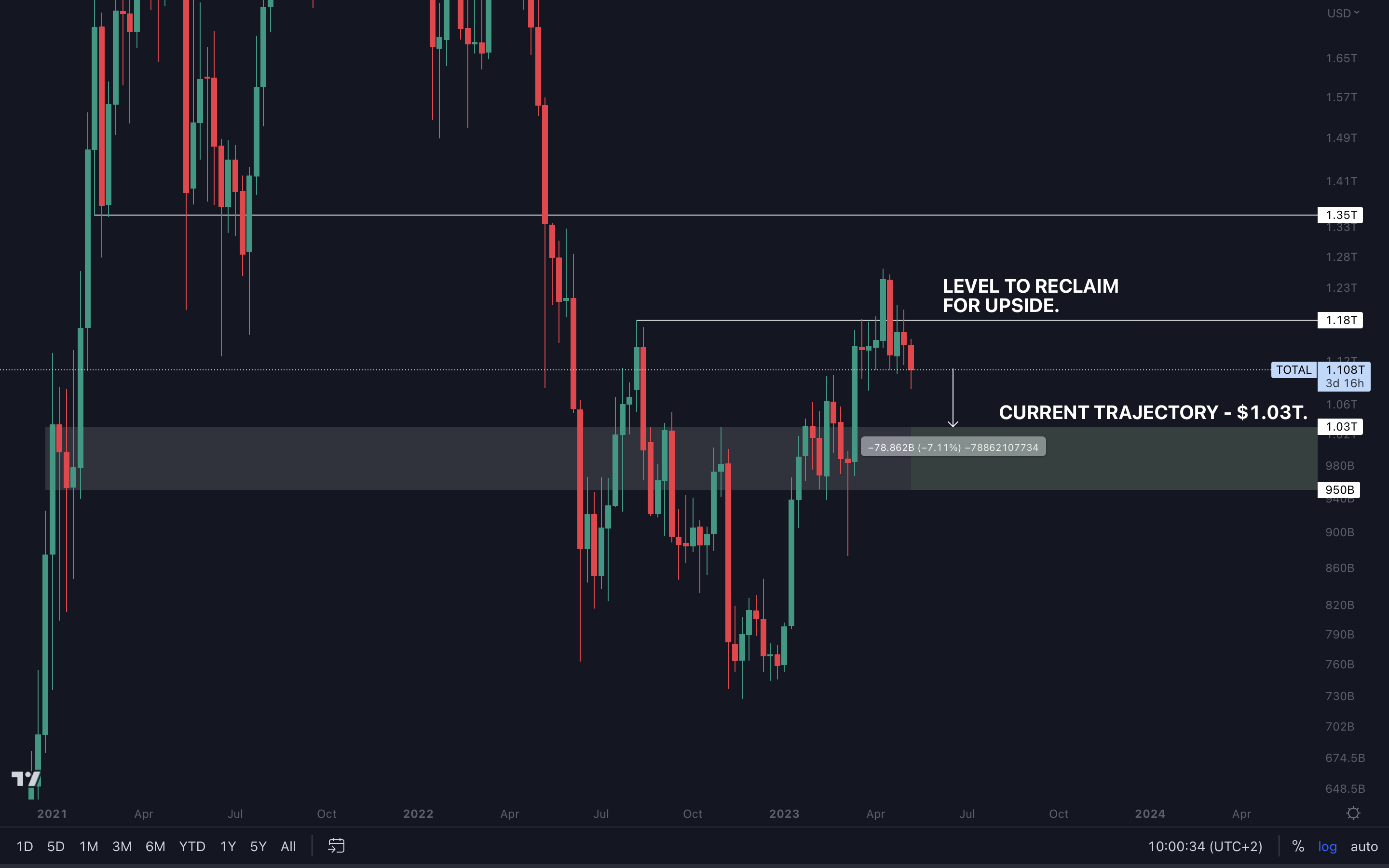

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will go next.

$1.18T was lost as support, and the index is now on track for $1.03T. Downside can be prevented only if the index flips $1.18T back into support. We see that as very unlikely.

$1.18T was lost as support, and the index is now on track for $1.03T. Downside can be prevented only if the index flips $1.18T back into support. We see that as very unlikely.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market: all coins other than BTC.

The altcoins market is on a clear path to $550B. Expect this level to be reached very soon – within one or two weeks.

The altcoins market is on a clear path to $550B. Expect this level to be reached very soon – within one or two weeks.

Bitcoin | BTC (Weekly)

Here’s some educational wisdom on market structure: A bullish market structure consists of higher highs (HHs) and higher lows (HLs). This is exactly what we saw in recent weeks until BTC created a lower high (LH) and flipped its weekly structure bearish. Yesterday, the market dropped and created a new low, meaning we are now trading in a bearish market structure on the weekly timeframe. Market structures are a pivotal part of technical analysis. They tell us that BTC is bearish and will be heading lower in coming weeks.

Ethereum | ETH (Weekly)

ETH is on track for $1,740, which is in confluence with BTC’s path. However, we could see ETH lose $1,740 as support. This suggests $1,420 as our next target.

Binance | BNB (Weekly)

BNB reached support at $308 - $300. With BTC falling, we’ll likely see BNB testing the bottom of this support area next. That’s $300.

Ripple | XRP (Weekly)

We see a clear path toward the bottom channel. $0.36 is the level to look for, although it can slightly differ depending on how fast XRP gets to the channel.

