Today's data essentially met consensus. It showed that the Fed's preferred inflation gauge came in at 2.6% YoY and 0.2% MoM, which aligns with what the Fed wants to see.

Alongside this, Personal Spending and Personal Income both came in positively, with personal spending at 0.5% MoM, indicating that the consumer is still spending at a relatively strong rate. If the consumer can keep up spending, growth can hold up. If we start to see companies laying workers off, this will see spending go down and growth slow, so tracking the labour market is pivotal as to whether the 'soft landing' will become a reality.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The alternate view

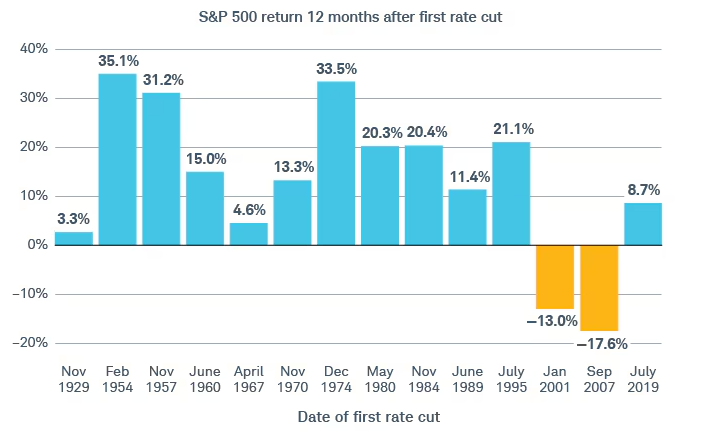

An alternate view we're seeing is that the markets may struggle in the run-up to the election for two key reasons:- Interest Rate cuts are usually bearish at the beginning.

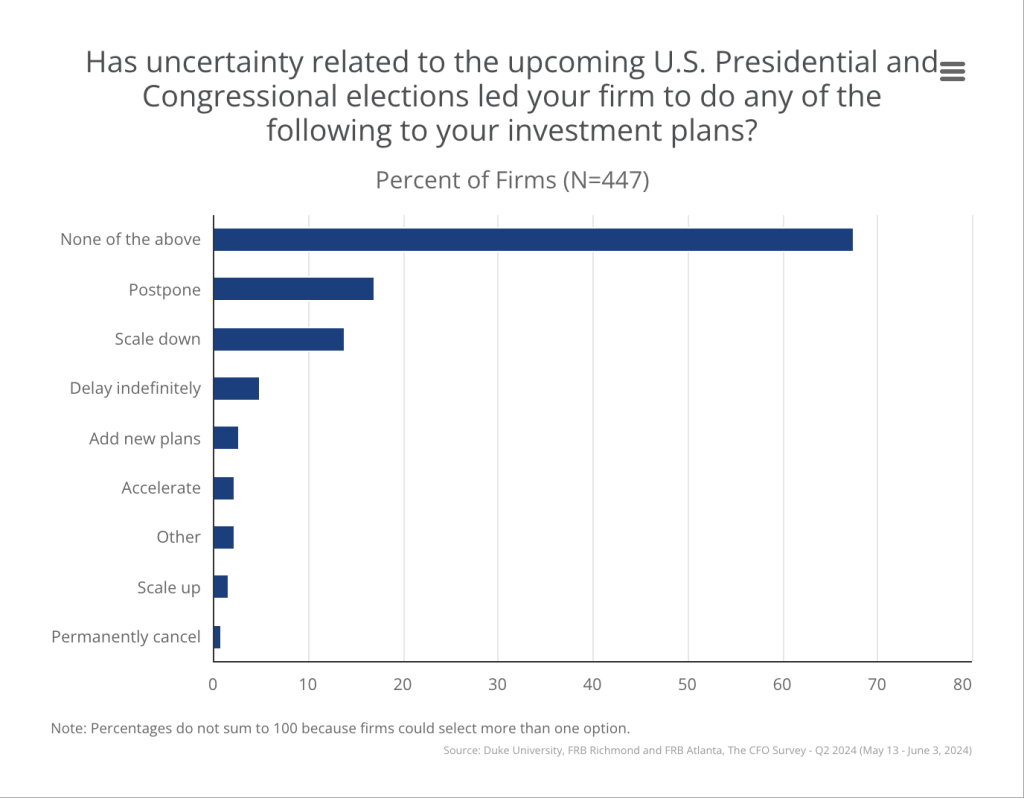

- Uncertainty ahead of the election, meaning businesses sit tight until after the election.

This time, the Inflation rate is around the 2.5% mark, while Fed Funds (the Interest Rate) is around 5.5%. So, the real rate (the Interest Rate minus the Inflation Rate) is 3.0%. A healthy economy is usually 1.0% restrictive. Currently, we're 3.0% restrictive. So, the Fed is planning to cut Interest Rates in order to bring down the level of restrictiveness.

This should help to stimulate more growth whilst the economy (and hopefully also the labour market) is holding up. This is bullish for risk assets. In the chart below, we can see the performance of the S&P over the 12 months following the first interest rate cut.

S&P500 Return 12 Months After First Rate Cut:

In answer to point 2, we have seen a recent shift from the markets focusing on inflation to the labour market. If the labour market significantly weakens, this would likely mean a recession, so the Fed is due to begin cutting Interest Rates in an attempt to get ahead of this.

Whilst we expect the data to hold up over the coming months - growth to remain positive, and the labour market to remain ok, probably further weakening but not recessionary like weakening - growth may slow due to the political uncertainty ahead of the election.

The Richmond Fed Survey shows that a third of respondents considered postponing, scaling down, or delaying indefinitely business expansion plans due to political uncertainty.

