The market is going down, what should I do?

We bet your blood is boiling from all the mind-numbing boredom, right? Time seems to be crawling by while the market refuses to give your mighty crypto wallet the excitement it craves. However, here’s the thing… This part is inevitable. There will be times when the market decides to take a chill pill and barely move or consolidate. That’s when you need to shift your focus to finding the most giga-brain move on your board. Lucky for you, we happen to be the chess masters of crypto, and we’re here to guide you in the right direction. Let’s dive into it!

TLDR 📃

- Bitcoin closed bearish last week. Expect more downside to $25,150!

- A “Hanging Man” candlestick was printed on ETH’s weekly timeframe. The chances of testing $2,000 just got slimmer.

- Our star performer is… well, performing! (we told you 😉)

- At this time, the risk outweighs the reward when trading most of our picks. We recommend waiting until clear bottoms are formed.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

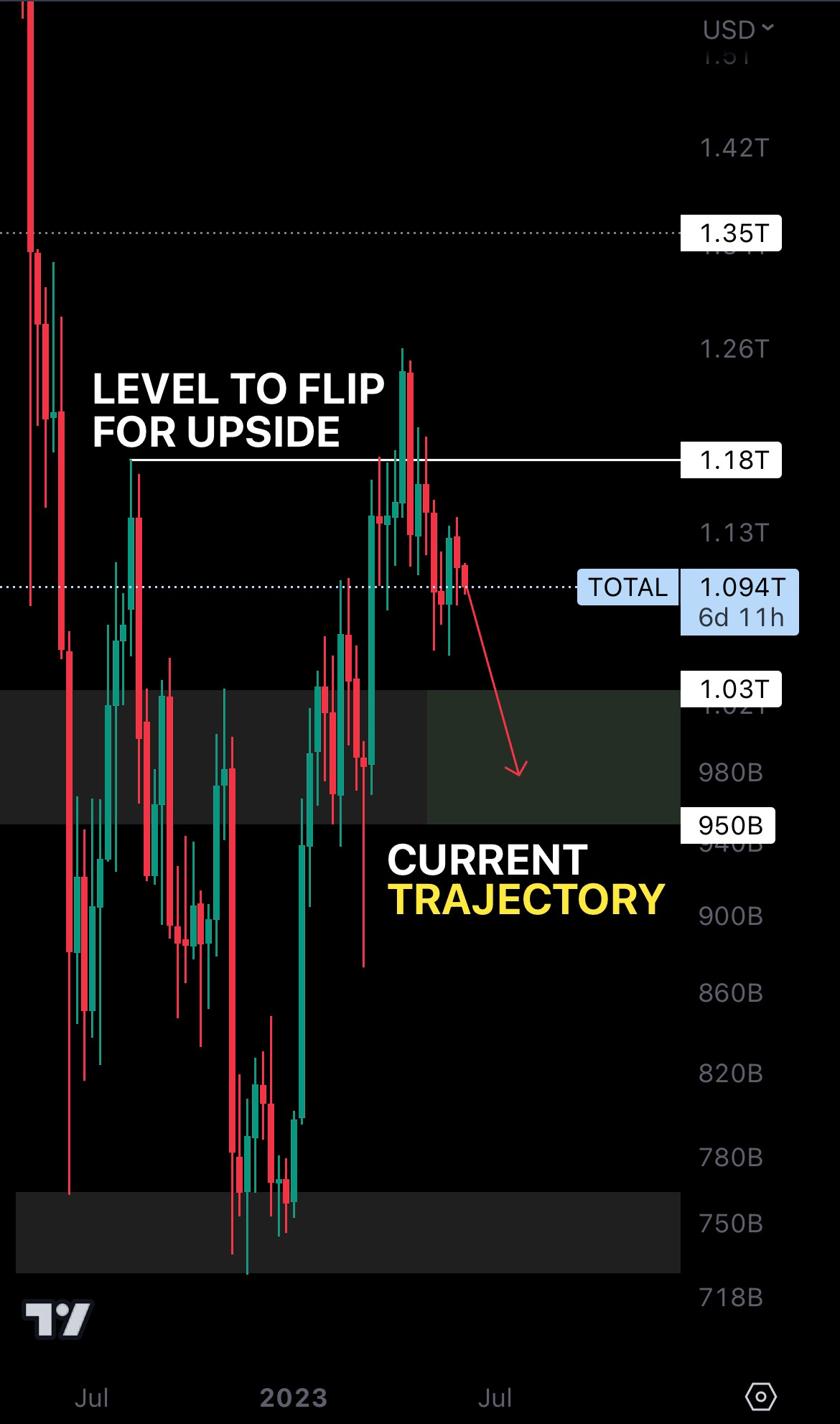

Total Market Cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand where the overall market is now and predict where it will go next.

Altcoins Market Cap

The Altcoins Market Cap index represents the evaluation of the altcoins market - all coins other than BTC.