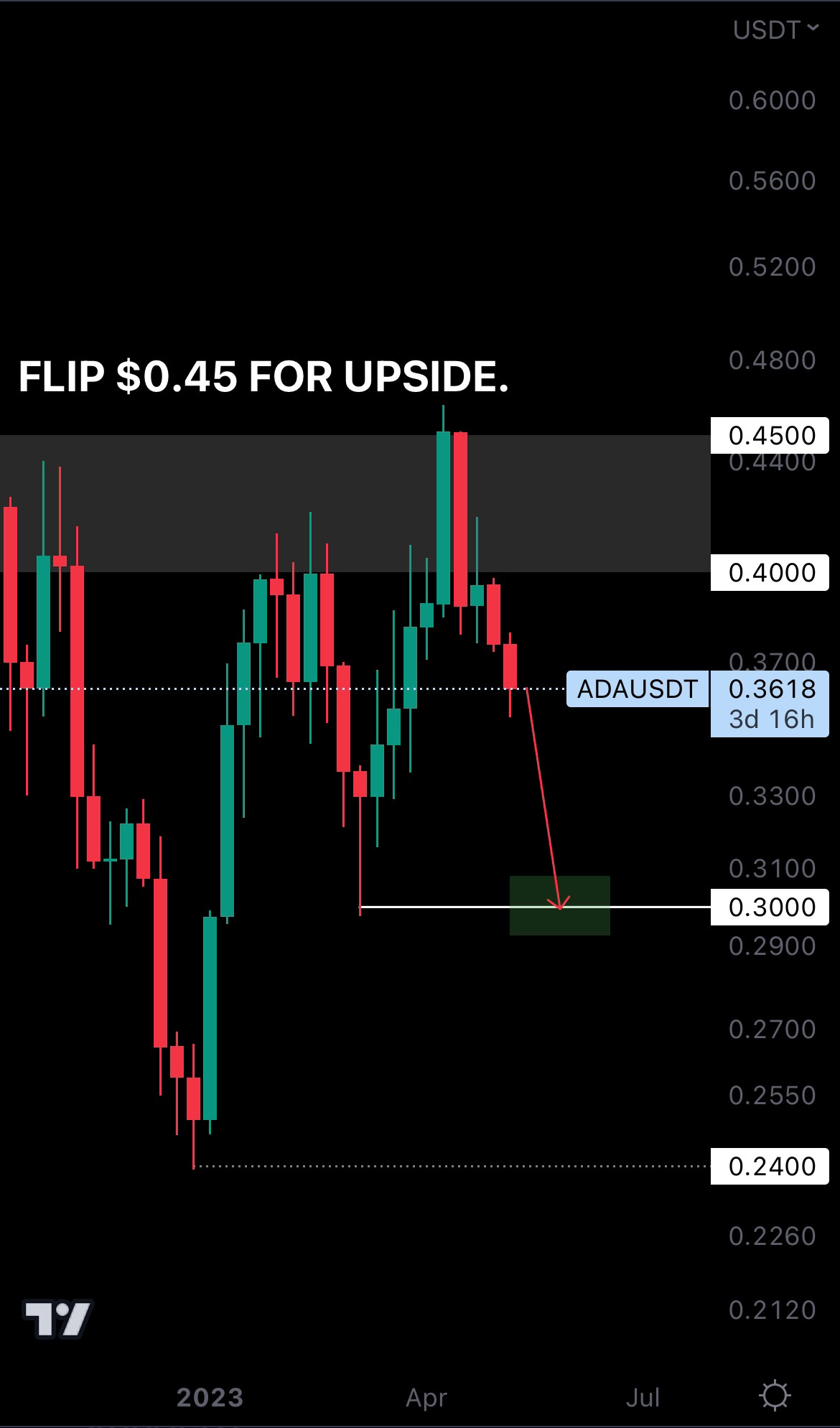

Cardano | ADA (Weekly)

ADA is headed for $0.30 unless it can flip $0.45 into support. That’s a very unlikely scenario, so down we go.

Dogecoin | DOGE (Daily)

$0.064, here we come!

Polygon | MATIC (Weekly)

MATIC is in the process of losing $0.9150 as support on the weekly timeframe. Yes, there are three days left until weekly closure. We think it’s safe to assume that MATIC will close under this level. This will put us on track for $0.76 next.

Solana | SOL (Weekly)

SOL is about to test the bottom of its current support area - $19. A loss of that level (likely) will open the doors for $15.

Polkadot | DOT (Weekly)

Like MATIC, DOT is about to lose support this week. A weekly closure under $5.50 confirms $5 as DOT’s next target.

Litecoin | LTC (Weekly)

LTC might have some support on this diagonal channel. The situation is very cloudy because it is not in line with current market conditions. We’ll have to wait for more price action. Sit back and let LTC do its thing.

Cryptonary’s take 🧠

We are patiently waiting for prices to reach our expected targets before accumulating more. This month’s Skin in the Game investments are likely to be interesting. 👀In our opinion, now is not a good time to buy. The market is sending clear bearish signals (BTC breaking structure and reaching major resistance), and the odds of going down are a lot higher than going up. We can easily enter at lower prices.

Action points 🎯

- Consider buying altcoins once BTC hits $25,150. Not before.

- Don’t over-leverage if you trade! The market is shaken after yesterday’s CPI data, and you can easily lose money if you’re inexperienced.