Why you should read this report

- You’ll gain insights into the hidden signals in this week's economic data and how they could catch the market off guard.

- We discuss why the Fed's next moves might surprise even the most seasoned investors in the short term.

- You’ll decode the true market implications of the Iran-Israel tension

- We uncovered an on-chain metric that whispers Bitcoin's next major move before it happens.

- We point out the similarities between the state of the market today and a pivotal moment in crypto history - and what it means for your portfolio.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's data

This week, we have some important macro data. Today, we've had PPI (Producer prices), tomorrow we have CPI (the main inflation data) and on Thursday we have Retail Sales.Each data point is important in its own right, and with a Fed that is data dependent, the markets will continue to watch all the data releases with a keen eye and react based on them.

Today, PPI came in substantially lower than expected, and the market has reacted positively to it. The market is now looking for a softer print (the numbers come in lower than what they're currently forecasted to come in at) in tomorrow's inflation data.

On Thursday, we have Retail Sales. While the market is still watching the inflation numbers, it is almost more attentive to any data point related to the labour market or the consumer now. The markets are trying to gauge whether the consumer is still holding up, as that is likely to be the difference between a soft and hard landing.

The expectation is for Retail Sales on Thursday to come in at 0.2%, which would show month-on-month growth. This would indicate that the consumer is still spending and, therefore, likely holding up well. This would be supportive of the 'soft landing' narrative.

Lastly, on Thursday, there is Jobless Claims. The market will want this to come out in line with consensus. A much higher-than-expected print could spook markets, but we're not expecting this.

Possible result of the data on markets

The market is currently pricing in the Fed's cuts of 100bps in 2024 and 200bps in 2025, meaning that by year-end 2025, the Fed Interest Rate would be at 2.5%.However, with the data so far holding up—i.e., the labour market not materially weakening, and growth still remaining positive—the argument is that “does the Fed really need to dive in and cut so aggressively?”

If not, and the data suggests not, then the Fed might make 75bps of cuts in 2024, meaning a 25bps Interest Rate cut in September, November, and December. This is less than what the markets are currently pricing, and therefore, the markets may be more dovish than the Fed here and have to re-price accordingly, especially if Chair Powell guides at Jackson Hole in late August that the Fed is thinking to do just 25bps in September.

A re-pricing of the market would mean Bond Yields and the Dollar go slightly higher over the coming 1-3 weeks, negatively impacting risk assets. We are expecting this to be a small move, but it suggests not to get fully bullish just yet but to wait until September, at least for now.

On a side note: We do expect Yields to continue trending lower over the next year.

2Y Bond Yield:

S&P:

Iran-Israel conflict

We will keep this section brief. Essentially, this is still a headwind for risk assets and just markets in general.From our research, we expect a retaliatory strike; however, we don't expect a regional war to break out, as both sides suggest they don't want this. We now believe this is a case of Iran feeling the need to retaliate simply to 'save face'. Of course, it depends on the strikes, but we don't believe any strikes would see markets move materially lower.

However, if there were big civilian casualties, that would be a more meaningful escalation, and that would then change our view. But again, we're not expecting this.

Positive on-chain developments

Today, we will examine two metrics related to on-chain data. The first is the Long-Term Holder Supply.In euphoric bull periods, this cohort sells down its supply and grows its supply when Bitcoin appears to be relatively undervalued in comparison to its 4-year cycle. We can see that the Long-Term Holders sold some of their supply (a decrease in this metric) into the $70k March highs.

However, this cohort of investors has begun materially increasing their holdings over the last month. Historically, this is a bullish signal. The current period looks similar to late 2019 and early 2020.