Cryptonary's Portfolio

BTC | Bitcoin

ETH | Ethereum

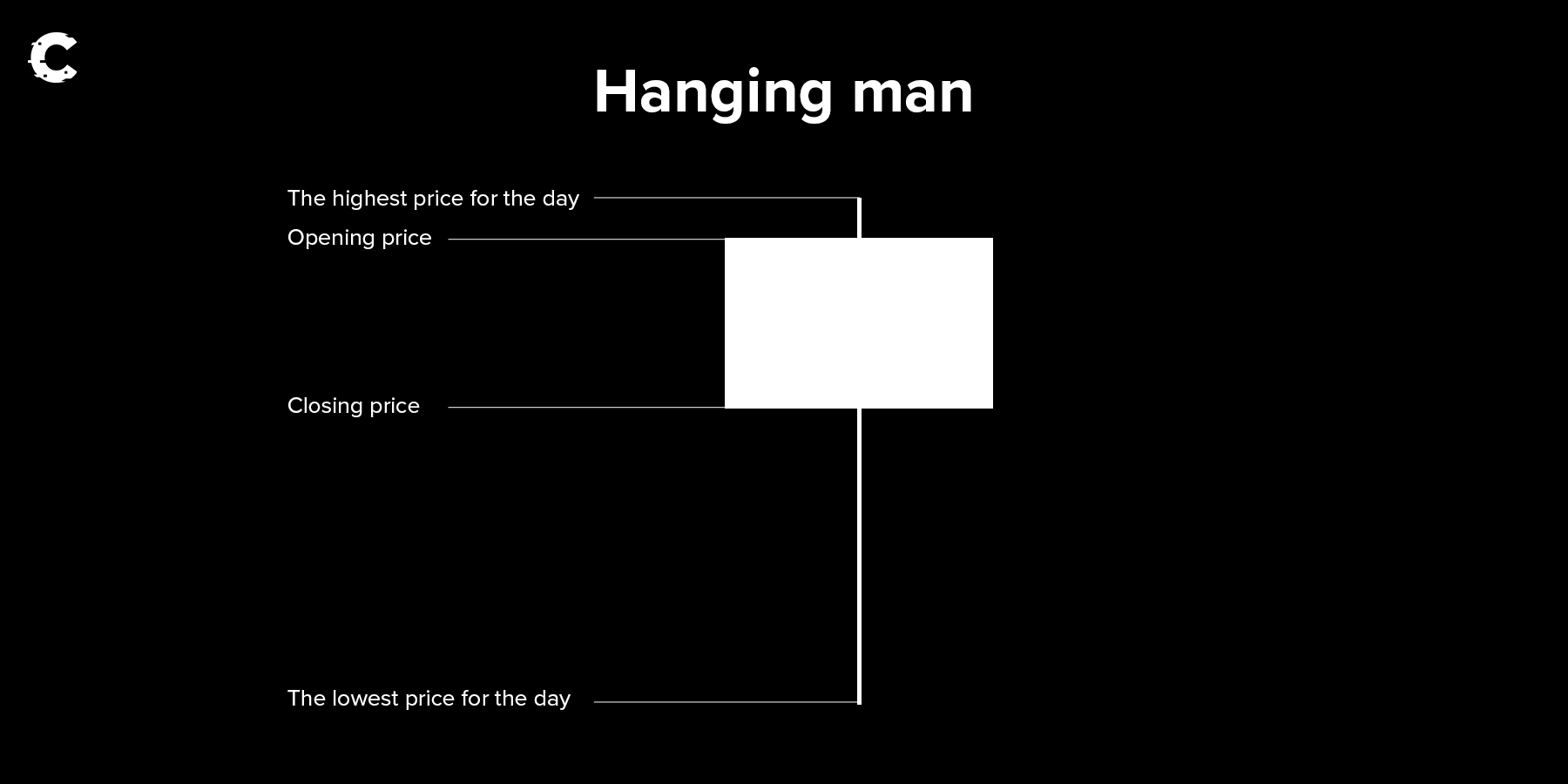

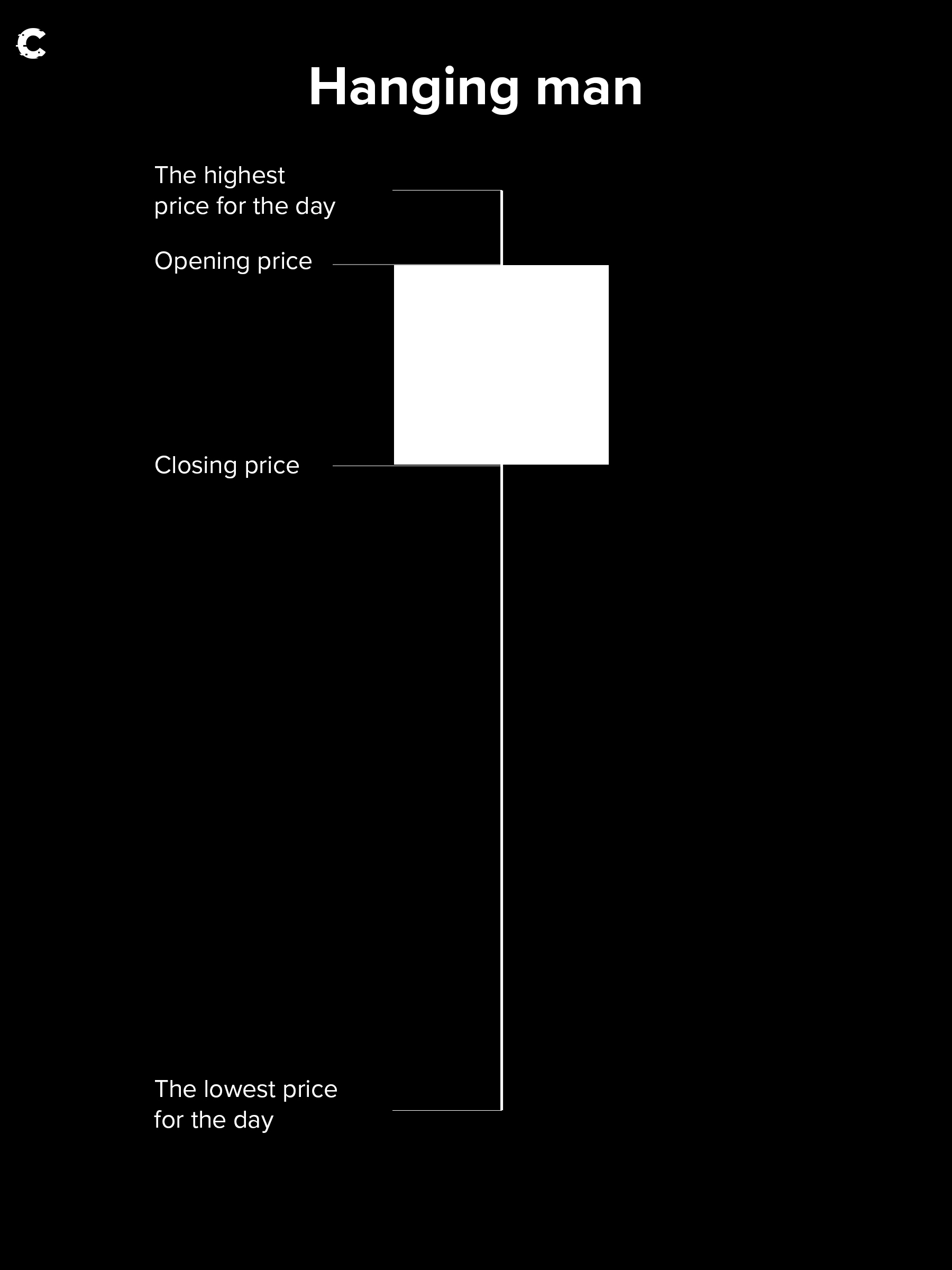

Buckle up, ETH might not be going to $2,000 after all…

Last week’s candle closed as a “Hanging Man”. You might have seen this candlestick around, but here’s a visual representation to make it simpler for you:

Last week’s candle closed as a “Hanging Man”. You might have seen this candlestick around, but here’s a visual representation to make it simpler for you:

This type of candlestick signals that sellers are regaining control and downside might be lurking around the corner. So, it might be best to ease off the gas pedal for a little while.

This type of candlestick signals that sellers are regaining control and downside might be lurking around the corner. So, it might be best to ease off the gas pedal for a little while.

DYDX | dYdX

SPA | Sperax

Cryptonary's Watchlist 🔎

DOT | Polkadot

RUNE | THORChain

SOL | Solana

SYN | Synapse

MINA | Mina Protocol

Astar Network | ASTR

THOR | THORSwap

OP | Optimism

LDO | Lido DAO

Our star performer is headed for the sky…

Just three weeks ago, LDO flipped $1.85 back into support, and guess what - it’s up by 20% since then.

Just three weeks ago, LDO flipped $1.85 back into support, and guess what - it’s up by 20% since then.

BTC? Down 0.25% in the last three weeks. We can’t argue with math, right?

LDO is outperforming the market, and we have a feeling that’s not going to stop anytime soon. Right now, the asset is headed for $3.10. Of course, things will go south if LDO loses $1.85 as support.

Cryptonary’s take 🧠

As downside looms large, our best advice for you is to wait for the opportunities to show themselves. Be patient, keep your eyes peeled, and protect that precious capital of yours in the meantime. There’s no point in trading or investing in a dangerous playground - you do that only when directions become clearer.Action points 🎯

- More downside is coming, so avoid getting too deep into the buys unless a complete invalidation happens (which we see as unlikely).

- The time to buy comes when BTC tests support at $25,150. In the meantime, your best play is to wait.

- Got questions? Hit us up on Discord in the “📉・technical-analysis” channel.

- We are always happy to help you get to the right decision for you.