This may result in markets and growth remaining range-bound or continuing in a slow grind higher between now and the election.

Cryptonary's take

It is certainly possible that the next month or two will be tricky, mainly if there are further growth scares or more material weakening in the economy. However, when we assess the set-up in front of us, we're seeing the following:- A series of interest rate cuts, but cuts to normalise/moderate policy (bullish for markets).

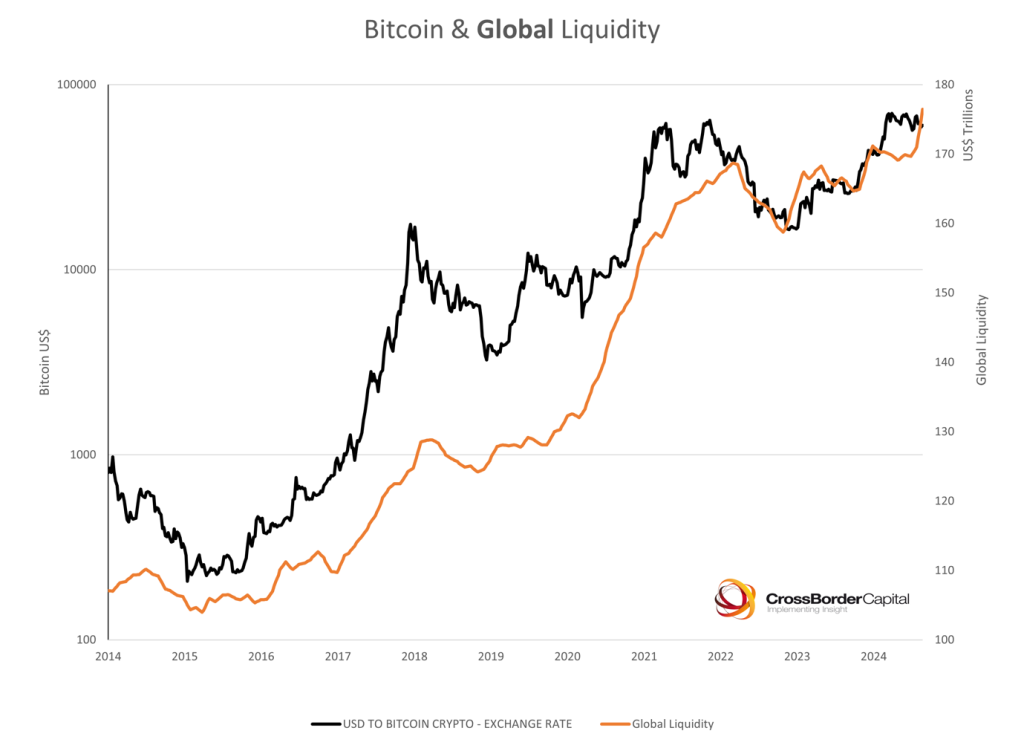

- Global liquidity is increasing, with China also beginning to provide an accommodative policy, enabled by the Fed cutting rates (refer to image 1 below).

- Consumer spending is still strong, suggesting that the consumer is still holding up.

- -On-chain data suggests we're mid-cycle, perhaps something similar to mid/late 2019.

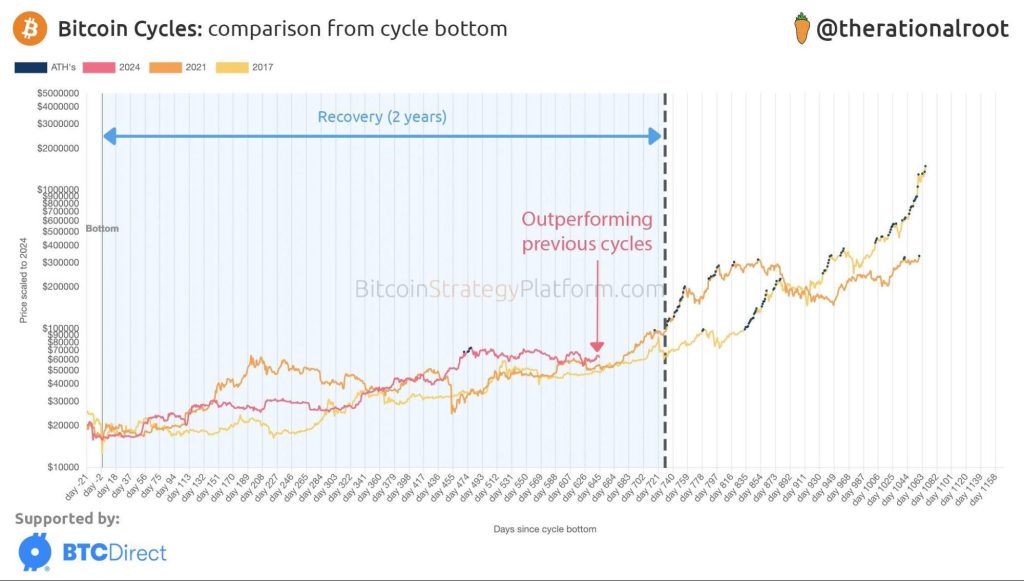

- We're currently four months post-Bitcoin Halving, and historically, it takes six months for prices to really begin running (refer to image 2 below—credit @therationalroot).

Image 2: Bitcoin Price Performance Comparison From Cycle Bottom Against Timescale

Ultimately, the market doesn't feel too great in the immediate term, but with many positive catalysts on the horizon, we still believe the best bet is to be positioned. Of course, we'd suggest not being leveraged but taking Spot positions in a concentrated portfolio. For us, that still is the barbell strategy: BTC, ETH, SOL, WIF, and POPCAT. For now, it's still not the time to diversify into more risk-on plays.