Long-Term Holder Supply:

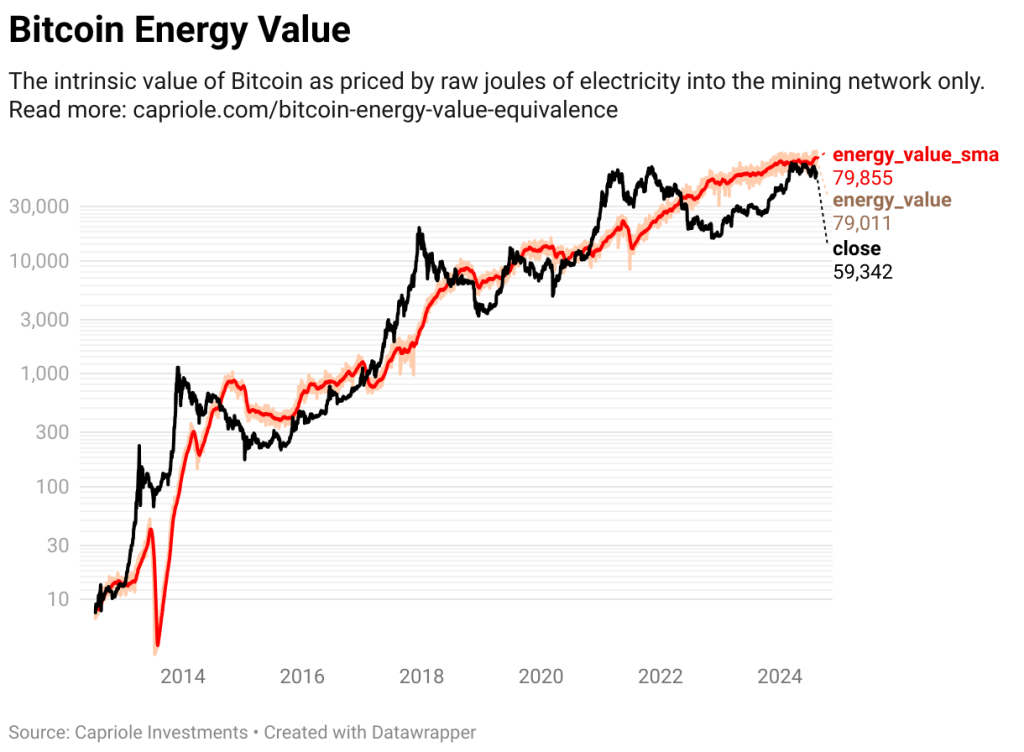

Another metric is the Bitcoin Energy Value by Capriole. This metric assesses Bitcoin's intrinsic value as priced by raw joules of electricity into the mining network. Bitcoin's price is currently below its Energy Value.

Bitcoin's price breaks substantially above its energy value in euphoric bull periods. This metric suggests to us that this period is yet to come for this cycle, and the current period is similar to that of Q2 to Q3 2020 before the major Bitcoin price breakout of late 2020 going into 2021.

Bitcoin Energy Value:

The above metrics suggest that Bitcoin is in a consolidation phase before a euphoric bull phase. The euphoric bull phase might take another couple of months (potentially 3 more months). However, the euphoric bull period is coming. Buckle up for Q4 2024.

Expectations for price between now and the end of the year.

BTC:

Cryptonary's take

We could reiterate the above. Bitcoin is in a consolidation phase right now, while the macro and on-chain both suggest a more euphoric bull period in the upcoming months.In the short term, the market is likely to continue to be whip-sawed by the data, resulting from a Fed that continues to say that it's 'data dependent' despite an Interest Rate cutting cycle coming and almost guaranteed to begin in September.

We therefore expect prices to remain range-bound until Powell speaks at Jackson Hole in late August, but more likely until the Fed Meeting in mid-September. The range-bound price for Bitcoin looks something like $54k to $63,400. In this period, we expect the bluechip memes to hold up the best and potentially even go higher, while we expect non-bluechip memes to perform poorly.

As a result, we remain in the barbell strategy for now and are not looking to materially diversify yet. The time will come; it's just not yet. Further patience is needed for now.